E&P | NGI All News Access | NGI The Weekly Gas Market Report

Some Private E&Ps Foresee 500-Plus Onshore Oil Rigs Idled in Two Months

Several publicly traded onshore exploration and production (E&P) companies are signaling big cutbacks to their 2015 capital spending plans, and some private operators are expecting to see activity reined in sooner rather than later.

Wunderlich Securities Inc. analyst Irene Haas, who follows many of the public E&Ps, recently conducted a “reality check” with some of the privates to determine what impact falling West Texas Intermediate (WTI) prices was having. They weren’t enthusiastic about the near term.

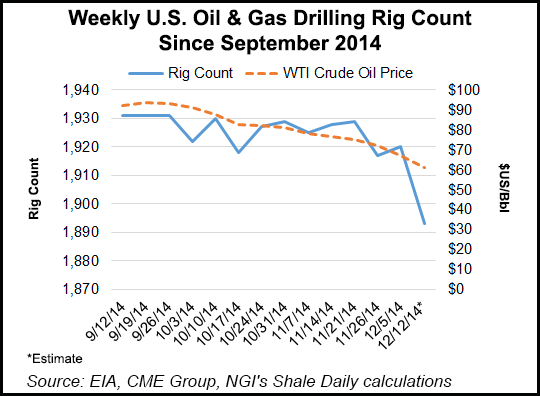

“Some private producers believe that there will be more than 500 rigs idling in the next 60 days,” Haas said Friday. Baker Hughes Inc. drilling data as of Dec. 5 indicated that there were 1,920 rigs running in the U.S. onshore, she noted. “So if this is true, we are talking about a drastic 25% cut to U.S. activity in short order.”

In the Permian, private operators indicated their rig counts “could be cut in half,” Haas said. A large unnamed oilfield services (OFS) company “is getting geared for voluntary and involuntary layoffs. One private Permian producer has already cut 62% of its rig count.”

In the Baker data reported Friday, the U.S. rig count was down by 29 rigs week/week, with the Permian rig count declining by 20.

The Permian’s core and many of the “best” areas already are held by public operators with balance sheets able to weather the storm,” said Haas. “But a host of smaller private companies will have a hard time with the economics in the fringe counties.”

Williston Basin (i.e., Bakken Shale) privates also are under pressure, according to Wunderlich.

“Multiple private companies operating in the Williston who have acreage held by production are pulling rigs off and not drilling as returns are too thin to justify operations,” Haas said. “Given the high differentials pushing down realized oil prices under $50/bbl, the additional requirements to treat crude prior to shipping by rail, and the Brent/WTI spread narrowing, the Williston Basin is becoming increasingly difficult.”

It’s not only the oil-heavy basins either. In the Marcellus and Utica, private E&Ps are being impacted by a decline in wet gas pricing, said Haas.

“While dry gas production should not be impacted by this crude price downturn, producers focusing on the wet portion of the Marcellus and the Utica will see margins compressed. One private Utica producer we spoke with said that there are a number of Utica producers with weak balance sheets. As a result, we could expect to see rigs get laid down and cuts in 2015, especially after the hedges fall off.”

The coming period in the oil patch could be “an exercise in Darwinism” for E&Ps and OFS players, said Haas.

“We believe that the sector has been over capitalized in the last 15 years, but with the capital markets less available, we expect a number of leveraged companies to become distressed. However, we are not expecting bankruptcies to be common, rather we expect a wave of mergers and ‘shotgun marriages.'”

Consolidation may occur with private equity-funded vehicles because the market for initial public offerings won’t be as fluid as it has been, Wunderlich analysts said.

“We are encouraged by how decisive and quick producers have been in responding to this downturn, which should tighten supply and set the stage for a gradual rebound. That said, look for similar fates for the OFS space as the bigger and better companies look to pick off the weaker players going through rough times.”

Tudor, Pickering, Holt & Co. (TPH) analysts said Friday the “timing and depth” of the oil price drop may force deeper U.S. cuts than they had expected.

“At sustained $60/bbl, we could see another 300-plus rigs pulled,” on top of the 25% pullback analysts already had baked in. For natural gas, that implies the United States could lose more than 1 Bcf/d of associated volumes at $4.00/Mcf prices in 2016, TPH said.

The Energy Information Administration (EIA) foresees a pull back in onshore drilling activity because of less-attractive economic returns in both emerging and mature oil production regions. As of Friday, however, projected oil prices “remain high enough to support development drilling activity in the Bakken, Eagle Ford, Niobrara and Permian Basin, which contribute the majority of U.S. oil production growth.”

EIA now expects U.S. crude oil output to average 9.3 million b/d in 2015, an increase of 0.7 million b/d from 2014, but down from the projected growth of .09 million b/d that EIA had forecast in November.

“However, all of the decrease in forecast production growth comes in the second half of 2015,” EIA said. The forecast “remains particularly sensitive to actual prices available at the wellhead and drilling economics that vary across regions and operators.”

The International Energy Agency (IEA) on Friday trimmed its expectations for oil demand growth in 2015 and maintained a forecast for higher production from non-OPEC nations, i.e., the United States.

“Barring a disorderly production response, it may well take some time for supply and demand to respond to the price rout,” IEA said.

Credit Suisse on Friday piled on, adjusting its oil price outlook down, with the West Texas Intermediate full-year 2015 price forecast to average $70.00, versus a previous $84.50. From 2016-2019, WTI prices are seen averaging $75.00, with long-term pricing at $80.00.

“The key driver of our forecast is an assessment of how much pain is required for how long to elicit a material downgrade of activity in the U.S. shale,” said Credit Suisse analyst Ed Westlake.

“In our cash-flow-driven, well-by-well upstream oil-activity model of U.S. oil production, a steady $75/bbl WTI oil price depresses shale oil production growth to barely 200,000 b/d in year one, in theory…

“Our new price deck is geared to drive that U.S. growth down from 1.7 million b/d in 2014 to barely 600,000 b/d in 2015.”

The assumed “new equilibrium” for U.S. crude is $75 WTI, “as that would depress U.S. production growth by enough to allow OPEC to keep its production flat at about 30 million b/d.”

The oil majors and many of the large caps should be in solid shape despite the price decline, particularly those with solid hedging programs, such as Devon Energy Corp. Because of hedging, the impact of lower oil prices will “not be nearly as large as you think,” COO Dave Hager said on Wednesday at the Capital One Ninth Annual Energy Conference in New Orleans.

Most of Devon’s 4Q2014 production is hedged above current pricing levels. Half of the projected 2015 oil output, about 140,000 b/d, already is protected at $91.00/bbl.

“We’re in outstanding shape as a company,” said Hager, who takes over as CEO next summer. Devon still expects oil output to increase by 20-25% in 2015, even in this low-priced environment, driven by the Eagle Ford Shale, Permian Basin and the Jackfish 3 oilsands project in Canada.

A lot of mid-cap and small-cap E&Ps are deeply in debt and/or have little to no hedging. Those companies are operating on the margin and will have to cut back. As spot prices fall, more of the shale plays will become uneconomic, Credit Suisse said.

“Shale wells typically pay out in one to three years so prompt oil prices matter to economics,” Westlake said. “The lowest cost rocks are the core of the Eagle Ford, core of the Bakken, core of the Wattenberg and some of the sweet spots in the Permian.”

At a WTI price of $75/bbl, “we cut overall well activity by 25% and U.S. production growth slowed to around 400,000 b/d of oil, 200,000 b/d of natural gas liquids. There would be substantial longer-term impacts to production elsewhere in non-OPEC also.”

At $60/bbl WTI, “it is likely U.S. production growth would slow to zero or become negative.” North America, Westlake said, “has been the only contributor to non-OPEC production growth in recent years. Limited supply growth from U.S. shale would prove unsustainable unless the world is entering a demand growth recession also, so consumer pocketbook relief may prove temporary.”

Companies with acreage in the core of the Eagle Ford, the Permian Basin’s Northern Midland and Delaware sweet spots, and Colorado’s Wattenberg field “should be able to create good economic returns even as others elsewhere struggle. That said, if the world assumed $60/bbl for the medium term, then there would likely be further downside across the space.”

Small-cap E&Ps are on the “thin edge of the wedge,” according to Credit Suisse.

“The best thing about these cycles is that it creates the opportunity to buy good geological positions with long lease lives…at bargain prices, and specifically looking at areas where already strong returns continue to show improvement, including the northern Midland, Delaware, Wattenberg, core Eagle Ford and Utica.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |