Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

NiSource Sets Terms for Columbia Pipeline IPO

NiSource Inc. said this week it would offer 40 million common units at $19-21 each for Columbia Pipeline Partners LP, a master limited partnership (MLP) first announced in September to help raise cash for its natural gas transmission, midstream and storage assets.

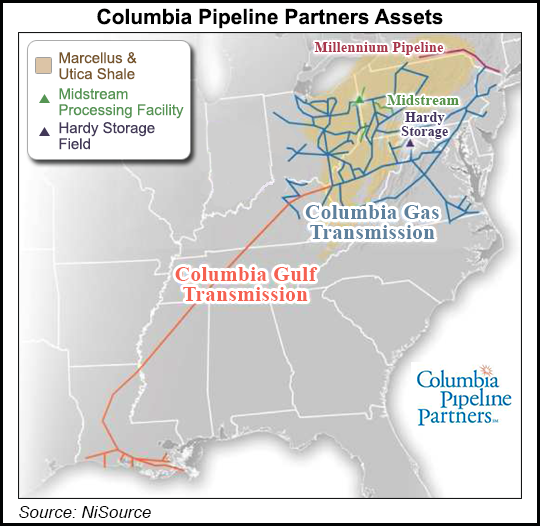

The MLP’s initial assets are expected to consist of a 14.6% interest in the Columbia Pipeline Group (CPG), which NiSource also plans to spin off into a separate publicly traded company that would own 15,000 miles of interstate natural gas pipeline, 300 Bcf of storage capacity and a portfolio of plans related to the surge in shale gas drilling, especially in the Appalachian Basin (see Shale Daily, Sept. 30, 2014). No timing was set for the initial public offering (IPO) launch.

The MLP has been approved to list on the New York Stock Exchange (NYSE) under “CPPL.” NiSource and CPG are expected to separate sometime this year.

NiSource also said it would grant the MLP’s underwriters a 30-day option to purchase up to an additional six million common units. If the underwriters exercise that option, the common units being offered represent a 46.2% interest in the MLP.

Under the plan, NiSource would retain its regulated gas utilities, which serve more than 3.4 million customers in seven states, and continue providing electric distribution, generation and transmission services in northern Indiana. CPG, meanwhile, would retain control of the company’s midstream assets and the MLP would help raise capital for them.

Some of CPG’s system is already being upgraded, while a long-term plan to improve its infrastructure and storage network to meet a growing supply of natural gas, particularly in Appalachia, is expected to cost $12-15 billion over the next decade.

NiSource itself also has plans to spend up to $30 billion over the next two decades at the utilities level, including modernization of its electric generation and natural gas distribution systems.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |