E&P | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

S&P: Sky is NOT Falling; U.S. 2015 E&P Liquidity ‘Adequate’ on Hedging, Capex Cuts

Prescient planning by some U.S. explorers should enable many of them to keep their heads above water this year, but if oil prices don’t rebound by 2016, liquidity issues will surface, according to Standard & Poor’s Ratings Services (S&P).

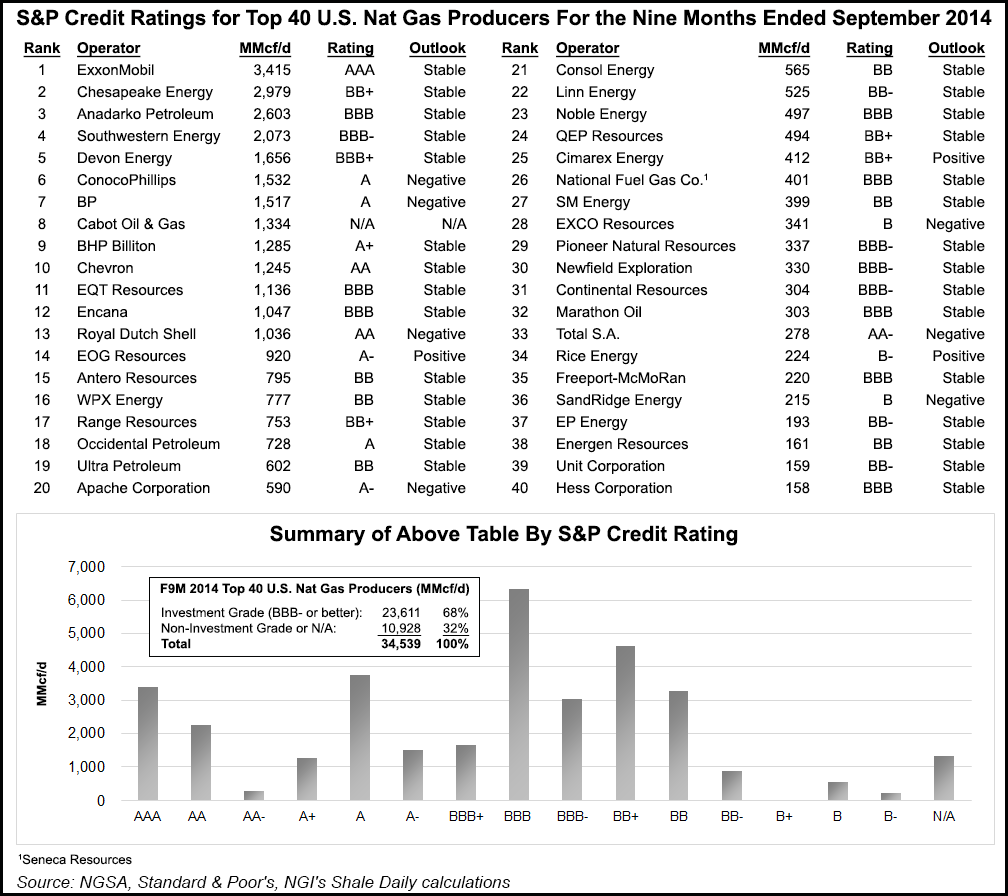

S&P Managing Director Tom Watters and a team of credit ratings analysts discussed the outlook for the sector during a teleconference on Wednesday. S&P last week downgraded 23 domestic exploration and production (E&P) companies on dimming prospects to secure more credit. Although some prognosticators believe the sky is falling, domestic E&Ps this year should be able to maintain operations even under low, sustained oil prices.

“Despite the lower prices and the potential for high-yield issuers facing borrowing-base reductions at their revolving credit redeterminations in April, we found liquidity in general, to be adequate for the next 12 months,” Watters said.

The S&P analysts found that liquidity may be less of a struggle this year than they had expected because:

“If prices don’t rebound in 2016, however, some producers may face material liquidity pressures,” Watters warned.

To provide a bit of perspective, since Nov. 1, S&P has issued 73 “negative ratings actions” for around 120 covered E&Ps.

“No doubt, we’ve been busy,” Watters said. “What we see is clearly a supply-driven issue, for the most part.” The move by OPEC last November to keep member output steady, instead of cutting back as prices began to fall, “clearly” is to target “marginal producers, U.S. shale players,” Watters said. “There’s hardly any producer that can sustain an investment drilling program. If prices stay low, they won’t work very well.”

There’s still no consensus on how low prices will go and for how long. “There’s a distinct possibility” that oil prices could plummet below $40/bbl, he said. “OPEC is attempting to eliminate some production.” S&P’s view is that the price slide could extend “to the middle of 2016 before prices rebound…”

A looming issue is the number of oil wells that were drilled in the second half of 2014. Those wells are “coming on in the first quarter,” which will exacerbate supply growth in the United States.

U.S. oil production will surge over the next few months before there’s any fall-off at all, according to S&P.

“As drilling stops and rigs are laid down, we see a decline in the latter half of this year and into next year,” Watters said.

The Saudis “have a pristine balance sheet,” with millions in reserve, Watters said. “They can play the game for awhile,” and in fact, much better than other OPEC nations. “Their budgets need higher prices.”

S&P doesn’t see “an awful lot” of defaults and bankruptcies in the U.S. space this year, “but there could be a wave” into 2016 without price support. What’s been encouraging is the quick action by domestic drillers to pare their spending significantly, with average U.S. unconventional oil drillers cutting back by 35-40% from 2014.

“We also found liquidity to be better than anticipated,” Watters said. Many producers are “well hedged for this year and they are hunkering down” on capital cuts to keep them at maintenance levels. There are concerns about debt, but most of the issuances are long-dated; most companies don’t have short-term maturities on the horizon. If a company needs to borrow, however, “capital access is almost nonexistent.”

S&P’s price deck is for West Texas Intermediate to average $50.00/bbl in 2015 and $55 in 2016. Brent is expected to average $5.00 more both years. U.S. natural gas prices at the New York Mercantile Exchange are set to average $3.50/Mcf in 2015 and $3.75 in 2016.

“We see liquidity spiraling out sometime next year” if oil prices don’t strengthen beyond their current level, Watters said.

The gas markets aren’t going to offer much support for a while for oil-focused E&Ps, according to S&P’s forecast.

“We have seen a prolific shift in gas production in the United States, a regional shift,” with production centered in Appalachia. It’s “driving out production in the Barnett and Haynesville because of the low costs and the amount of reserves,” said Watters. The issue with Northeast differentials all rests on a lack of infrastructure. “Wells have come on with very strong, high IP [initial production] rates, more than anticipated, and it’s created somewhat of a bottleneck…Storage is high, weather is not cooperating.

“When we think about the longer term for natural gas markets, the low-cost plays like the Marcellus and Utica have effectively put a cap on prices. We believe [the market will be] hard pressed to see gas over $4.00 anytime soon given the low cost of the plays. It’s just a matter of infrastructure catching up…In the Haynesville and Barnett, it’s going to be a struggle given the low costs of Appalachia.”

Asset sales aren’t likely at these prices, especially and not until there’s clarity on the oil price, said Watters. In the first nine months of 2014, global E&Ps did around $115 billion of deals, with $75 billion worth in the United States. Companies through most of 2014 still had “deep pockets and access to markets,” he said.

If prices don’t cooperate, “you could start to see some cherry picking,” he said. Asset valuations in deals today “would be pretty low,” and producers want to get the value from their plays. “Maybe sometime next year we will see an uptick” in deal-making. However, E&Ps will not part with their assets at these prices unless there’s no alternative.

Through the first half of this year, “we don’t expect a lot of asset sales to go through,” said S&P Director Carin Dehne-Kiley. “Given some disagreement on where the oil price would stabilize, [producers] will defer some sales…I do think that companies that rely on asset sales have taken that into consideration…”

Producers “won’t be giving away the business for nothing,” Watters added.

Twenty-three domestic E&Ps were downgraded by S&P last Friday. Among them is Rockies-focused WPX Energy Inc., reflecting “our estimate for increased leverage due to the reduction in our oil and natural gas price deck assumptions.” S&P now expects funds from operations (FFO)/debt to fall and remain below 45%, with debt/earnings to approach 2.5 times for the next few years. Warren Resources Inc. also was downgraded in part on its “limited hedge position,” while Swift Energy Co.’s downgrade reflects its lack of hedges and assumed lower output.

Appalachia-focused Magnum Hunter Resources Corp. was downgraded on an expectation that operating cash flows “will be insufficient to support its interest burden and maintenance capital spending on an ongoing basis under our price assumptions. In addition, we believe that Magnum Hunter’s liquidity position will likely deteriorate in 2015 due to low commodity prices.”

Houston-based Energy XXI (Bermuda) Ltd., which works in the Gulf of Mexico, had its corporate credit rating cut on the expectation that under the revised price assumptions, financial measures “will materially deteriorate.” S&P sees the operator’s debt to earnings exceed 5.5 this year, with its FFO/debt below 12, “which we consider inconsistent with the rating.” There’s a risk of more deterioration of the credit measures and potential restrictions on its ability to borrow under its revolving credit facility if it fails to address covenant issues to allow for a cushion.

S&P also revised outlooks for several operators, including Chesapeake Energy Corp. to “stable” from “positive,” on a forecast that credit measures will weaken on lower prices and the company will not meet an upgrade trigger of sustainable debt/earnings below two times within the next 24 months. SM Energy Co.’s outlook also was revised even though S&P expects it to improve its operational scale and reserve life. Denbury Resources Inc., an enhanced oil recovery specialist, also had its outlook downgraded on deteriorating credit measures.

Halcon Resources Corp.’s outlook was downgraded, even though its hedges support price realizations in 2015, because leverage is expected to be five times debt/earnings in 2016. “We note that the company has reduced capital spending substantially in response to lower prices and has full credit facility availability, although the amount could be reduced at the next borrowing base redetermination this spring.”

Also downgraded was SandRidge Energy Inc.’s outlook on lower natural gas price assumptions. While hedges are expected to support realizations in 2015, its leverage also is expected to exceed five times debt to earnings next year. The company for now “has ample liquidity in the form of cash on and an undrawn credit facility.”

Placed on “credit watch negative” was Apache Corp., the only large-cap on the list, on a view that cash flow generation would be impacted on low oil prices and “that leverage is likely to exceed the level we view as appropriate for the current rating, even considering recent asset sales and North American capital spending reductions.” Long-time CEO Steve Farris stepped down on Tuesday and COO John Christmann has taken over.

S&P also affirmed the rating for Bakken and Midcontinent operator Continental Resources Inc. and said the outlook was stable. “We are revising our view of the company’s financial profile to ‘significant’ from ‘intermediate’ to reflect our estimate of increased leverage due to the lower oil and natural gas price assumptions.” FFO is expected to be about 30%, with debt to earnings of about two and a half times this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |