Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Carrizo to Stick With Oil, Stay Flexible During Downturn

Carrizo Oil & Gas Inc. will join its peers and “downshift” its drilling program this year, company management said during an analyst conference Tuesday, announcing a plan to stick with oil, cut spending and stay flexible in the event that commodity prices rebound.

“Well, obviously this wasn’t the analyst day we had in mind when we scheduled it last summer,” said CEO Chip Johnson. “We thought we were going to be talking about five rigs in the Eagle Ford, two frack crews, 50% year-over-year well growth, and that’s not going to happen.

“None of us like producing oil at $45/bbl or drilling wells before service costs come down anyway,” he added. “So then we started focusing on what do the shareholders want, and it came back pretty loud and clear: don’t worry about growth, protect the balance sheet, protect assets and don’t decline.”

Johnson thinks that won’t be hard for Carrizo to do, saying the company is well positioned, with costs coming down in its oil and condensate cores in Colorado’s Niobrara Formation and South Texas’ Eagle Ford Shale.

“We’re going to stay with oil and not go to gas; we purposely left gas in 2010 and we’re still glad we did,” Johnson told analysts.

For a company like Carrizo, which has sold-off non-core assets from north Texas to Pennsylvania in favor of oil, and seen its stock hold up better compared to its peers with a 52-week low of $31.70/share, oil’s decline over the last six months couldn’t have come at a worse time. The company increased its 2014 oil production target at the end of the third quarter from 57% to 63% and increased capital spending early last year on gains in the Eagle Ford and Niobrara (see Shale Daily, Oct. 27, 2014; May 6, 2014).

“Given [a] repaired balance sheet, highly economic wells in the heart of the Eagle Ford and [an] ability to accelerate or decelerate activity levels is what differentiates Carrizo from its small-cap peers,” Wells Fargo analyst David Tameron said in a research note. “We believe fundamentals remain very strong.”

Although Carrizo will reduce this year’s spending 42% from last year’s level, it plans to lean on its recent progress in Texas and Colorado to help keep oil production up and natural gas volumes stable during the downturn. Capital spending will drop to about $495 million this year from the $857 million it spent in 2014, company officials said. About $377 million of that will be spent in the Eagle Ford to run a robust program, considering the circumstances.

Carrizo has yet to release year-end production, but it’s aiming to boost oil volumes from the 2014 guidance level of 17,500-18,200 bbl/d to 21,800-22,400 bbl/d. Meanwhile, it expects gas and liquids production to stay flat at around 75 MMcfe/d. Flat gas production is mainly the result of a decision to pare drilling in Ohio’s Utica Shale, where the company has little infrastructure in place, and as its Marcellus program winds down to serve cash-flow purposes, Johnson said.

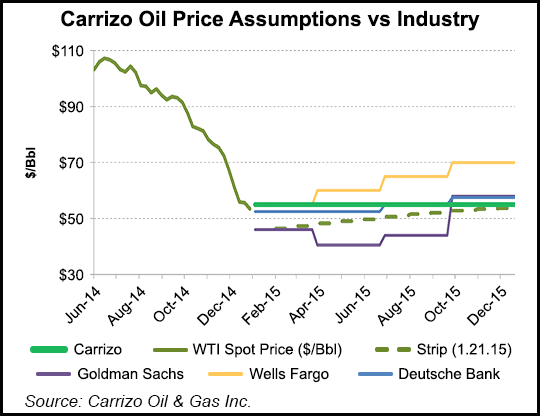

Carrizo has about 55% of its 2015 oil production hedged at $90/bbl. Its 2015 capital spending is based on an assumption that oil will fetch between $45-55/bbl, drilling service costs will come down by 8% and completion costs will come down by 18%.

The company plans to run three rigs in the Eagle Ford, where it expects to drill 55 net wells. It said Tuesday that it was increasing estimated ultimate recoveries in the field from 499,000 boe to 510,000 boe on better performance. Carrizo also forecast that the cost of its Eagle Ford wells would decline to $5.8 million by 4Q2015 from the $7.5 million it was spending on each early last year. The company said it has about 16 wells that are awaiting completion in the Utica Shale as well, which it will keep in inventory should commodity prices rebound.

It will also run a rig in the Niobrara formation, where it has plans to drill four net wells this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |