Markets | NGI All News Access | NGI Data

Futures Probe New Lows Following Report of Lean Storage Pull

Natural gas futures plunged following the release of government storage figures showing a lower withdrawal than what the market was anticipating.

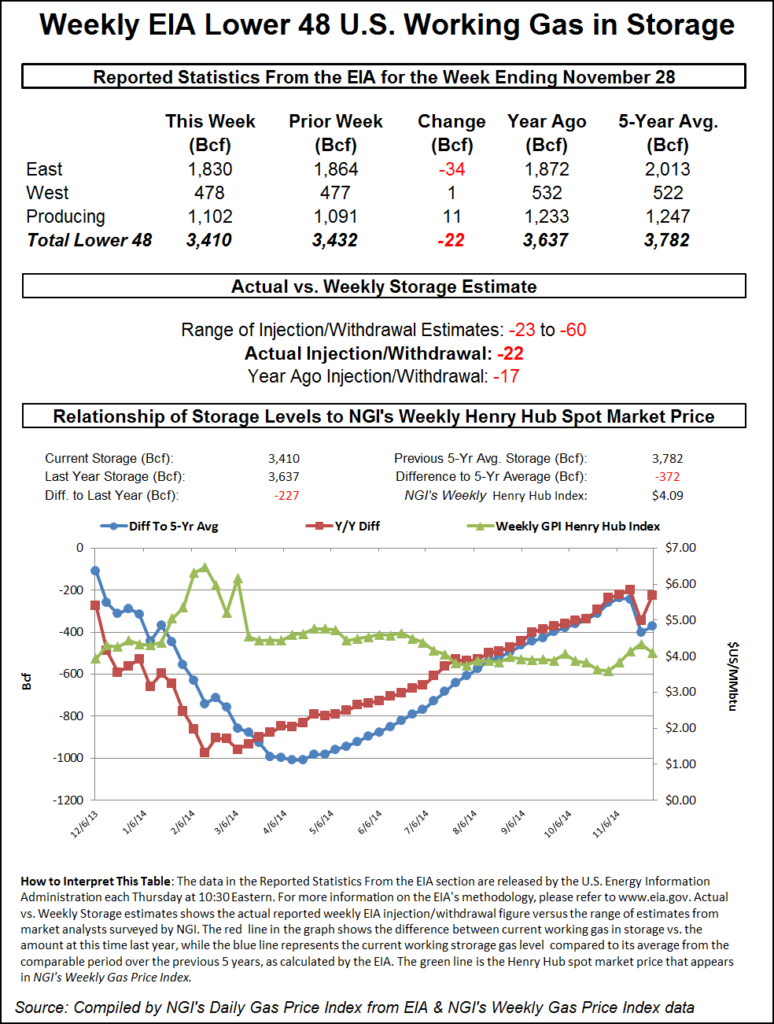

The Energy Information Administration’s (EIA) 10:30 a.m. EST report of a withdrawal of 22 Bcf for the week ended Nov. 28 was about 10 Bcf less than market expectations. January futures fell to a low of $3.671 after the number was released and by 10:45 a.m. January was trading at $3.695, down 11.0 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease of about 32 Bcf. An analysis by United ICAP revealed a pull of 30 Bcf, and IAF Advisors analysts calculated a 23 Bcf decline. Bentek Energy’s flow model anticipated a withdrawal of 31 Bcf.

“I think we are now looking at $3.50 support and $3.75 resistance, although there probably won’t be much resistance at $3.75,” said a New York floor trader; “$4 is a better resistance number.”

“The 22 Bcf net withdrawal for last week was at the bottom of the range of market expectations, implying both a larger than expected drop in demand as temperatures warmed back up and possibly some step up in supply,” said Tim Evans of Citi Futures Perspective. “It implies an even weaker flow of storage withdrawals in the weeks ahead.”

Inventories now stand at 3,410 Bcf and are 227 Bcf less than last year and 372 Bcf below the five-year average. In the East Region 34 Bcf was withdrawn and the West Region saw inventories increase 1 Bcf. Stocks in the Producing Region rose by 11 Bcf.

The Producing Region salt cavern storage figure added 8 Bcf from the previous week to 314 Bcf, while the non-salt cavern figure rose by 3 Bcf to 788 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |