E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Laredo Trims Fat From 2015 Budget; Already Reducing Permian Rigs

Permian pure-play operator Laredo Petroleum Inc. indicated Tuesday that it was acting quickly to defend its balance sheet against sliding oil prices, announcing that it had already begun to reduce its rig count and slashing next year’s capital budget by nearly 50%.

The company said it will allocate $525 million in 2015 for a program focused on its Permian Garden City assets in Glasscock, Howard, Reagan and Sterling counties, where it targets the Wolfcamp, Cline and Spraberry shale zones. That’s down from this year’s $1 billion budget (see Shale Daily, Dec. 10, 2013), but Laredo still expects to grow production by 12% in 2015, while spending within its means.

The production growth, combined with its hedges, which have more than 95% of next year’s anticipated oil production locked in at an average floor price of $80.99/bbl, will help generate cash flow to fund 75% of 2015 spending. Laredo also said 65% of its anticipated natural gas production next year is secured at an average floor price of $3.93/Mcf.

“The company’s philosophy of limiting the length of its service contracts and hedging a significant portion of expected production has enabled us to appropriately respond to the dramatic drop in the price of oil and the current service cost environment,” said CEO Randy Foutch. “We have already begun to reduce our operated rigs and expect to further reduce the number of drilling rigs we operate to five by the end of the first quarter of 2015.”

Crude oil continued its six-month slide on Tuesday, with the global benchmark setting a new five-year low and U.S. prices hovering well below $60/bbl. Laredo is not alone it its move to make operations leaner, other operators have been aggressively cutting budgets and signaling a reduction in their rig counts as well (see Shale Daily, Dec. 12).

“We applaud management’s move to slash spending in order to maintain its balance sheet integrity and while debt levels are inching higher through 2016, we do not foresee any breaches of its bank covenants,” said Topeka Capital Markets analyst Gabriele Sorbara.

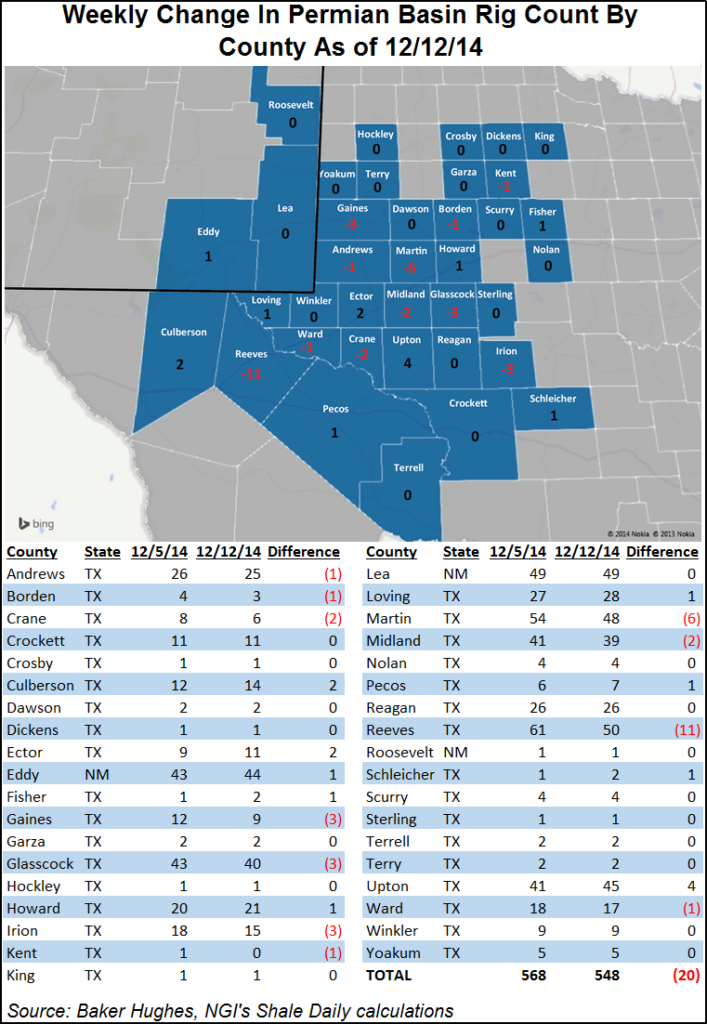

In a note to clients on Tuesday, Wunderlich Securities analyst Irene Haas said the Permian’s rig count would likely be cut in half in 2015 — a stark deviation from last year when analysts predicted that about half of all new rigs in the U.S. would be added in the basin throughout 2014, as a result of stronger commodity prices at the time (see Shale Daily, Nov. 19, 2013).

At this time last year, Laredo made plans to run up to seven horizontal rigs and five vertical rigs throughout 2014. Next year’s budget calls for the equivalent of 2.5 horizontal rigs and 1.5 vertical rigs to be operated. The company said it plans to drill up to 30 gross horizontal wells and 30 gross vertical wells.

Laredo expects to complete 45-50 gross horizontal wells and approximately 40 gross vertical wells. The company said 70% of those completions will occur during the first half of the year. Multi-well pads are expected to aid next year’s production growth.

The company will spend $430 million for drilling and completions, $35 million for production facilities, $25 million for Laredo Midstream Services, and $35 million for land and other costs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |