NGI Data | NGI All News Access

Robust Northeast Gains Tug Otherwise Soft Market Higher

Unless you were trading gas in the Northeast, the week was something of a snoozer as nearly all points lost about a nickel to a dime. Curiously for the week ended Jan. 30 the NGI Weekly Spot Gas Average managed a healthy 25-cent gain to $3.21, led mostly by volatile, weather-driven trading in the Northeast.

The market point sporting the greatest gains was Transco Zone 6 NY with a rise of $3.96 to $8.60 and a distant second, also in the Northeast, was Iroquois Zone 2 advancing $2.95 to $8.20. The Northeast was also home to the week’s weakest market point, Tennessee Zone 4 200 L, which fell 21 cents to $2.59. All regions of the country were down with the exception of the Northeast, which rose $1.15 to $4.50.

Regionally, Rocky Mountain quotes fell a dime to $2.59 and California came in 9 cents lower at $2.85.

East Texas, South Texas, and the Midcontinent all shed 6 cents to $2.76, $2.75, and $2.68, respectively.

South Louisiana fell 4 cents to $2.83, and the Midwest was off by 2 cents to $2.92.

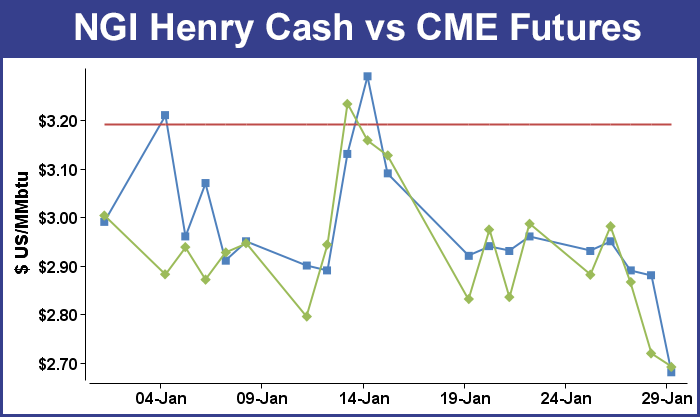

March futures proved to be the week’s biggest loser dropping 26.7 cents to $2.691 and the week’s loss was pretty much cast by the 10:30 a.m. EST Thursday release of inventory data by the Energy Information Administration (EIA), which normally is expected to give traders a better idea of how much of an inventory will be in place at the end of March. The report, however, raised as many questions as it answered, as the actual figure came in well under expectations. The EIA announced a withdrawal from storage of just 94 Bcf, about 20 Bcf less than market expectations, and prices fell hard. At the close, the newly minted spot March futures took a 12.3-cent drubbing to finish at $2.719 and April was lower by 11.5 cents to $2.715.

With nine weeks remaining on the traditional withdrawal season, slightly less than 100 Bcf would have to be pulled weekly to bring supplies under the arguably bearish ending inventory level of 1,700 Bcf.

All indications were that the figures for the week ended Jan. 23 would cause an increased surplus relative to a year ago and diminish the year-on-five-year deficit. Last year a stout 219 Bcf was withdrawn and the five-year pace stands at 168 Bcf. IAF Advisors calculated a pull of 108 Bcf and ICAP Energy was looking for a withdrawal of 114 Bcf. A Reuters poll of 21 industry traders and analysts resulted in a sample mean of a 113 Bcf draw with a range of 97 Bcf to 144 Bcf.

Industry consultant Bentek Energy utilizing its flow model calculated a 107 Bcf withdrawal on the basis of more moderate temperatures. In a report it said that “Fundamentals converged with sample storage activity, with many fields suggesting a much stronger withdrawal than the demand estimates would indicate. Furthermore, the holiday during the week adds some additional risk to this week’s forecast. Demand fell significantly from the previous week to average just 88.4 Bcf/d, while demand over the previous two weeks averaged well above 100 Bcf/d. Above normal temperatures led to the decline in demand as weather moderated across the country.”

The best minds in the business missed the mark as the number came in far less than what traders were anticipating. March futures fell to a low of $2.691 after the EIA number was released at 10:30 a.m. EST and by 10:45 March was trading at $2.703, down 13.9 cents from Wednesday’s settlement.

“We were trading unchanged just before the number came out, and this thing fell out of bed once the number was released,” said a New York floor trader.

“A close above $2.75 might convert to a support level.”

Tim Evans of Citi Futures Perspective said “The 94 Bcf net withdrawal was well below the 110-113 Bcf consensus expectations, with the shortfall suggesting a weakening of the underlying supply/demand balance, with bearish implications for future reports.”

Inventories now stand at 2,543 Bcf and are 324 Bcf greater than last year and 79 Bcf below the 5-year average. In the East Region 69 Bcf were withdrawn and the West Region saw inventories fall 9 Bcf. Stocks in the Producing Region declined by 16 Bcf.

In Friday’s trading, natural gas for Sunday and Monday delivery added over a quarter, buoyed by forecasts of a fresh winter storm expected to rip through coastal New England and a major pipeline disruption bringing gas from the Rockies to the Midwest.

New England and the Mid-Atlantic posted multi-dollar gains, but while Midwest points were mostly steady, Gulf, Midcontinent, and Rockies points suffered double-digit losses. Overall, the market added 29 cents.

Futures prices continued their trek lower as traders digested government reports showing production as much as 7 Bcf/d higher than a year ago. At the close, March had eased 2.8 cents to $2.691, and April was off 2.8 cents as well to $2.687.

Sunday and Monday gas prices in the Northeast jumped as buyers took no chances being caught short ahead of another major storm expected to impact the area over the weekend. AccuWeather.com forecast that Boston would receive another eight inches of snow on top of the 33 inches it has already accumulated during January. Hartford, CT was expected to endure another six inches over and above the 23 inches it has seen for the month.

Gas at the Algonquin Citygates rose $1.16 to $12.69, and deliveries to Iroquois Waddington jumped $5.58 to $12.42. Gas on Tennessee Zone 6 200 L rose $1.22 to $12.07.

Gas on its way to New York City on Transco Zone 6 added a stout $7.16 to $15.45, and deliveries to Tetco M-3 rose by $2.54 to $7.63.

AccuWeather.com meteorologist Brian Lada forecast a strengthening storm system for northern New England over the weekend.

“Eastern Maine will take the brunt of the storm Friday night into Saturday, but that does not mean that the rest of the Northeast will escape the snow. As the system strengthens off the coast of New England, snow showers will occur from southern and western New England to New York City, Washington, DC, and Pittsburgh into Friday night.

“Boston will be on the edge of accumulating snow to the north and snow showers to the southwest. Conditions will deteriorate quickly across northeastern New England Friday night and carry into Saturday as winds pick up and snow intensifies. While this is not expected to evolve into a blizzard, it will still cause major disruptions to travel. With snow rates up to two inches an hour possible in portions of Maine, roads can quickly become snow-covered and dangerous for travel,” he warned.

Rockies Express Pipeline (REX), a major interstate pipeline carrying gas as far east as Ohio, declared a force majeure Thursday night due to operational issues in Segment 300 in eastern Missouri. At some points all scheduled flows were cut to zero. Total outflows on REX from the Rockies were down by nearly 1 Bcf/d.

“Interestingly, I’m not seeing any other Rockies pipelines picking up the slack,” said Genscape’s Rick Margolin. “It doesn’t look at all like gas is getting re-routed, which would suggest shut-ins. I would think that gas would get bounced onto other takeaway pipes, but it’s not.”

On the delivery side, NGPL and Midwestern appear to be most affected, Margolin noted. “Both seem to be taking more gas from their upstream interstate interconnects to make up for lost supply from REX.”

Next-day gas at the Lebanon, OH REX interchange rose a stout 24 cents to $3.00, whereas neighboring Marcellus delivery points traded a few cents higher to as much as a dime lower.

REX deliveries east of the Midwestern interconnect looked stable, likely the result of the REX reversal that has been in progress pushing gas further westward, Margolin said. “Friday, REX east-to-west flows were showing up as far away as the Illinois-Indiana border. Previously, REX westbound flows were only moving as far as the interconnect with ANR at Shelby in eastern Indiana.”

The 1 Bcf production loss had an immediate impact as differentials between Midwest and Rockies points widened considerably.

On Alliance, Sunday and Monday gas was up 3 cents at $2.84, and gas at the ANR Joliet Hub gained 1 cent to $2.82. At the Chicago Citygates, gas was quoted at $2.78, down a penny, and on Consumers, gas was seen at $2.84, down 2 cents. Deliveries to Michcon shed 8 cents to $2.78.

Rockies prices plummeted. Gas at the Cheyenne Hub fell 29 cents to $2.26, and gas on CIG Mainline fell 21 cents to $2.30. Gas at Opal was quoted 33 cents lower to $2.25, and on Northwest Pipeline WY Sunday and Monday deliveries shed 24 cents.

Weather forecasts continued a trend of moderation overnight Thursday. Friday’s six-10 day forecast “is not as cold or warmer than the previous forecast across much of the nation,” said WSI Corp. “This is due to model trends and the day shift. Forecast confidence has improved and is average as models are in rather good agreement with the evolution of the large scale pattern.

“There is a slight cold risk across the central and southern U.S., mainly early in the period. Otherwise, the much of the West and Plains have a slight upside risk due to an amplified pattern.”

Analysts aren’t expecting any kind of significant weather event to draw inventories low enough to cause a rally in prices.

“Inventory destocking is typically at its highest level in January, given the tendency of the coldest weather to surface during this month,” said BNP Paribas’ Teri Viswanath, director of natural gas trading strategy, in a note regarding the EIA storage report Thursday. “However, the release represents the slimmest January withdrawal since 2012, a comparison that was certainly not lost on the market. A warmer midday weather model run simply fortified the ongoing sell-off, sending the front of the curve to the lowest levels since September 2012.

“Moderate heating demand and strong production growth, enabled the industry to record the lightest December inventory withdrawals in three decades. This event triggered a $1.00 correction in natural gas prices, with the prices in the front of the curve sliding from $4.00 to $3.00/MMBtu by month end.

“And while colder weather has enabled heavier destocking to take place this month, the aggregate monthly drawdown will still fall short of the five-year average level. Looking ahead to February, we see a similar pattern of variable weather limiting the call on storage.”

Once the withdrawal season ends, the market will be staring down the barrel of as much as 7 Bcf/d of additional production, and “with prices now re-aligned with 2012 levels, the question remains on whether fundamentals will contribute to the same sort precipitous collapse that occurred that year.” she said.

The EIA in its monthly 914 production report Friday indicated that year-on-year gross production from the Lower 48 was 7.1 Bcf/d higher in November.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |