NGI Archives | NGI All News Access

Confidence Dropping Sharply Among Global Energy Executives

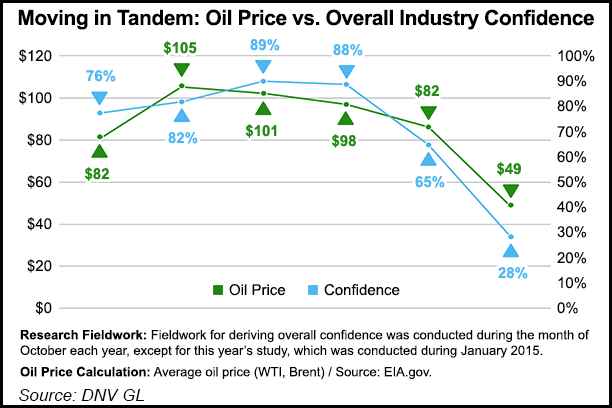

In three months’ time, confidence among senior energy executives in the outlook for the oil and natural gas industry this year has dropped dramatically, according to DNV GL.

DNV’s report, now in its fifth year, is based on a global survey done the week of Jan. 19 that incorporated the views of 367 senior industry professionals and executives, and 18 interviews with a range of experts, business leaders and analysts. The research, compiled in “A Balancing Act: The outlook for the oil and gas industry in 2015,” was carried out by Longitude Research. The results were compared with a similar survey done in October.

In North America, one-third of senior industry executives surveyed “are confident about the year ahead, the most confident of any region, but this is still a significant drop from 93% the previous year,” researchers said. “The biggest drop in confidence, however, is in Asia Pacific where 27% are confident about the outlook for 2015 compared to 89% the year before. The lowest confidence globally is reported in Europe (26%).”

The pessimistic outlook is reflected by announced slashed capital expenditure (capex) plans, with those planning to increase capex since the October survey dropping to 12% from 40%. Those planning to reduce headcount has risen to 47% from 26%.

Almost two-fifths (37%) of the respondents were oil and gas operators, while 56% were suppliers/vendors, and other respondents were regulators and trade associations. The companies surveyed varied in size with 41% having annual revenue of $500 million or less, while 18% have more than $10 billion in revenue. Respondents were drawn from publicly listed companies and privately held firms. They also represented a range of functions within the industry, from board-level executives to senior engineers.

Senior industry professionals are torn about how to tackle the year ahead, researchers found, already reflected in recent conference calls by management teams including BP plc (see related story).

“Those who are most confident about reaching their profit targets plan different cost-management measures, taking a long-term approach to riding out the storm, while those pessimistic about hitting their profit targets are more likely to take short-term cost-cutting measures,” DNV said.

Among the “profit confidents,” two-thirds intend to increase or maintain capex, versus 29% of the “profit pessimists.” Profit-confidents are defined as being “highly” or “somewhat confident” of achieving profit targets in 2015, while the other half are “somewhat” or “highly” pessimistic.

“The demographic profile of the profit-confident group is broadly similar to the overall survey sample, but is slightly more weighted to smaller companies with revenue of $100 million or less,” DNV said.

About 70% of the optimists plan to bolster research and development spending this year, versus 40% of the pessimists.

On imposing strict cost controls, profit confidents appear more focused than the pessimists on improving workflow/work processes (45% versus 35%), using more automation (11% versus 1%) and adopting new technology (13% versus 4%).

On the reverse side, the “pessimists are more likely to take cost-cutting measures such as reducing headcount, 35% compared to 15% in the confident group.”

The correlation between oil prices and confidence levels was anticipated, said DNV CEO Elisabeth Tørstad. However, “we need to take heed of lessons learned from previous downturns.

“The oil and gas sector faces a dilemma over balancing long-term growth or cutting back more sharply in response to short-term pressures. By taking a broader view, reducing complexity and standardizing processes, materials and documentation, industry players can develop a long-term sustainable cost base to adjust to this lower-margin environment.”

Operators’ “tight schedules, high activity and complex projects have driven costs up over the last few years, but it is interesting to see that the most confident industry players are forging a different path to their less confident peers,” she said. “They are showing counter-cyclical behavior by investing during the downturn, which is positive for the long-term health of the industry.”

Also noteworthy among those surveyed is that the industry’s skills shortage, considered the largest barrier to growth for the past two years has fallen to 10th place (14%) jointly with geopolitical instability in key markets. Low oil prices are now the biggest barrier in 2015, cited by 68% of respondents. The weak global economy is second (35%), followed by uneconomic natural gas prices (20%).

The United States is considered the most favorable investment destination by 28% of the respondents, followed by China (11%) and Norway (9%). Globally, respondents in Asia Pacific are those who most expect to increase capex (15%), while the lowest expectations, only 4%, are recorded in Latin America. Decreasing the headcount is similar in number across the globe, with 46-49% now expecting layoffs.

The survey also found that Latin America (78%) has the “highest intention” to increase cost controls, while one-quarter of the respondents plan to boost standardization of tools/processes to impose stricter cost controls.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |