U.S.-Europe LNG Margin Shrunk, Not Gone, Says Wood Mackenzie Analyst

The latter half of 2014 saw a spate of final investment decisions (FID) on U.S. natural gas liquefaction and export projects. While the global oil price crash has helped to make liquefied natural gas (LNG) exports from the U.S. a less-profitable proposition, there still will be money to be made, a Wood Mackenzie analyst said.

“What we’ve seen change in U.S. LNG over the last year, we’ve seen the cost of projects go up…” Wood Mackenzie’s Noel Tomnay, head of global gas and LNG research, told NGI. “In order to stay competitive, I don’t think there’s any scope for capacity charges to go up. So what you’re seeing as a theme is U.S. LNG is becoming less profitable because of rising costs as much as anything.

“And then yes…the influence of the low oil price environment has definitely made some potential buyers stop and think.”

But the capacity charges for liquefaction capacity in the United States, as well as the charges for regasification capacity at terminals in Europe, are sunk costs. So, according to Tomnay, European gas prices would have to get down to around $5/MMBtu before liquefying U.S. gas and regasifying it in Europe becomes an unattractive proposition, at least for those already holding liquefaction and regas capacity. “And frankly, we don’t think that European gas prices will get that low,” he said.

Announcements of FID during the second half of the year largely pertained to U.S. liquefaction projects. Cameron LNG, Freeport LNG (Trains 1 and 2) and Cove Point LNG were all sanctioned after receiving their Federal Energy Regulatory Commission authorizations. Cheniere Energy also announced a string of new sales contracts from its Corpus Christi terminal — finishing the year with 8.5 mmtpa contracted, Wood Mackenzie said.

In a new report looking back at the year in LNG, Wood Mackenzie noted that demand from Asian markets was not as robust as many had been expecting.

“Production was up 5 million metric tonnes per annum (mmtpa) to 246 mmtpa and overall trade was boosted by higher levels of re-exports. But the big surprise was that Asian LNG demand was much lower than expected. Demand in emerging markets, like China, failed to grow to the extent anticipated, and demand in the established South Korean market fell considerably,” said Wood Mackenzie’s Giles Farrer, principal analyst for global LNG.

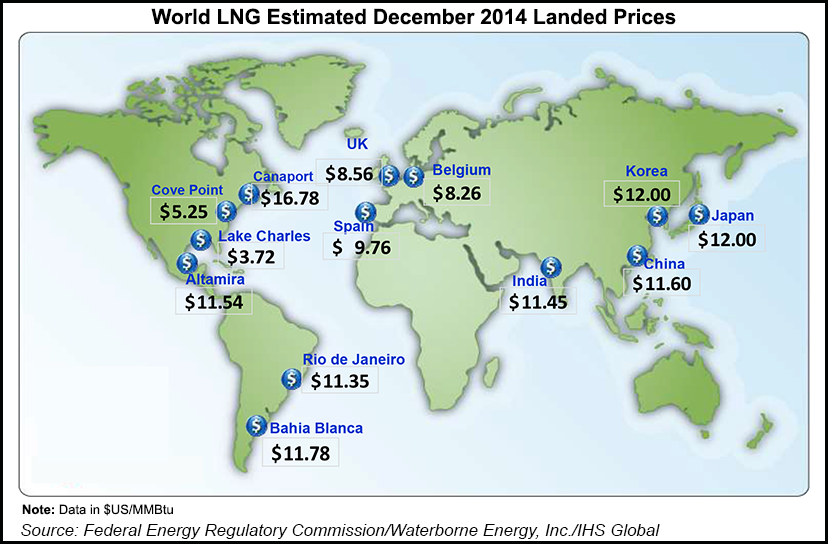

Lower demand from Asia contributed to a crash in LNG spot prices last year. Prices fell from a peak of more than US$20/MMBtu in mid-February to under US$10/MMBtu at Thanksgiving. “Prices dropped in the summer as new supply from PNG LNG and reduced Asian demand left the Pacific Basin long supply,” Farrer said, “then fell further as Brent oil tumbled from $110/bbl in August to below $60/bbl in December.”

Andrew Buckland, Wood Mackenzie principal analyst for LNG shipping, said a record number of new ship orders were placed in 2014, driven by the prospect of huge volumes of U.S. exports; 67 orders were placed, despite falling charter rates.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |