Alberta Feels Biggest Oil Price Pain in Bitumen Royalties

Alberta Premier Jim Prentice is highlighting a government reason for persistent growth of oilsands plants and their natural gas use as he canvasses his electorate for politically acceptable revenue alternatives to royalties on production of provincially owned energy resources.

The traditional mainstays of the provincial budget evaporated as oil fell by half into a trading range of US$45-55/bbl from US$90-110 since last summer, Prentice said as he declared his Conservative regime open to considering all options for income and consumption tax and service fee increases.

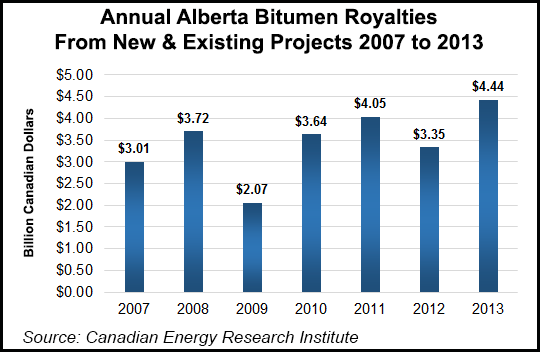

The biggest casualty of the oil price drop has been Alberta’s bitumen royalty on oilsands production. The provincial budget for the 2014-2015 fiscal year, which ends March 31, relied on bitumen for C$5.6 billion (US$4.75 billion). Longer-range plans hinged on an annual bitumen bonanza to multiply in step with rising oilsands output.

Prentice’s scramble for new revenue sources arises from built-in features of the royalty regime that shield producers and make the provincial treasury the worst victim of oil and gas price setbacks. The bitumen revenue structure, designed in collaboration with the industry in the 1990s to encourage plant expansions and new projects, provides the most help.

Unlike traditional royalties on other Alberta resource commodities, the bitumen rate is not a share of gross production revenues. Instead, the levy applies only to net profits after deduction of plant costs including a deemed fair return roughly equal to interest paid by government bonds.

Current market prices leave little net profit available for a provincial royalty share. The Athabasca Oil Sands Project, a consortium led by Shell Canada, for instance, discloses annual average unit costs of US$37.37-54.73/bbl.

The Alberta treasury takes a double hit from market setbacks. The oilsands revenue pie not only shrinks — so does the size of the province’s piece. As oil prices drop, government royalty rates automatically go down. The scale peaks at 40% if benchmark West Texas Intermediate oil climbs to US$120/bbl. The royalty rate falls by almost half to 25% of plant net profits if WTI drops to US$55/bbl or less.

New oilsands production projects fare best of all. Until all capital costs of installing new plants are paid off, the province settles for royalties of 1% to 9% as WTI fluctuates over the range of US$55-120/bbl.

Official government policy explains the structure as necessary to enable development of a resource with high initial capital costs, and as a case of deferred or delayed gratification for long-life reserves that pay off richly during highs on the energy price cycle.

So far in the current international market setback, the approach is working and bitumen development is proceeding at a steady, only mildly slowed pace.

Canadian Natural Resources Ltd., for instance, in recent days cut drilling for smaller supply sources but kept going on a C$13 billion (US$11 billion) project that will double production to 250,000 b/d at its Horizon oilsands mine as of late 2017.

Imperial Oil Ltd., in tandem with 70% owner ExxonMobil Corp., shows no sign of slowing a similar but even bigger program that is scheduled to triple output from their Kearl bitumen mine to 345,000 b/d as of 2020.

In investor presentations, Imperial executives urge the financial community to judge oilsands commitments against a yardstick frequently used to evaluate asset acquisitions and corporate mergers within the oil and gas sector: the cost of reserves additions. The Kearl mine lease contains an estimated 5.5 billion bbl of recoverable bitumen. Counting all costs over the plant’s projected 40 years of output at its full capacity for 345,000 b/d, a reasonable C$6.80/bbl (US$5.80) is being paid for the Kearl reserves.

A survey of oilsands projects now under way by Calgary energy investment boutique Peters & Co. acknowledges that deferrals are bound to happen but still forecasts Alberta bitumen production will rise by 50% into a range of three million b/d as of 2020. Previous predictions, before the current oil price plunge, called for only a moderately higher 3.4 million b/d.

The bitumen growth outlook is supported by expectations of chronic North American surpluses of natural gas, which is a key item in the thermal process of separating oil and sand with hot water or steam.

Consumption averages 1 Mcf of gas per barrel of production, and increases to 2 Mcf/bbl or more at the most intense in-situ or underground thermal extraction sites that use steam injection because the oilsands ore is too deep for mining.

Gas gave Alberta an early taste of the severe government revenue losses made possible by the provincial royalty regime. While not entirely a net-profit structure like the oilsands system, the gas system has versions of its key features.

Alberta gas royalties vary on a sliding scale that makes rates go down as prices and well productivity drop. A variety of “holidays” or royalty-free periods for desirable activity, such as deep drilling and technology improvements, also pare the rates.

Over the past 10 years of growing North American supplies, softening prices and eroding output from aging Alberta wells, the effective provincial gas royalty rate net of all favors granted to the industry has sunk to 8.5% from 21%. The annual cash value of gas to the provincial treasury shriveled by 90% to about C$900 million (US$765 million) forecast for the current budget from a peak of C$8.3 billion (US$7 billion).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |