E&P | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton Readying For North American E&P Capex Cuts

Halliburton Co. isn’t reporting much impact to its North American business from plunging oil prices yet, but adjustments are likely to occur through 2015 as operators recalibrate, CFO Mark McCollum said Wednesday.

McCollum soon will be stepping down from his financial post to take over as chief integration officer for the Halliburton takeover of Baker Hughes Inc., which is expected sometime in 2015 (see Shale Daily, Nov. 17). He discussed those integration plans, as well as the outlook for the oilfield service (OFS) giant at the Capital One Ninth Annual Energy Conference.

“In a lower oil price environment there’s nowhere to hide,” McCollum said. “It is going to affect all markets equally, and North America will probably be adjusting as we go into 2015…There are going to be rigs laid down,” but “we don’t yet have a view.

“The problem is that we still have customers who have upset their budgets. There is a lot of uncertainty yet. So from our standpoint, what we’re trying to do is just maintain optimal flexibility to just whatever…Our…overall notion is we’re going to live within our cash flow. We’re going to trim the sails as hard as we can, maintain high levels of flexibility from a cost standpoint.

“We’re already pulling in. We are right now anticipating a restructuring charge in the quarter probably to the tune of about $75 million, as we trim out some head count and activities around the world…”

No. 1 OFS provider Schlumberger Ltd. earlier this month also announced it was cutting back its workforce and would take a $200 million charge in the final period.

North American customers “are continuing to drill,” said McCollum. Producers are working on “uncompleted inventories or whatever else,” and business “continues to go…

“Now, having said that, given this point in the quarter, we’re seeing a bit more weather and holiday impact than we probably thought that we would be seeing…Now, as we look in North America for the quarter, we’re anticipating flattish results in both terms of revenue and operating income with the third quarter.

“We had kind of hoped that it might be a little bit higher, but given the weather and holidays, it seems like that probably is a bridge too far.”

As the largest U.S. onshore hydraulic fracturing provider, Halliburton has deep insight into a broad cross-section of North America. ConocoPhillips has cut its capital expenditures (capex) for 2015 by 20% (see Shale Daily, Dec. 8). Mid-cap and small-cap explorers in North America of late have been announcing plans for capex cutbacks almost daily.

The OFS industry should expect a much lower forecast for North American unconventional drilling in 2015, according to a report issued this month by PacWest Consulting Partners LLC (see Shale Daily, Dec. 4).

“We’ve been here before,” McCollum said. “It’s not our first rodeo. We know how to do this, and we firmly believe that Halliburton’s market position both in North America and increasingly international puts us in a very, very good spot.

“We are a low cost service provider and we’re very effective…Customers tend to high grade to Halliburton if we’ve got time on our schedules to do work…There will probably be some marginal adjustments.

“The one thing that I am not necessarily worried about in this environment right now is utilization…We tend to see this as an opportunity not as a problem. “

Halliburton’s “head is not in the sand…There are things that are happening out there in the marketplace. As many of our peers have done, we need to recalibrate, not just as we go into ’15, but the fourth quarter as well.”

Tudor, Pickering, Holt & Co. (TPH) analysts in a note Thursday said Halliburton and Schlumberger were “being proactive in controlling that which can be controlled,” operational costs, “in this harrowing oil price environment.”

TPH pondered how much OFS costs may decline in the United States because those costs will influence exploration and production (E&P) breakeven well economics. Well economics “in turn influences how much U.S. oilfield activity will decline next year, which is a key variable in determining the magnitude of the impact on U.S. oil production.

“Anecdotes already point to oil service pricing declines starting but it will head further lower as activity declines.” TPH analysts said “something in the range of 15-20% lower cost structure to E&Ps looks like the potential relief” by the second half of 2015.

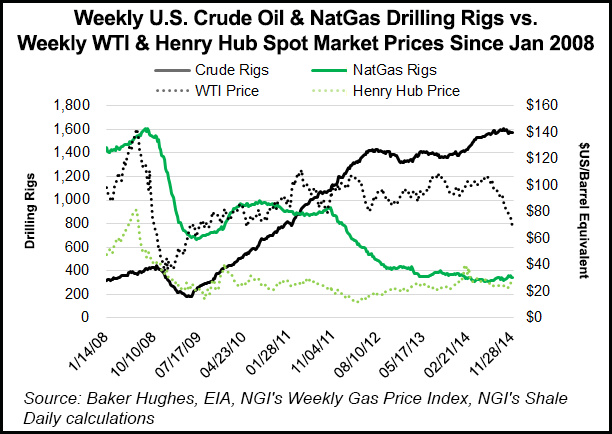

History is not always a good indicator of future performance, but it is worth noting that during the last major collapse in crude oil prices in 2008, there was a four-month lag between the high WTI oil price and the peak U.S. oil drilling rig count. On July 4, 2008, the weekly WTI price reached a cyclical high of $142.52, with the cyclical high in crude drilling rigs reaching 442 on Nov. 7, 2008. Of course, that price rout began in the middle of the year, well before most companies planned their capital expenditure budgets for 2009. With the crude oil collapse starting much closer to the December annual budget planning season this time around, companies may be in a better position to drop rigs more quickly than they were in 2008.

It took roughly seven months for both the crude oil price and the oil drilling rig count to move from their cyclical highs to their cyclical lows during the 2008-2009 downturn. The weekly crude oil price fell 74% from its cyclical July 2008 peak to its $36.94 trough on Feb. 13, 2009, while the crude drilling rig count declined 60% from its then recent high in November 2008 to 179 rigs on June 5, 2009.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |