Markets | NGI All News Access | NGI Data

Strong Northeast No Match for West, South; Futures Tumble on Bearish Storage

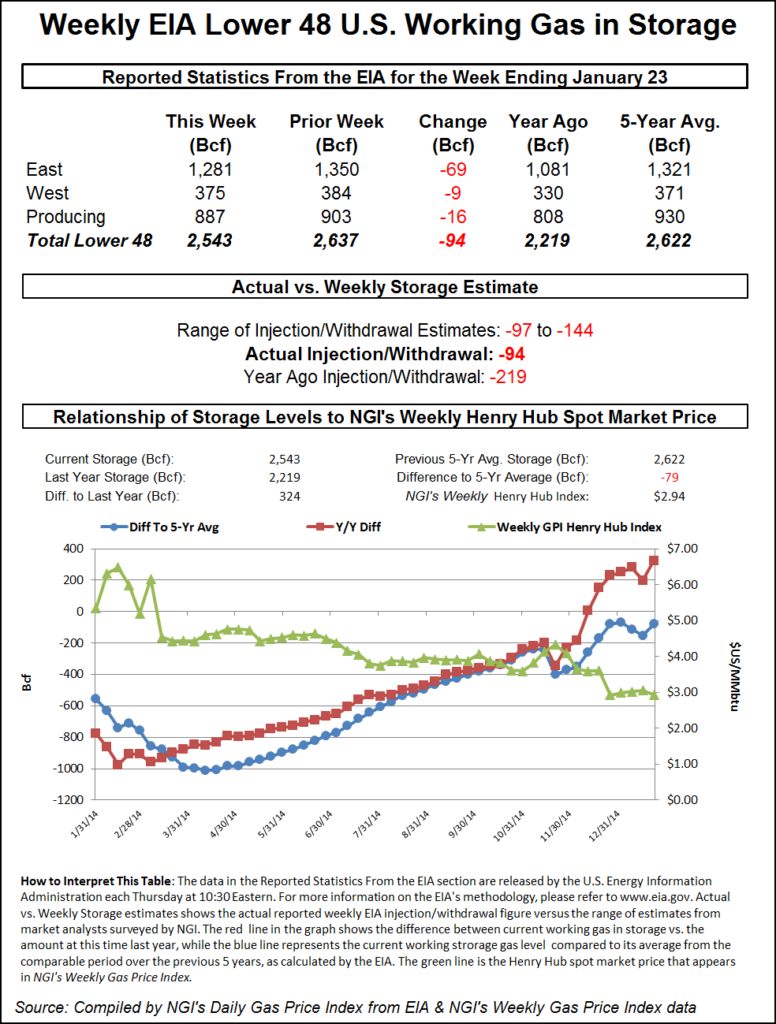

Many traders appeared to have gotten deals done before the Energy Information Administration (EIA) storage data on Thursday, which may have insulated the physical market from the free-falling futures following a withdrawal report of just 94 Bcf, about 20 Bcf less than market expectations.

Cash prices were mostly lower by a nickel or more in the Gulf, Midcontinent and Rockies, but it wasn’t enough to offset dollar-plus advances in the East and Northeast. Overall, the market finished the day 23 cents higher.

Prices fell hard following EIA’s report. At the close, the newly minted spot March futures took a 12.3 cent drubbing to finish at $2.719, and April was lower by 11.5 cents to $2.715. March crude oil traded at a new low before managing to finish in positive territory by 8 cents at $44.53/bbl.

Next-day gas prices at East and Northeast locations rose as another round of cold and snow was expected to hit New England. The National Weather Service in southeast Massachusetts said high pressure over New England was expected to move east Thursday into the evening hours.

“A clipper low pressure will move into the Great Lakes…with a secondary low developing along the southern New England coast and intensifying over the Gulf of Maine Friday by Friday evening. This will bring a period of snow” into Friday night for parts of the region. “Blustery and very cold conditions are expected this weekend. Another storm may bring snow to the region Sunday night and Monday.”

Next-day gas prices lost no time responding. Gas for Friday delivery at the Algonquin Citygates jumped $2.57 to $11.53, and deliveries to Iroquois Waddington added $2.31 to $7.04. Gas on Tennessee Zone 6 200 L rose $1.81 to $10.85.

Gas headed to New York City on Transco Zone 6 bounced $4.54 to $8.29 and deliveries to Tetco M-3 added $1.42 to $5.09.

Marcellus points also improved. Packages on Millennium added 18 cents to $1.34 and gas at Transco Leidy changed hands 8 cents higher at $1.19. Deliveries to Tennessee Zone 4 Marcellus gained 9 cents to $1.21, and on Dominion South gas was quoted at $2.05, 21 cents higher.

Temperature forecasts throughout New England were at or below normal levels, and next-day peak power rose. Forecaster Wunderground.com predicted that Thursday’s high in Boston of 33 degrees would make it to 36 Friday before dropping to 18 Saturday, a hefty 18 degrees below normal. Hartford, CT’s 31 high Thursday was expected to reach 34 Friday before also falling to 18 on Saturday. The seasonal high in Hartford is 35. Providence, RI’s 33 high Thursday was seen inching up to 35 Friday before falling to 17 Saturday, 21 degrees below normal.

Intercontinental Exchange reported peak power for delivery Friday at the ISO New England’s Massachusetts Hub rose $9.26 to $84.21/MWh and at the PJM West terminal peak power added $1.05 to $40.07/MWh.

Areas far removed from New England’s snow and cold — and more likely to be influenced by Henry Hub pricing — saw prices ease.

Gas on Columbia Gulf Mainline fell 3 cents to $2.75, and deliveries to the Henry Hub shed a penny to $2.88. Next-day deliveries on Tennessee 500 L fell 4 cents to $2.79, and gas at Katy was flat at $2.73.

In the Midcontinent, gas on ANR SW fell 7 cents to $2.56, and gas at the NGPL Midcontinent Pool fell 6 cents to $2.58. On OGT, next-day packages were quoted at $2.50, down 7 cents, and parcels on Panhandle Eastern changed hands 6 cents lower at $2.50.

West Coast prices were also weak. Deliveries to Malin fell 3 cents to $2.64, and gas at the PG&E Citygates was seen 3 cents lower at $3.09. Friday gas at the SoCal Citygates skidded 7 cents to $2.86, and parcels at the SoCal Border lost 7 cents as well to $2.69. Gas on El Paso S Mainline dropped 9 cents to $2.68.

EIA’s inventory data on Thursday was expected to give traders a better idea of how much storage would be in place at the end of March, yet the report raised as many questions as it answered as the actual figure came in well under expectations.

Working gas stands at 2,543 Bcf currently and with nine weeks remaining on the traditional withdrawal season, slightly less than 100 Bcf would have to be pulled weekly to bring supplies under the arguably bearish ending inventory level of 1,700 Bcf.

All indications were that this week’s figures for the week ended Jan. 23 would cause an increased surplus relative to a year ago and diminish the year-on-five-year deficit. Last year a stout 219 Bcf was withdrawn and the five-year pace stands at 168 Bcf. IAF Advisors calculated a pull of 108 Bcf and ICAP Energy was looking for a withdrawal of 114 Bcf. A Reuters poll of 21 industry traders and analysts resulted in a sample mean of a 113 Bcf draw with a range of 97 Bcf to 144 Bcf.

March futures fell to a low of $2.691 after the number was released and by 10:45 EST March was trading at $2.703, down 13.9 cents from Wednesday’s settlement.

“We were trading unchanged just before the number came out, and this thing fell out of bed once the number was released,” said a New York floor trader. “A close above $2.75 might convert to a support level.”

Tim Evans of Citi Futures Perspective said, “The 94 Bcf net withdrawal was well below the 110-113 Bcf consensus expectations, with the shortfall suggesting a weakening of the underlying supply/demand balance, with bearish implications for future reports.”

Inventories now stand at 2,543 Bcf and are 324 Bcf greater than last year and 79 Bcf below the 5-year average. In the East Region 69 Bcf were withdrawn and the West Region saw inventories fall 9 Bcf. Stocks in the Producing Region declined by 16 Bcf.

Weather forecasts overnight changed little with forecasters calling for a below normal six- to 10-day period and a warming trend in the 11- to 15-day horizon.

Commodity Weather Group in its Thursday morning outlook said forecast estimates called for “relatively small single-digit national demand loss and part of that is due to warmer-than-expected temperatures…on the East Coast as the current cold air mass underperforms, especially on low temperatures despite clear skies, snow cover, and calming winds.

“Otherwise, colder than normal conditions still prevail in the big picture across the Midwest, South, and East for the upcoming six-10 day with fairly good consistency, but some minor colder tweaks for the East Coast next week (with a more suppressed storm track assisting).

“The 11-15 day continues to progress warmer as the Alaskan ridge takes a time-out. The latest collection of ensembles suggest ridging starts to return to the Western Canada and Alaska area by the very end. There is always the caution that this could be too fast, and we took the slower route today, but either way, it would make for a fairly short-lived warmer period,” said Matt Rogers, president of the firm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |