Bakken Shale | E&P | NGI All News Access

As Prices Plunge, Bakken Production Slows

North Dakota officials reported some still-robust oil/natural gas production numbers Friday, but they indicated it was clear that producers are beginning to react to plunging oil prices with cutbacks in their operations.

Reporting a local price of $41.75/bbl for Flint Hills posted Bakken sweet crude oil, state Department of Mineral Resources (DMR) Director Lynn Helms said the current sharp drops are a cause for concern, although he predicted the impact will be delayed in his state, given the large volume of uncompleted wells and other factors. Current prices are the lowest since March 2009, following the U.S. economic meltdown of late 2008.

“The sharply lower prices are a cause for concern, although I think the impact will be delayed because we have the inventory of wells already drilled but not completed,” said Helms, adding that an average year in the state yields 2,000 completed wells and this year there is an inventory of more than 600 uncompleted wells going into next year. In October, the state had an all-time record number of 11,892 producing wells.

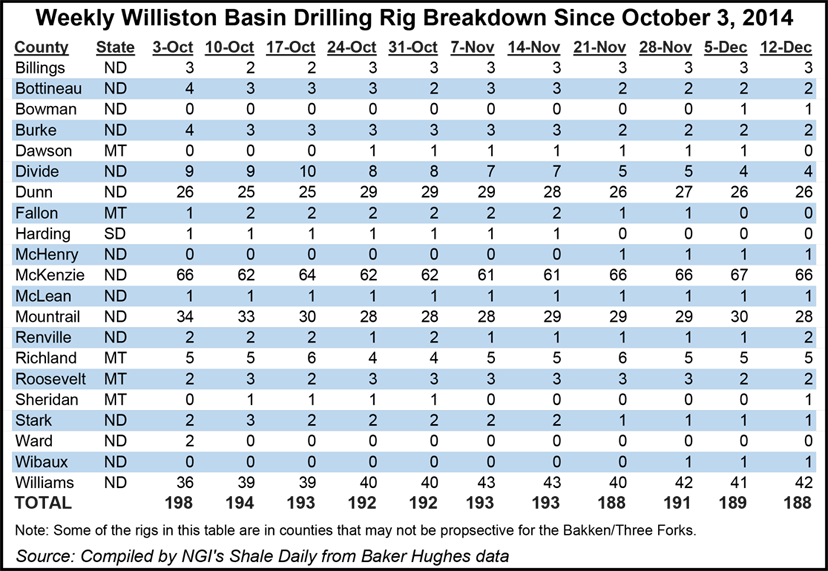

“The other cushion for us is that the four or five counties that account for the majority of the production have break-even prices well below $50/bbl, so we expect activity to continue in McKenzie, Williams, Mountail, and Dunn counties. Those people may see more activity next year than they have at high oil prices.”

Oil production for October was nearly flat compared to September — 36.6 million bbl, or 1.18 million b/d, compared with 35.5 million bbl, 1.18 million b/d, for September. Natural gas production was more robust — 44.3 Bcf , or 1.42 Bcf/d, in October, compared with 42.4 Bcf, or 1.41 Bcf/d, in September.

Another indicator of low prices, the rig count continued to trend downward hitting 183 as of Friday, compare to 188 in November, 191 in October, and 193 in September. “We have been advised by a half-dozen companies that in the first quarter next year they expect reduce their overall collective rig count down by 30,” Helms said. “And if this price decline holds well into next year, we could see another 12 to 15 rigs being released.”

During the state’s last big downturn in oil prices nearly six years ago, Helms said the state’s total rig count in May 2009 hit a low point of 34 rigs after being at 93 the previous year and did not return to 93 until February 2010.

“Today it is not like we are going to see a drastic, sudden drop, but we are going to see all of the producers ratcheting down the rig count as we walk through January, February and March, and maybe longer, depending how long oil prices stay down,” Helms said.

Price swings are one of three major forces in play, all pushing downward on North Dakota’s historic run of robust production increases, said Helms, adding the state’s new gas capture plans to combat wellsite flaring (see Shale Daily, Sept. 17) and new oil conditioning rules are also impacting or will eventually impact production. Prices and the capture plans now are the major factors.

“I think oil conditioning rules [see Shale Daily, Dec. 11] are not having any effect yet because the date for that becoming effect is April 1 next year, so there is still plenty of time for operators to get their plans in order,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |