Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

NGV Sector Pumps Up Activity in New Year

While advocates kept a wary eye on shifting economics with falling oil prices, the natural gas vehicle (NGV) sector pumped out a variety positive activities in the opening days of the new year, with the private and public sectors both contributing to the mix.

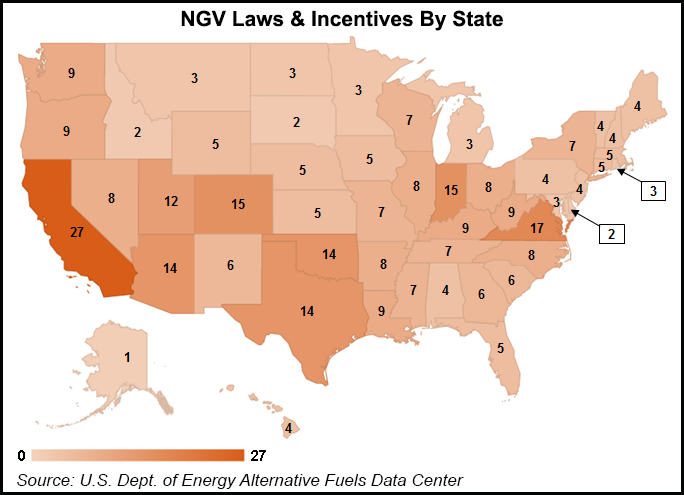

On both coasts, state governments offered more encouragement to NGVs as alternative fuel advocates planned an energy summit and U.S. Department of Energy (DOE) meeting in Washington, DC, next month. At the same time, industry continues to look for expansion opportunities in the West and East.

In California, the state energy commission approved an $11.2 million grant to the University of California system for a university-administered program for putting more NGVs on the state’s roadways. It was one of three grants by the California Energy Commission under its Alternative and Renewable Fuel and Vehicle Technology Program.

In New Jersey, the state’s Clean Cities Coalition (CCC) scheduled an NGV stakeholder meeting for Feb. 13. New Jersey Natural Gas will host the meeting at its Wall, NJ, facilities.

CCC coordinator Chuck Feinberg said the state has a wide variety of NGV stakeholders and the meeting is designed to bring the parties closer together. Stakeholders expected to attend include NGV fleet operators, fuel providers, infrastructure providers, vehicle manufacturers/upfitters, business advocacy groups, legislative affairs specialists, and public officials, Feinberg said.

Growth and interest in NGVs continues in New Jersey despite what Feinberg called “currently low diesel and gasoline prices,” along with scant state-level incentives for natural gas-powered vehicles.

The government part of the NGV puzzle will be the focus of a three-day, two-event set of meetings (Feb. 22-24): the Energy Independence Summit for the year and a DOE-hosted CCC meeting for coalition and industry leaders to share best practices.

The two-day summit preceding the CCC conclave will focus on Congress and funding opportunities, with NGV advocates getting a chance to talk with key members of Congress and senior officials from DOE, the departments of Transportation, Defense, and Agriculture, and the Environmental Protection Agency.

CCC coordinators and industry representatives also are planning to spend time on Capitol Hill Feb. 24, all in the name of seeking more incentives from Congress, something that the industry did last month during a meeting of the Senate Finance Subcommittee on Energy, Natural Resources and Infrastructure (see Daily GPI,Dec. 4, 2014).

At that hearing, Mike Whitlatch, senior director for global energy and procurement at Atlanta-based UPS, called “removing barriers” a key to the nation’s attempted transformation away from traditional petroleum products. Whitlatch also said that if Congress wants to accelerate the adoption of liquefied natural gas (LNG) in heavy-duty trucks and more use of U.S.-produced gas supplies, it needs to eliminate disproportionate taxing of LNG compared with diesel fuel.

The two fuels are taxed on a volumetric basis, but since LNG has a lower energy content than diesel that taxing approach means LNG is taxed at 170% of what diesel is. LNG produces only 58% of the energy that an equivalent amount of diesel does, Whitlatch told the Senate subcommittee.

In commercial developments, on Thursday, Wisconsin-based U.S. Venture Inc., a general automotive products distributor/marketer, said it has established a separate division for its compressed natural gas (CNG) business operating as U.S. Gain. The unit will provide all of its operations related to an expanding CNG fueling network for commercial fleet operators and shippers throughout North America.

The newly created division is an indicator of U.S. Venture’s goal of growing the Gain clean fuel brand, according to Bill Renz, U.S. Gain general manager. Originally, Gain clean fuel was managed within the U.S. Oil division, whose principal focus is petroleum and biofuel distribution, trading and terminal operations.

Natural gas fleet transportation received a boost with a major order of CNG buses in Orange County in Southern California, and implementation of a mobile CNG fueling technology in and around New York City. Southern California-based Orange County Transportation Authority (OCTA) has signed a long-term contract for 202 CNG New Flyer XN40 Xcelsior buses, replacing 192 LNG and 10 diesel-fueled buses in the OCTA fleet that have reached the end of their useful life, according to transit authority officials. The replacement will be made over a three-year period.

OCTA’s fleet currently has 525 buses, 521 of which have been built by New Flyer since 2006, and all are powered by natural gas.

In New York, Mobile Fueling Solutions plans to deploy the first of at least two “virtual pipeline” CNG transportation and dispensing units from Argentina-based Galileo. Mobile Fueling officials said their units should help expand the use of natural gas in fleets by allowing some operators to convert their vehicles without having to invest in CNG fueling facilities.

“What we want to do is wrap the virtual pipeline around the existing [CNG/LNG] infrastructure,” Mobile Fueling CEO Dean Sloane told the Fleets & Fuels newsletter. “You need to get fuel to where the fleet is.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |