E&P | NGI All News Access | NGI The Weekly Gas Market Report

Domino Effect of Lower Oil/Gas E&P Capex Now Hitting Offshore, Midstream

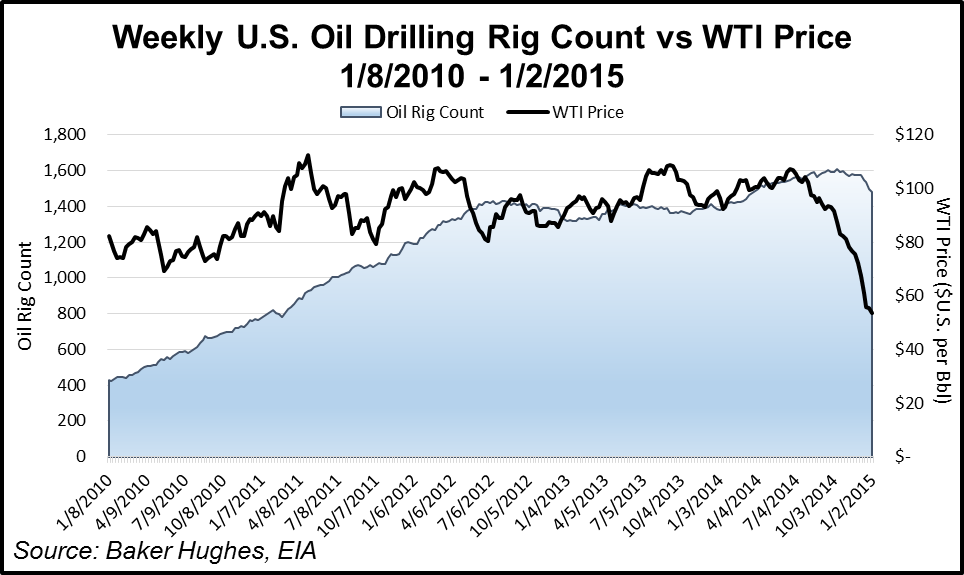

Capital spending reductions by exploration firms and the pace of falling rigs have moved beyond trivial and now pose real dangers to 2015 prospects, according to analysts.

Credit ratings agencies and private prognosticators point to dozens of announcements since late November about capital expenditure (capex) cutbacks, falling rigs and job losses as signs that the worst may be yet to come, not only for exploration and production (E&P), and the oilfield service (OFS) sectors, but also for the midstream and related pipeline industries.

E&Ps are being hit first, while OFS and midstream energy operators “will feel the knock-on effects of reduced capital spending in the E&P sector,” said Moody’s Investor Service Managing Director Steven Wood. For offshore contract drillers, 2015 may be the “toughest year since 2009,” while the oil majors and OFS leaders may be best positioned to react.

“If oil prices remain at around $55/bbl through 2015, most of the lost revenue will hit the E&P companies’ bottom line, which will reduce cash flow available for re-investment,” Wood said. “As spending in the E&P sector diminishes, oilfield services companies and midstream operators will begin to feel the stress.”

At an average $75.00/bbl price for crude oil this year, North American E&P companies likely would reduce their capital spending by around 20% from 2014 levels; below $60, spending could be cut by 30-40%.

Tudor, Pickering, Holt & Co. (TPH) has determined that at least 40 publicly held North American-focused E&Ps have since Dec. 8 reduced their 2015 capex guidance by an average 31% from 2014 spending levels. ConocoPhillips, the largest independent in the country, has trimmed its 2015 plans by 18%.

However, even with across-the-board cuts, onshore production overall is forecast to rise on average 8% year/year, TPH’s E&P 2015 Capex Tracker indicated. The tracker was compiled using company filings, company press releases and TPH research.

Since Jan. 1, TPH said seven E&Ps have announced reductions to capex spending by at least 25% from 2014. On Thursday, three more onshore E&Ps announced reductions to their spending plans: SandRidge Energy Inc., the Permian Basin unit of privately held American Energy Partners LP and Halcon Resources Corp., which cut its capex in half for the second time in two months. Other operators, like Pioneer Natural Resources Co., are shaking up their hedging strategies to cope.

Surprisingly, a lot of the capex cuts are by operators that have been working the Eagle Ford Shale, considered a three-way play with a plethora of oil, liquids and natural gas. It had been considered by some energy analysts late last year to be one of the “safer” exploration bets because of its supposedly lower costs to develop (see Shale Daily, Jan. 5; Oct. 28, 2014).

Natural gas-weighted E&Ps more than two years ago began repositioning their portfolios, and all of that work appears to be prescient. In better shape today are companies that include Encana Corp., Chesapeake Energy Corp. and Devon Energy Corp., which all still carry gassy legacies, but they’ve sold off many of their poorer performing assets and sit with a bigger pile of cash on their ledgers. Spending likely will decline, but it will be targeted and less impactful overall, analysts said.

The same cannot be said of a big chunk of the U.S. independents, however. TPH now estimates that domestic onshore activity — oil and natural gas — may fall around 40% from 2014 because of capex reductions. Analyst Matt Portillo and his team compiled the data. Some of those announced budget plans already are out the window, with many E&Ps likely to reduce their spending more than once, said Portillo.

“It’s not just trivial activity cuts,” he said. What’s concerning analysts is how much money is being cut — almost one-third of capex down — and where it’s being cut.

For some big operators, such as Appalachia-focused Antero Resources Corp., 2015 spending plans remain in flux because the environment is changing so quickly, Chief Administrative Al Schopp said this week (see Shale Daily, Jan. 6).

However, the environment is becoming clearer every day, said Wunderlich Securities Inc.’s Irene Haas. A full month of December information is available for several onshore plays, which her team dissected in a note Thursday.

E&Ps “are heading for higher ground,” Haas said. Permitting activity remains high in the Denver-Julesburg (DJ) Basin of Colorado and a few select areas of the Eagle Ford. In addition, Permian Basin activity also appears to be stabilizing. Activity in Ohio’s Utica Shale, however, “peaked in November and we are seeing a decline in December permits.”

DJ appears to be bucking the national trend, said Haas. From October to November, permit activity was flat in Weld County, CO, but they grew to 250 permits in December from 206 in November.

From October to November, the Permian subbasin, the Midland, saw drilling permit activity take a 47% nosedive, said Haas. A few counties in West Texas actually added more permits in December, but in New Mexico’s Delaware Basin, permits continued to decline, down to 85 from 135.

Although activity is down in Eagle Ford, Wunderlich doesn’t see that as a long-term trend because of the high-value E&Ps operating there.

Meanwhile in Appalachia, producers now may be “retreating back” to the Marcellus Shale, which is more developed than Utica. In any case, it’s difficult to determine a direction, because “crude prices have not found a bottom,” Haas said.

“In the Utica-Point Pleasant trend, we tallied permits filed in the more popular Ohio counties: Belmont, Carroll, Guernsey, Harrison, Monroe, and Noble,” which fell to 79 in December from 116 a month earlier.

Aubrey McClendon’s American Energy Partners LP, “appears to be stepping up with 27 of the 79 permits, or 34% of total in the Utica,” Haas said. She also pointed to a significant number of permits from other players that include Rice Energy, Eclipse Resources and Gulfport Energy.

Still, troubling signs for onshore activity are afoot based on new information from Helmerich & Payne Inc. (HP), which indicated on Wednesday during a presentation at the Goldman Sachs Global Energy Conference that its “idle and available” FlexRig count in the United States had increased nearly 20% since Dec. 11 — to 26 from 15. HP is one of the leading onshore suppliers, with its flagship FlexRig a hot commodity among horizontal drillers.

FlexRig spot pricing also has fallen, off by about 10% sequentially to begin the fiscal second quarter, and HP has “received early termination notices related to four long-term contracts. Given the current trend, we expect to see another 40-50 FlexRigs become idle and spot pricing continue to soften during the next 30 days.” HP said it expects more rigs to idle with “spot pricing softness” to continue after that.

Given HP’s rig fleet, and its customer base, it’s difficult not to see at least a one-quarter cut to overall E&P activity the onshore, Portillo said.

HP’s customer list includes a bevy of big Permian Basin and Eagle Ford operators, with 60% of the fleet contracted with Apache Corp., BHP Billiton, ConocoPhillips, Continental Resources Inc., Devon Energy Corp., EOG Resources Inc., Marathon Oil Corp., Pioneer Natural Resources and Occidental Petroleum Corp. Only 3% of HP’s fleet is vertical, so most of those falling rigs are going to be horizontals, Portillo said.

More horizontals likely will drop as contracts come off, according to TPH.

HP, Patterson-UTI Energy Inc. and Nabors Industries, three of the biggest contract drillers in North America, likely will reduce their combined workforces of 50,000 by about 15,000 this year. HP said day rates already have dropped 10% year/year.

The one sector not as impacted by falling U.S. energy prices is Big Oil, according to Moody’s. Also less impacted will be the OFS Big Three: Schlumberger Ltd., Halliburton Co. and Baker Hughes Inc., all of which have diversified global businesses.

“Integrated oil companies have been more measured in their response to falling oil prices, typically making investment decisions assuming prices of no more than $50-60/bbl, since projects can take years to complete,” Moody’s Wood said. ExxonMobil Corp., Royal Dutch Shell plc and Total SA have announced plans to cut spending this year, and Chevron Corp. and BP plc likely will join them, he said.

By Moody’s calculations, OFS sector earnings would fall by 12-17% if oil averages $75/bbl in 2015, while an average price below $60 a barrel could drive earnings down by 25-30%. Schlumberger, Halliburton and Baker Hughes are “sufficiently strong” to weather sustained declines in activity, but the smaller OFS players may not be as lucky. In the midstream sector, a spending cut of 25% or more would make it difficult for operators to maintain earnings growth at current levels of 12-15%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |