NGI Archives | NGI All News Access

Northeast Natural Gas Basis Gets Support from Ongoing Cold; Other Markets in Lull

Northeast natural gas forwards markets stole the show this week as frigid weather remains in the high-demand region, with key market hubs putting up double-digit gains in an otherwise lackluster market.

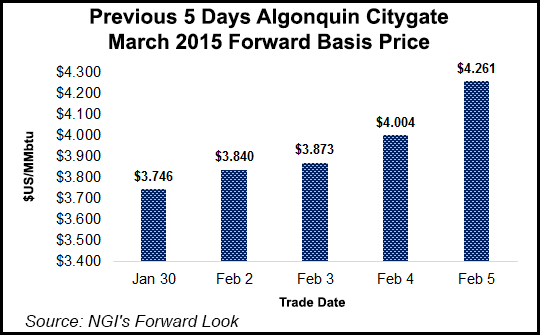

The constrained Algonquin Gas Transmission City-gates led the pack as March basis jumped 42.1 cents from Monday to Thursday to reach plus $4.261/MMBtu, according to NGI’s Forward Look. The April package slipped 1.9 cents to plus 56.7 cents/MMBtu, while the summer 2015 strip tacked on 1.4 cents to land at plus 0.008/MMBtu.

Algonquin’s next two winter strips saw more action as the winter 2015-2016 package surged some 23 cents to plus $6.35/MMBtu, and winter 2016-2017 rose 34 cents to plus $4.54/MMBtu.

Despite the persistent chill hovering over the Northeast, LNG supplies that have been delivered and are currently awaiting delivery in the New England are helping to keep a lid on prompt-month prices at Algonquin, according to a Northeast trader.

“They did a great job of having it available when needed,” the trader said.

Another factor holding down Algonquin March prices is price caps that have been sold by insurance companies to help alleviate the huge spikes in basis typically seen at this market hub during winter.

For a premium paid up front, buyers of these so-called price caps will not pay more than a certain amount at that market hub during a pre-determined time period, the trader explained.

“Supposedly, that’s why cash hasn’t gone nuts this winter. Plus, we didn’t have a winter,” the trader said.

While the trading practice has been around for years, it’s been several years since it’s been used in the forwards markets, the trader explained.

“But if you’re an insurance company, what better market than after last winter to sell caps and collect a BIG premium?” the trader said.

Meanwhile, weather forecasts continue to favor cold weather in the region through at least the first half of the month, while the latter part remains uncertain.

Forecasters with NatGasWeather indicate cold blasts are trending slightly colder over the high-demand regions of the Northeast, with the strong demand in this region likely countering what is expected to be milder conditions over many westerns and central regions of the U.S.

“This will basically lead to a standstill in supplies as stronger demand over the Great Lakes and Northeast is looking to be just enough to prevent weekly withdrawals from deviating too far from normal,” NatGasWeather said. “Supplies will hover near normal until we see which side weather patterns finally break during the second half of February to either cold blasts finally pushing over more US territory to increase deficits, or the cold pool over southern Canada finally fizzling, allowing warmer temperatures to surge into the northern US.”

In a mid-Friday update, NatGasWeather said there is now enough data to suggest the cold won’t last after Feb. 17, and the pattern will trend milder over much of the US.

For now, the bitter temperatures were enough to lift other Northeast market hubs.

At Transco zone 6-New York, March basis climbed 30.8 cents from Monday to Thursday to reach plus 70.9 cents/MMBtu, while April picked up 4.6 cents to reach minus 29 cents/MMBtu. The overall summer 2015 strip climbed 9 cents to minus 36.7 cents/MMBtu, while the winter 2015-2016 package was up 31 cents to plus $3.20/MMBtu and the winter 2016-2017 was up 37 cents to plus $2.75/MMBtu.

Texas Eastern M3 posted slightly less substantial gains. March basis rose 25.4 cents to minus 16.6 cents/MMBtu, while April slipped 2.6 cents to minus 63.1 cents/MMBtu. Winter 2015-2016 jumped 19 cents to plus 70 cents/MMBtu, and winter 2016-2017 moved up 18 cents to plus 67 cents/MMBtu.

Elsewhere across the U.S., markets shifted less than five cents for the week, mirroring the lack of extreme volatility in futures. The Nymex March contract lost some 8 cents from Monday to Thursday amid a smaller-than-expected withdrawal from storage and ongoing uncertainty in long-term weather forecasts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |