Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Oil Patch Lodger Slashes Workforce, Spending as Cheap Oil Hits Home

Civeo Corp., a major provider of housing to energy patch workers, especially in Canada, is slashing its workforce in the United States and Canada due to weak commodity prices and in response to oil/gas producer spending cutbacks next year.

“The acceleration in November of the decline in global crude oil prices and forecasts for a potentially protracted period of lower prices have resulted in major oil companies reducing their 2015 capital budgets from 2014 levels. This has had the effect of reducing the near-term allocation of capital to development or expansion projects in the oilsands, which is a major driver of demand for the company’s services in Canada,” Civeo said Monday.

CEO Bradley Dodson said that in Canada the company has closed its Athabasca and Lakeside lodges and is evaluating similar actions in other locations. “We are limiting our discretionary capital spending in 2015 to those projects that are supported by customer contracts.”

In the United States, Civeo is active in the Bakken Shale in North Dakota, where it has two lodges, as well as in the Permian Basin and Eagle Ford Shale in Texas, where it has one lodge each.

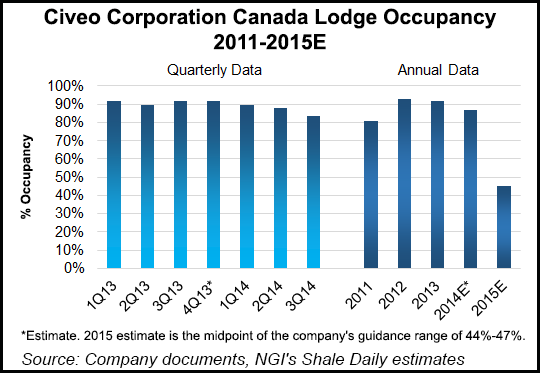

Entering 2015, the company has about 35% to 40% of its lodge rooms contracted in Canada, down from more than 75% contracted for 2014 at the beginning of 2014. Civeo said it expects Canadian occupancy of 44% to 47%, with an average daily rate of C$139 to C$145 for 2015. Anticipated occupancy rates for the U.S. facilities were not provided in the company’s guidance.

The company said it has reduced headcount in its Canadian and U.S. operations by 30% and 45%, respectively, from levels at the beginning of 2014. These efforts have included closing locations that were unprofitable at the expected low levels of occupancy, including the temporary closure of the Athabasca Lodge and the permanent closure of the Lakeside Lodge as well as the continued assessment of two undisclosed U.S. locations.

In Australia, persistently low metallurgical coal prices continue to hinder demand for accommodations in Civeo’s primary markets. In Australia, the company has approximately 35% to 40% of its village rooms contracted, down from more than 55% contracted for 2014 at the beginning of 2014. Civeo expects Australian occupancy of 55% to 57% with an average daily rate of A$88 to A$95 for 2015. Civeo’s Australian manufacturing location has been closed due to projected limited demand for additional rooms over the next several years.

The company said it is assessing the manufacturing capacity required to support the North American market. In reaction to softer markets, the company is pursuing additional revenue opportunities, adjusting its cost structure, limiting capital expenditures and suspending its quarterly dividend. Impairment charges could be required, Civeo warned.

The company expects 2015 capital expenditures to be in the range of $75 million to $85 million, a significant reduction compared to estimated 2014 capital expenditures of $260 million to $280 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |