NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Raymond James Slashes U.S. NatGas Price Outlook to $3.00

U.S. natural gas prices are going to be “meaningfully lower” than most currently expect in 2015, but West Texas Intermediate (WTI) should bottom in the first half of the year, analysts with Raymond James & Associates predicted Monday.

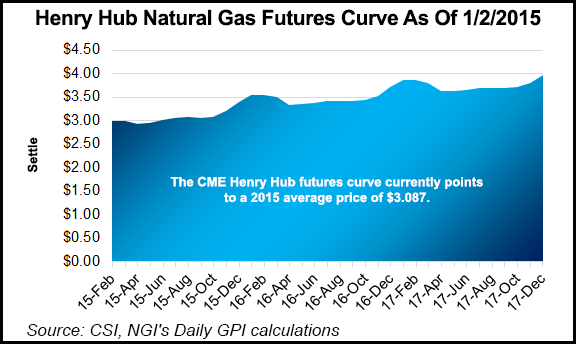

Because of the swift growth in domestic gas supply, 2015 prices likely will average $3.00/Mcf, analysts J. Marshall Adkins and Pavel Molchanov said in a note to clients. In early September, the analysts had predicted 2015 prices would average $3.65 (see Daily GPI, Sept. 8, 2014).

“With such aggressive gas supply growth, we expect Henry Hub will average $3.00 in 2015, hitting a low point in 3Q2015 at $2.65.”

A year ago, the Raymond James energy team predicted prices in 2014 would average $3.75/Mcf, 50 cents below futures strip pricing at the time. The forecast was based in part on an above-consensus expectation that U.S. gas supply would grow around 2.4 Bcf/d last year because of pipeline constraints.

However, an abnormally cold winter pushed weather-sensitive gas demand and prices higher, with prices edging above $6.00 in late February. The year-ago drivers that led to the original bearish call are more pronounced today, said analysts.

Gas supply in 2014 rose more than 4 Bcf/d, and demand remains delayed until 2016 and beyond. More important, however, supply growth accelerated into the end of the year, with data indicating December was up 7 Bcf/d year/year, Adkins and his colleague noted.

“This surging supply has already erased the gas inventory shortfalls created by last winter’s extreme weather,” they wrote. “We expect continued strong production will be the primary lever causing gas prices to drift even lower in 2015,” despite a plunging rig count and cuts to exploration and production spending.

By 2016, the outlook appears brighter for the bulls, per Raymond James, whose production forecast slows on lower rig counts, with only 0.7 Bcf/d growth. Expected surging demand from the industrial, petrochemical and liquefied natural gas exports suggests gas prices could bounce back to the “high $3.00 range” at least by the end of 2016.

“Longer term, it has become abundantly evident that U.S. gas producers can grow supply more than 5% annually (or over 3.5 Bcf/d) at gas prices below $4.00,” Adkins and Molchanov noted. “Accordingly, we are lowering our long-term forecast from $4.25 down to $3.75.”

As usual, weather remains the big wildcard for prices. Raymond James models weather from the 10-year average. However, the past few years have been anything but “normal,” the analysts said.

“If another bitterly cold winter hits North America like last year, we could easily see gas prices soar back above $4.00 in 2015. However, if the winter is warmer than normal (which is just as likely statistically), we could see Henry Hub with a $1.00 handle. Put simply, weather is clearly the largest driver of winter storage withdrawals and remains a significant, yet unpredictable, variable in everyone’s gas model.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |