Markets | NGI All News Access | NGI Data

NatGas Futures Swan Dive Following Thin Storage Withdrawal

Natural gas futures had the trajectory of Wile E. Coyote falling off a cliff in a Saturday morning cartoon following the release of government storage figures Thursday morning that revealed a much lower withdrawal than what traders were anticipating.

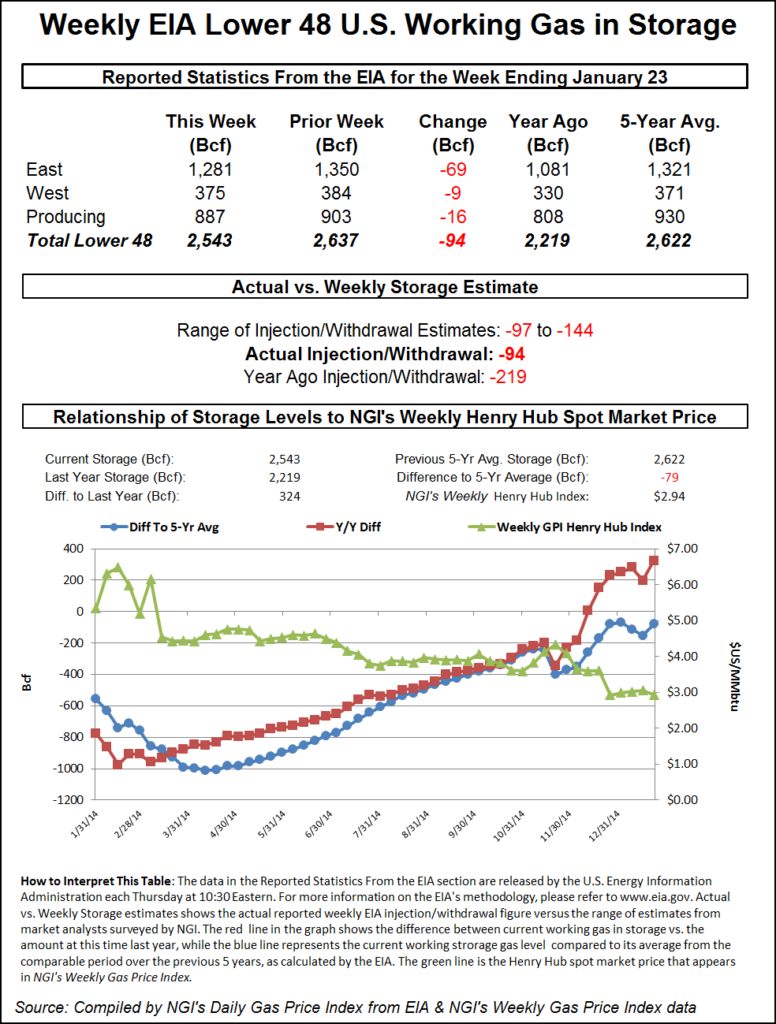

For the week ending Jan. 23 the Energy Information Administration (EIA) reported a decrease of 94 Bcf in its 10:30 a.m. EST release, about 20 Bcf less than estimates. March futures bunched below long-term support in the $2.800 area to a low of $2.691 after the number was released and by 10:45 EST March was trading at $2.703, down 13.9 cents from Wednesday’s settlement.

Prior to the release of the data analysts were looking for a decrease of about 114 Bcf. IAF Advisor analysts calculated a 108 Bcf decline, but a Reuters survey of 21 industry observers revealed an average 113 Bcf pull. Analysts at ICAP Energy were looking for a 114 Bcf pull, and industry consultant Bentek Energy utilizing its flow model predicted a 107 Bcf withdrawal.

“We were trading unchanged just before the number came out, and this thing fell out of bed once the number was released,” a New York floor trader told NGI. “A close above $2.75 might convert to a support level.”

Tim Evans of Citi Futures Perspective said “The 94 Bcf net withdrawal was well below the 110-113 Bcf consensus expectations, with the shortfall suggesting a weakening of the underlying supply/demand balance, with bearish implications for future reports.”

Inventories now stand at 2,543 Bcf and are 324 Bcf greater than last year and 79 Bcf below the five-year average. In the East Region 69 Bcf were withdrawn and the West Region saw inventories fall 9 Bcf. Stocks in the Producing Region declined by 16 Bcf.

The Producing region salt cavern storage figure fell by 3 Bcf from the previous week to 257 Bcf, while the non-salt cavern figure dropped 13 Bcf to 630 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |