NGI Archives | NGI All News Access

Northeast NatGas Basis Skyrockets; Traders Differ on Why

Natural gas forwards markets in the U.S. Northeast were revived this week, with prompt-month basis prices at the volatile New England hub surging more than $2 on a host of factors, including one that a regional trader said had nothing to do with fundamentals.

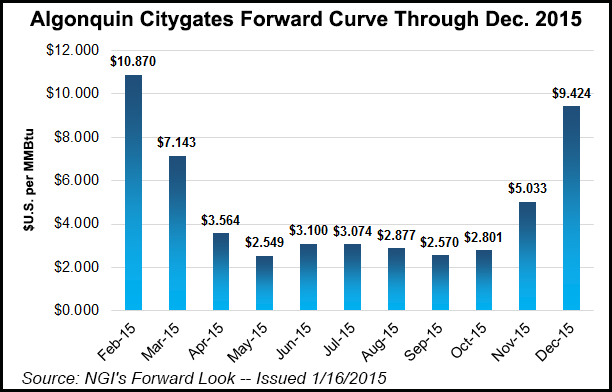

Algonquin Gas Transmission citygates February basis shot up $2.016 between Monday and Thursday to reach plus $7.712/MMBtu, just 6 cents below where the package priced on January 2 despite losses of well more than $1 the past two weeks, according to NGI’s Forward Look.

Algonquin March basis was up about 80 cents from Monday to plus $4.022/MMBtu, while the winter 2015-2016 strip jumped 95 cents to plus $6.02/MMBtu and the winter 2016-2017 shot up 60 cents to plus $4.14/MMBtu.

Strength at Algonquin is not unusual given this week’s volatility in the Nymex. The Nymex February contract soared some 36.3 cents from Monday to Thursday, driven largely by traders’ apparent reluctance to call the winter season over with still half of it remaining.

Hefty storage withdrawals the past two weeks, and another one possible for next week, also aided the stout gains in the Nymex.

But with demand in the New England area expected to wane in the coming weeks, and additional LNG supplies awaiting unloading, one trader said fast money in the form of hedge funds was behind this week’s price action.

“I’ve done this 30 years. It’s not like last year. It’s not the polar vortex. It’s not storage. It’s not producers. It’s fast money in here,” the trader said, adding that although it’s only a handful of players that create this volatility, the market can quickly get out of whack.

“People are literally making up reasons why basis moves. It’s all driven by this price action, and the price action is not in step with weather,” the trader said.

Indeed, forecasters with NatGasWeather said Friday that current weather models are not to be trusted even with outlooks as early as Jan. 23, much less for the last week of January, although even those seem to be trending warmer.

“Colder air will begin filtering back into the northern U.S. late next week around Jan. 22-23rd. The weather data has been all over the place on how much colder air will arrive with this system, but the data is coming more in line with our forecast of keeping the Arctic air over Canada and only providing a glancing blow of it to the upper Great Lakes,” NatGasWeather said.

Another Northeast trader said that while he was unsure whether hedge funds were the culprit behind this week’s rally, he said volatility in the cash market spooks basis all the time.

Thursday’s trading session proved to be a prime example of the wild swings that often take place in the cash market. Algonquin prices for Friday delivery jumped $2.80 on the day to average $13.60/MMBtu, according to NGI price data.

Still, the dramatic rise in basis this week comes as demand is expected to weaken during the next couple of weeks. Genscape shows New England demand falling to 3.46 Bcf/d by Jan. 23 and down to 3.40 Bcf/d by Jan. 29, down from the 3.68 Bcf/d projected for Jan. 16.

Other Northeast markets catapulted higher this week as well.

TETCO-M3 February basis jumped $1 from Monday to Thursday to reach plus $1.743/MMBtu, while March moved up 22 cents to minus 58.2 cents/MMBtu. Even the next two winter strips posted gains of about 10 cents on average.

At Transco zone 6-NY, February was up 67 cents this week to plus $4.22/MMBtu, and March was up 15.3 cents to plus 25.3 cents/MMBtu. Meanwhile, the winter 2015-2016 package climbed 35 cents to plus $2.76/MMBtu, and the winter 2016-2017 rose 25 cents to plus $2.27/MMBtu.

Genscape demand projections show Appalachian demand sliding to 18.84 Bcf/d by January 23 and to 18.41 Bcf/d by Jan. 29, down from 19.73 Bcf/d projected for Jan. 16.

Meanwhile, all other U.S. natural gas basis markets shifted less than 10 cents this week as the prospects for milder conditions, returning production following recent freeze-offs and healthy storage inventories weighed on traders.

Freeze-offs knocked out about 1.5 Bcf/d of supply last week, according to Genscape estimates, with the biggest declines in Texas (-0.8 Bcf/d, mostly Permian), the Midcontinent (-0.25 Bcf/d) and the Rockies (-0.2 Bcf/d).

“Recovery is likely to occur soonest in Texas and the Midcon,” said Genscape’s Rick Margolin, senior natural gas analyst. “Rockies field freeze-offs were accompanied by heavy snowfalls in some areas, which delays ability of crews to get into the field.”

Meanwhile, the U.S. Energy Information reported a 236 Bcf withdrawal for the week ending January 9, lowering total working gas in storage to 2,853 Bcf, which is 3.8% below the five-year average of 2,966 Bcf but above last year’s level of 2,571 Bcf.

Interestingly, the Dominion and TCO storage fields in the Northeast have reported their largest withdrawals during the past week, but both facilities’ inventories remain at a surplus to last year thanks to robust production in the region.

But market insiders do not appear concerned these facilities could reach their maximum capacity early this summer even if more cold weather does not come to fruition.

“Most storage holders will just ease off of injections,” a trader said. “We’ve seen injection activity in the Appalachia storage facility reduce over the last four years anyhow due to production sitting there locally. Prices will get crushed locally and force production to come off like the last few weeks.”

Genscape’s Margolin said the pressure will indeed be on storage facilities this summer as this winter’s production growth and the expected growth next summer will weigh heavily on operators.

“The market’s going to have to price gas to flow to more near-term demand sources. How effectively it will be able to do that in the power sector given the drop in coal prices in questionable,” Margolin said. “There are roughly 22 MW of coal retirements slated for 2015, but we’re not expecting that to stimulate a ton of new gas demand growth due to the low capacity factors of those to-be-retired plants.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |