Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota’s Oil Rig Count Plummeting With Prices

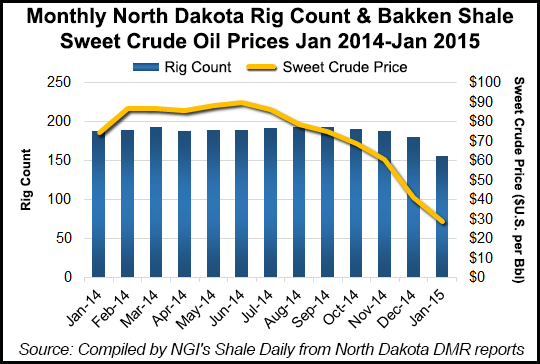

North Dakota officials Wednesday reported a big drop in Bakken Shale sweet crude oil prices and a rig count that has fallen to 158, the lowest in six years.

The price of crude in the state fell from October-November to a current price of $29.25/bbl.

“We’re in the upper-150s in rig count — down significantly in the last month by 20 or 25 rigs,” said Lynn Helms, director of the Department of Mineral Resources. He said efficiency gains in the past two years allow for fewer rigs to sustain the state’s current 1.2 million b/d production.

Helms put the current dramatic price drop over the past half-year in perspective by reminding reporters on a webinar that in the 2008 global financial meltdown, global oil prices sank from $147/bbl to $27/bbl in a six-week period. Production in North Dakota then, however, was less than 25% of what it is today at about 250,000 b/d.

The price impact is further dramatized in the state by the current number of incomplete wells (775) waiting for hydraulic fracturing (fracking) and other completion techniques, Helms said. Inactivity has spread into the state’s four-county core area in the Williston Basin.

“Eighteen months ago, it took on average about 90 well-completions each month to maintain production levels in the core area, but as the technology has improved drilling and completions, amazingly, we were able to sustain production this past November with only 39 wells completed,” Helms said. Even without the technology advances, wells in the core area are two or three times more productive than other parts of the Bakken/Three Forks formations.

He called it “a little ray of sunshine” among the gloom of depressed oil prices, adding that 18 months ago it took 90 well completions in a month to get overall production of 900,000 b/d while most recently the 39 completions occurred with monthly production of 1.18 million b/d — 35.6 million bbls overall in November.

For natural gas, production hit 42.7 Bcf, or 1.42 Bcf/d, in November, down slightly from October’s 44.3 Bcf (1.43 Bcf/d). The gas change was “statistically insignificant,” according to Helms. He did not think that either the oil price plunge or the state’s gas capture requirements were contributing to lower associated production.

North Dakota Tax Commissioner Ryan Rauschenberger said oil prices have dropped low enough to trigger a production tax reduction to 2% from 6.5% for producers of new wells over the past 24 months. If West Texas Intermediate prices stay below $55.09/bbl for five consecutive months even bigger tax incentives would kick in to try to jump start new well production, he said.

Helms speculated that many of the wells awaiting completion could be an indication that some operators are hoping to cash in on one or both of the tax decrease triggers.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |