NGI Data | NGI All News Access

Weekly Natural Gas Prices Take It On The Chin Amidst Mild Temps

Weekly natural gas prices were stopped in their tracks once again as only 3 market points could muster gains for the week ended Dec. 5. The NGI Weekly Spot Gas Average plunged 48 cents to $3.58 and most locations nationally were down between 40 to 60 cents.

Of the actively traded points the week’s best performers were Tennessee Zone 6 200 L with a gain of $1.21 to $6.34 closely followed by Algonquin Citygates posting a rise of $1.01 to $6.23. Losers included Tennessee Zone 5 200 L with a decline of 80 cents to $3.50 with Emerson not far behind with a 74 cent drop to average $3.85. All regional averages lost ground.

The Midwest was down 69 cents to $3.88 with the Midcontinent and Rockies close on their heels with declines of 56 cents and 52 cents to $3.60 and $3.59, respectively.

South Texas also shed 52 cents to average $3.48 and East Texas was off 51 cents to $3.51.

Strongest regions proved to be South Louisiana with a loss of 49 cents to $3.57, California with a drop of 47 cents to $3.86, and the Northeast sliding only 34 cents to average $3.45.

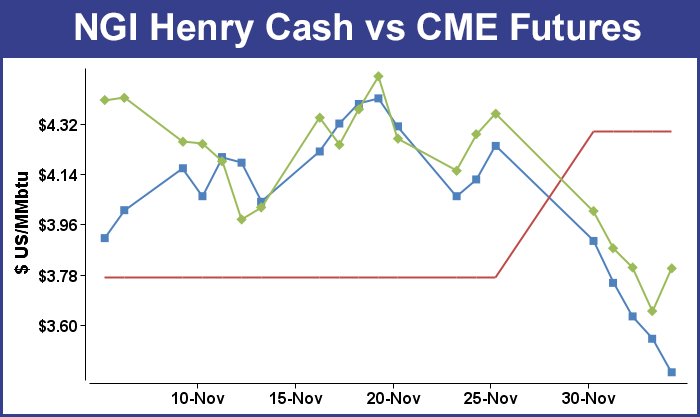

January futures retreated 28.6 cents during the week to finish at $3.802, aided by the Energy Information Administration’s (EIA) bearish storage report on Thursday that revealed a withdrawal of just 22 Bcf for the week ending Nov. 28. The report caught more than a few traders by surprise. It was far short of market expectations, which were as high as a 60 Bcf pull, and by Thursday’s close, January futures had dropped 15.6 cents to $3.649 and February was lower by 14.7 cents to $3.661.

Once the inventory figures hit the market, futures prices lost no time cascading lower. January fell to a low of $3.671 after the number was released and by 10:45 EST January was trading at $3.695, down 11.0 cents from Wednesday’s settlement.

The falling prices had traders resetting their trading parameters. “I think we are now looking at $3.50 support and $3.75 resistance although there probably won’t be much resistance at $3.75,” said a New York floor trader. “$4 is a better resistance number,” he said.

“The 22 Bcf net withdrawal for last week was at the bottom of the range of market expectations, implying both a larger than expected drop in demand as temperatures warmed back up and possibly some step up in supply,” said Tim Evans of Citi Futures Perspective. ” It implies an even weaker flow of storage withdrawals in the weeks ahead.”

Inventories now stand at 3,410 Bcf and are 227 Bcf less than last year and 372 Bcf below the 5-year average. In the East Region 34 Bcf were withdrawn and the West Region saw inventories increase 1 Bcf. Stocks in the Producing Region rose by 11 Bcf.

Analysts now see the modest 22 Bcf storage withdrawal as setting up the eventual erasure of the year-on-year deficit, perhaps by the end of the month; the year-on-five-year deficit will take a bit longer. Jim Ritterbusch of Ritterbusch and Associates thinks “such a development is also highly likely and will be a dynamic that will act to contain occasional weather-induced price advances as this winter proceeds. From a technical perspective, today’s close into new low territory below $3.70 in the January futures contract would appear to set this market up for a quick test of next support at the 3.55 level,” he said Thursday.

“Additional declines are certainly possible should the current mild temperature views extend through the upcoming weekend. In the background, the near-record pace of production is back in the forefront of trader attention as it will continue to act as a limiter to weekly storage withdrawals going forward.

“Meanwhile, the front switch has swung to contango, and we look for this carrying charge to be sustained in the process of encouraging speculative investment in the coming weeks, especially if temperature trends continue to lean toward the mild side. We are still looking for a place to establish longer-dated bull spreads but would caution against such an effort until some regions of the country begin to exhibit some colder than usual trends.”

Others see the variability between forecast and actual storage draws as making it difficult to draw conclusions about weather, storage and prices going forward. Tim Evans of Citi Futures Perspective says that the 22 Bcf was clearly bearish, but looking back over the last two weeks, “it’s just difficult to forecast the impact on storage when temperatures shift dramatically.

“For the week ended Nov. 21, the consensus was for a 150 Bcf in net withdrawals and the actual figure was 162 Bcf. For the week ended Nov. 28 the consensus was for 38-41 Bcf and we saw 22. At the very least, this volatility reduces our confidence that the storage data for last week contains any clear economic signal.”

In Friday’s trading physical gas for weekend and Monday delivery vaulted higher, led by multi-dollar gains at a handful of New England points. The gains took place as Algonquin Gas Transmission announced major curtailments. Overall, the market gained 14 cents, but if the few constrained New England locations are factored out, a more representative figure of a 9-cent decline emerges.

The Midwest was off about six cents, and the Midcontinent shed more than a dime. Rockies and the West Coast were seen about 16 cents lower. At the close of futures trading, January had finally reversed a string of six consecutive losses and had risen 15.3 cents to $3.802 and February was up 16.2 cents to $3.823.

Prices at New England points soared as Algonquin Gas Transmission reported major curtailments at its Cromwell and Southeast Compressor Stations as well as points west of Burrillville. “AGT has scheduled and sealed nominations sourced from points west of its Burrillville Compressor Station (Burrillville) for delivery to points east of Burrillville. No increases in nominations sourced from points west of Burrillville for delivery to points east of Burrillville, except for Primary Firm No-Notice nominations, will be accepted,” the company said on its website.

Gas for weekend and Monday delivery to the Algonquin Citygates jumped $7.58 to $12.14, and deliveries to Iroquois Waddington added 12 cents to $4.04. Gas on Tennessee Zone 6 200 L jumped $7.87 to $12.58.

Cold, blustery weekend conditions helped keep a strong bid under the market as well. The National Weather Service in southeast Massachusetts said Friday that “low pressure approaching New England will result in a brief mix of snow and sleet this evening…then quickly changing to all rain. The exception will be across western Massachusetts where freezing rain will linger a bit longer. The low tracks just south of New England Saturday and Saturday night resulting in periods of rain. The low departs late Saturday night yielding dry but much colder and blustery weather Sunday. Dry and cold weather lingers into Monday. By Tuesday a coastal storm may develop and impact southern New England with rain and wind…possibly wet snow over western Massachusetts.”

Other eastern points posted nominal gains or experienced losses. Gas headed to New York City on Transco Zone 6 was down a penny at $3.54, and packages on Tetco M-3 added 10 cents to $3.22.

Deliveries to Millennium added just a penny to $2.53, and gas on Transco Leidy for weekend and Monday delivery shed 30 cents to $1.98. Gas on Tennessee Zone 4 Marcellus came in 22 cents lower at $1.92, and deliveries to Dominion South added 7 cents to $2.81.

West Coast locations slumped as weather conditions over the weekend were expected to be mild. AccuWeather.com forecast that San Francisco’s 62 high on Friday would hold Saturday and reach 63 Monday. The normal high in San Francisco is 58. Los Angeles’ 70 high Friday was anticipated to hold for Saturday as well and rise to 72 Monday. The normal early December high in Los Angeles is 68. San Diego’s 68 high Friday was predicted to inch up to 69 Saturday and Monday, 4 degrees above normal.

Gas at Malin tumbled 16 cents to $3.37, and parcels on PG&E Citygates fell 10 cents to $3.89. Deliveries to the SoCal Citygates were seen off 24 cents to $3.64, and gas at the SoCal Border dropped 16 cents to $3.42. On El Paso S Mainline weekend and Monday gas fell 14 cents to $3.42.

“After days of rain that brought localized flooding and mudslides across parts of California, dry, sunny conditions will return to the Los Angeles area,” said AccuWeather.com’s Katy Galimberti. “Temperatures will rest near the 70 F mark over the weekend, on par with usual temperatures for this time of year. There will be intervals of clouds and sunny skies throughout the weekend. Looking ahead to next week, temperatures will climb into the mid-70s by the middle of the week. Skies should remain dry and mostly sunny.”

In its Friday morning Energy 20 Day Outlook, WeatherBELL Analytics said it sees a pattern of a warm West Coast, Great Plains, and Midwest with a storm threat to the East out to about 10 days. In the six- to 10-day period a “hangover from the storm keeps East colder than normal while huge break engulfs the midsection,” said meteorologist, Joe Bastardi. In the 11- to 15-day period the warmth reaches a “high tide nationwide,” and from days 16 to 25 things start to get colder with winter settling in by day 25.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |