NGI Archives | NGI All News Access

2014 Ends With a Whimper for Natural Gas Forward Basis

Natural gas forward basis markets ended 2014 on a downslope, falling under the pressure of a bearish storage report and apparent little confidence in weather forecasts ahead of the New Year’s holiday.

The short week had many traders still out vacationing and the bulk of markets shifted less than five cents, but Northeast points remained in freefall even as some of the coldest weather currently blanketing the U.S. is situated in that region.

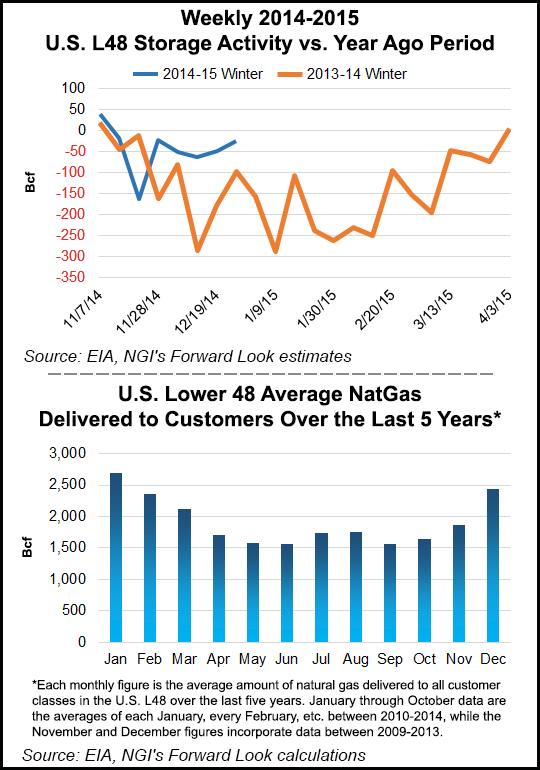

“Natural gas prices have three major strikes going against them right now, at least in the short term,” said Patrick Rau, NGI director of strategy and research. “First, although January is typically the highest demand month of the year, demand starts falling on average around Jan. 15, and storage is in pretty good shape relative to last year. That means as we get later into January, the odds that demand will absorb any excess gas in storage really begin to diminish, everything else being equal.”

Rau said a second problem is that year-over-year storage withdrawal comparisons are likely going to look pretty weak in the weeks ahead. “The U.S. averaged roughly 48 Bcf of withdrawals per week in December (2014), versus 160 Bcf in December 2013. So obviously we are already off the pace. But between Jan. 9 and Feb. 13, 2014, there were five separate weekly withdrawal totals greater than 200 Bcf. Withdrawals averaged 229 Bcf per week during that time. No way we even approach that without severe cold weather, so absent that, you are going to start seeing the storage surplus to last year really grow over the next five to six weeks.” he said.

“Finally, production may not slow fast enough to stave off lower prices over the next few months,” Rau continued, adding that the U.S. natural gas rig count has actually increased by 20 since early October. “The main impact on gas production will likely come from a reduction in associated gas production from crude oil drilling, but that will probably take several months to begin having a noticeable impact on overall gas production,” he said.

Boston highs on New Year’s Day hovered just above freezing, while New York temperatures failed to hit 40.

In New England, Algonquin Gas Transmission Citygates February basis tumbled $1.235 between Monday and Wednesday to reach plus $7.772/MMBtu, according to NGI’s Forward Look. There was no trading Thursday in observance of the New Year’s holiday. For the month of December, Algonquin’s February package lost some $4.006/MMBtu.

Algonquin March was down 53.6 cents to plus $4.81/MMBtu, while the summer 2015 package stayed flat at minus 5 cents/MMBtu. Further out the curve, Algonquin’s next two winter strips were down 15 cents and 10 cents, respectively.

Forward basis was poised to recover some of those losses, however, as Nymex futures were putting up double-digit gains in midday trading Friday thanks to the latest weather outlooks showing cold air sticking around through Jan. 10 and then possibly returning after Jan, 13. The Nymex February contract was trading a few cents above the $3/MMBtu mark at around noon EST.

“After Jan. 13, another surge of very cold temperatures is likely to push into southern Canada, which will have the potential of being tapped by weather systems tracking across the northern U.S.,” said forecasters with NatGasWeather. “How much frigid air weather systems tap going into the second half of the month is uncertain, but there will be opportunity for it.”

Forecasters with Weather Services International last week painted a more bullish picture when they said the eastern United States could expect to see colder-than-normal temperatures through March.

Nevertheless, prices in the Northeast were drastically cut this week. Transco Zone 6-New York February basis plunged 67.8 cents between Monday and Wednesday to reach plus $4.455/MMBtu, resulting in a December decline of about $2.90. March dropped 16.1 cents to plus 18.4 cents/MMBtu.

Unlike Algonquin, New York saw only modest price swings further out the curve, with shifts of no more than 5 cents seen as far as out the winter 2016-2017 strip.

At Texas Eastern Transmission Zone M3, February basis fell 39 cents to plus 82.1 cents/MMBtu, ending December some $1.47 lower than where it started the month. March dropped 15.6 cents to minus 79.6 cents/MMBtu.

Over in the Upper Midwest, much smaller decreases were seen at the front of the curve as temperatures are expected to drop into the single digits in some areas next week. Chicago Citygates February basis was down 10.5 cents to plus 23 cents/MMBtu, and the summer 2015 was down just 1.2 cents to minus 4.8 cents/MMBtu.

AccuWeather forecasts show daytime temperatures in Chicago plummeting to the single digits on Monday, a drop of more than 20 degrees from Sunday and more than 20 degrees below seasonal averages for this time of year. Temperatures are expected to remain below normal throughout the week.

In the Pacific Northwest, Northwest Pipeline-Sumas February fell 12 cents to move into negative territory at minus 5.4 cents/MMBtu as temperatures in the region remain at or slightly above normal. Seattle temperatures are forecast by AccuWeather to hover in the mid-40s to mid-50s for the next couple of weeks. The Sumas summer 2015 package slipped 2.7 cents to minus 47.1 cents/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |