E&P | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Florida Utility Has No Business in Shale Gas Patch, Consumers Say

The shale gas patch is too risky a place for an electric utility to be dabbling with ratepayer money, public interest lawyers and industrial power consumers told Florida regulators considering Florida Power & Light Co.’s (FPL) proposal to take a stake in Oklahoma’s Woodford Shale.

In June FPL filed a plan with the state’s Public Service Commission (PSC) to invest in gas supply at the wellhead, arguing that by cutting out the gas market it could save $107 million over the life of its first such upstream arrangement (see Daily GPI, June 25). FPL has requested an increase in its rate base of up to $750 million per year in order to pay for the exploration and production costs and is seeking guidelines for future similar upstream arrangements.

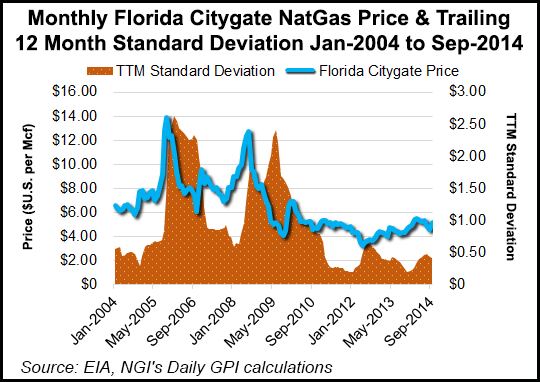

“The Woodford project offers FPL and its customers an excellent opportunity to obtain a portion of FPL’s gas requirements at a stable, lower cost,” the utility company told the PSC, as summarized in a case document. “By disassociating a portion of FPL’s natural gas purchases from market prices that historically have been volatile and instead obtaining that gas at a stable cost of production, the Woodford project will help mitigate volatility in market prices and ensure more stable prices for the gas FPL burns in its power plants. Ownership of interests in gas reserves such as the Woodford project thus would operate as a long-term physical hedge against market volatility.”

FPL said revenue required from ratepayers for the Woodford project would be lower than the market price for natural gas, even in the project’s early years, and would be far lower during the later years of the 30-year-plus deal, assuming gas prices increase as expected.

However, the state’s Office of Public Counsel (OPC), which represents consumer interests, appealed to the PSC to deny authorization. The proposal would “…shift all risks of investing in gas reserves to the customers in exchange for promises of potential customer fuel savings and guaranteed trued-up profits (or returns) for shareholders,” OPC said. The advocates said they are not opposed to guaranteeing cost savings to consumers, but FPL cannot guarantee savings over the next 40-50 years. “…FPL should not be permitted to spend the customers’ money on the faint promises of speculative fuel savings on investments in gas reserves transactions…” they said.

OPC also said the state regulators lack authority to audit FPL’s proposed shale patch partner, PetroQuest Energy Inc., to determine the prudency or reasonableness of its actions. The PSC also lacks authority to disallow production costs, it said. Further, the PSC would lack jurisdiction over the FPL affiliate that would strike the deal with PetroQuest. “Capital investments and ventures in a competitive business undertaken to make profits from the production and sales of fuel are not regulated by the commission,” OPC said.

The consumer advocates also argued that what FPL has proposed would not result in a true physical hedge against rising gas prices. “…[T]he Woodford estimates are not fixed, but rather estimated and subject to change,” OPC said. “There is no hedge or assurance that these estimates will be accurate, both in terms of the amount of gas that can be delivered or the costs of the delivered gas.”

OPC also said FPL’s estimates of future gas prices decades out as well as estimates relating to Woodford production costs are “unreasonable” and are biased in favor of the project.

Florida Industrial Power Users Group (FIPUG) also opposes the plan, saying it would be a win for FPL and a big question mark for consumers. “FPL’s request to increase its rate base by up to $750 million per year for oil and gas exploration and production costs, and to earn a return on those monies, will help FPL annually bolster its rate base and unquestionably benefits FPL’s shareholders,” FIPUG said. “Potential benefits to FPL’s ratepayers are uncertain and speculative.”

FIPUG said what FPL proposes entails “significant public policy ramifications” and should be left to state lawmakers, not the PSC. “…[T]here is no indication that the Florida Legislature contemplated ratepayer dollars being used to fund oil and gas exploration in Oklahoma,” the group told the commission.

In its defense of the proposal, FPL said, “…OPC and FIPUG are simply wrong. The arguments are premised upon erroneous facts and calculations as well as a fundamental lack of understanding of the oil and gas industry.”

The utility said its projections show “substantial benefits” for consumers. “And if the intervenors are correct that there is a high degree of uncertainty about future natural gas prices, then the price stability that gas reserves projects provide will be especially valuable to FPL and its customers.”

The PSC is expected to decide on the proposal by the end of the month.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |