E&P | Eagle Ford Shale | NGI All News Access

Analysts Infer Pioneer Production Down in Eagle Ford, Capex Cuts Looming

Although it will be another three weeks before Pioneer Natural Resources Co. holds its fourth quarter earnings conference call and announces a capital budget for 2015, analysts are already reading the tea leaves from a company executive and its joint venture (JV) partner in the Eagle Ford Shale over how both 4Q2014 and 2015 will shake out.

On Friday, India’s Reliance Industries Ltd. announced that for the quarter ending Dec. 31, gross production on its JV acreage with Pioneer averaged 725 MMcfe/d, which included about 69,300 b/d of condensate — a 3% increase over the previous quarter.

“[The] Eagle Ford Shale remains one of the most competitive liquid shale plays in the U.S. and is better positioned to remain competitive even in a volatile price environment,” Reliance said. “[The] Pioneer JV continued with implementation of better completion technologies, which has demonstrated improved well performance.

“Similarly, downspacing efforts have been progressing well and improving the potential well count for the JV. This improved efficiency greatly helps managing the depressed oil price environment.”

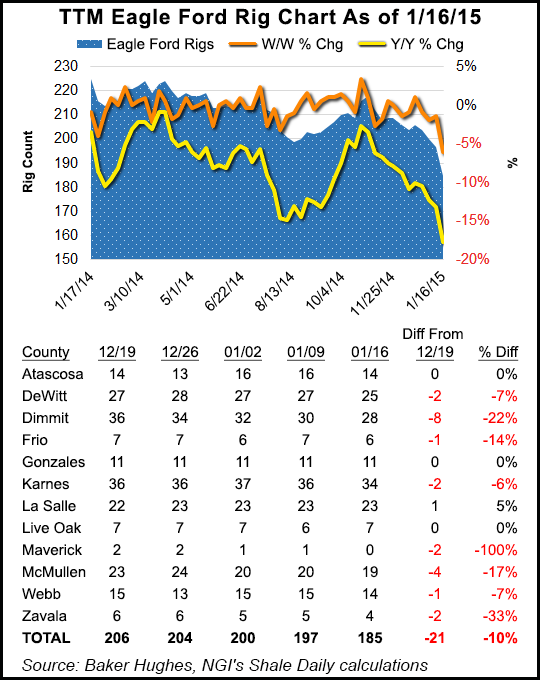

Reliance entered into an upstream JV with Pioneer in 2010 (Daily GPI, June 25, 2010). At the time, the companies expected to grow the JV’s Eagle Ford leasehold position within an area of mutual interest that included six Texas counties (Atascosa, Bee, DeWitt, Karnes, Live Oak and McMullen). Over the past month, the area has seen a declining rig count, with McMullen among the hardest hit counties. Reliance also holds JVs in U.S. shale formations with Chevron Corp. and Carrizo Oil & Gas Inc. (see Shale Daily, Oct. 5, 2012; Feb. 22, 2011).

In a note Friday, Gabriele Sorbara, an analyst with Topeka Capital Markets, said Reliance’s gross production figures for the JV implies that Pioneer’s production was about 49,100 boe/d — assuming Pioneer’s average implied interest over the past three quarters — an amount below Topeka’s estimate of 50,100 boe/d.

Sorbara said that for 4Q2014, Topeka is modeling total production of 203,000 boe/d, a number just above the consensus figure of 202,500 boe/d, yet within Pioneer management’s guidance of 200,000-205,000 boe/d.

“With Eagle Ford volumes coming in below our estimate, our 4Q2014 production estimates may have some downside,” Sorbara said. For the fourth quarter, Sorbara said, Topeka estimates Pioneer will have $1.15 earnings/share and $4.07 discretionary cash flow/share.

Pioneer is trying to sell its 50.1% stake in Eagle Ford Shale Midstream (EFS Midstream), which it owns and operates with Reliance, which owns the remaining 49.9% share (see Shale Daily, Nov. 7, 2014). The JV was formed in 2010. Services are provided by the operator, Pioneer (46%), as well as Reliance (45%), Newpek LLC (9%) and various third parties. EFS Midstream has 10 central gathering plants and 460 miles of pipelines.

Sorbara said Topeka reaffirms its “hold” rating for Pioneer, with a price target of $158/share, but said it considers “the potential EFS Midstream sale as a positive catalyst, and [believes] Pioneer should be more defensive at current levels, given its Tier 1 assets, ample financial liquidity and strong hedge book.”

Another analyst said that after a meeting last week with Pioneer COO Tim Cove, some key takeaways were that the company could reduce its capital expenditures (capex) and rig count in the Permian Basin in 2015. The firm set Pioneer stock on a “buy” rating with a price target of $176/share.

“Pioneer will still generate growth but will focus only on the highest return plays in the Midland Basin core and will delay capex on some infrastructure projects,” Irene O. Haas, an analyst with Wunderlich Securities Inc., said in a note Friday. “We kept our upstream spending and production forecasts unchanged, but both items will likely come down when Pioneer reports.

“We believe that Pioneer will emerge from this downturn [in world crude oil prices] leaner and even better. While its shares are still priced at a premium, they are about 40% off the 52-week high; we would buy Pioneer as a core holding.”

Haas said Pioneer believes full-year production for 2015 will be similar to the full-year 2014, and that production will grow again in 2016. The company also said it was “attracting buyers” for its EFS Midstream assets, which should fetch $100 million net to Pioneer.

“The company also sold six cargoes of condensate overseas and has signed contracts for two more,” Haas said in her note. “The company will export about 50% of its condensate production overseas with an uplift of about $6/bbl netting out transportation expenses.”

Pioneer is scheduled to hold its 4Q2014 earnings conference call at 9 a.m. CST on Feb. 11.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |