Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

EIA Foresees More Than 8 Bcf/d of Northeast Bidirectional Capacity

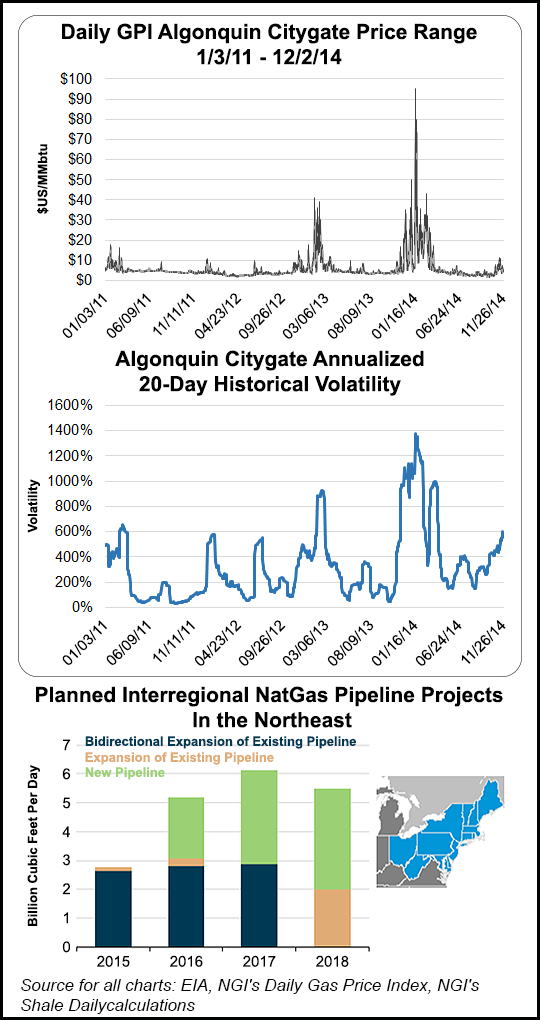

The natural gas pipeline industry’s response to booming Northeast production is well under way as up to 8.3 Bcf/d of existing capacity into the Northeast could be modified to also flow the other way. And besides bi-directional projects, new capacity out of the region is also planned.

Last year, capacity into the Northeast stood at about 25 Bcf/d, according to the U.S. Energy Information Administration (EIA). Flows on ANR Pipeline, Texas Eastern Transmission, Transcontinental Pipeline, Iroquois Gas Pipeline, Rockies Express Pipeline, and Tennessee Gas Pipeline accounted for 60% of flows to the Northeast last year, the agency said.

“Flows on these pipelines in 2013 were between 21% and 84% below 2008 levels, with the largest percentage decline occurring on the Tennessee Gas Pipeline,” EIA said in a note posted on its website Tuesday. “In 2014, the Tennessee Gas Pipeline and the Texas Eastern Transmission pipelines began flowing gas both ways between states along the Northeast and Southeast region borders.”

Columbia Gulf Transmission completed two bidirectional projects in 2013 and 2014 that enable its system to transport gas from Pennsylvania to Louisiana. ANR Pipeline, Columbia Gulf Transmission, Tennessee Gas Pipeline, Texas Eastern Transmission, and Transcontinental Gas Pipeline are planning to send gas from the Northeast to the Gulf Coast to serve industrial demand and liquefied natural gas exports. These projects total 5.7 Bcf/d.

The Rockies Express Pipeline’s partial bidirectional project (representing 2.5 Bcf/d of capacity) is mainly to flow Marcellus gas to Chicago, Detroit and the Gulf Coast (see Shale Daily, June 24). And Iroquois Gas Pipeline’s bidirectional project (0.3 Bcf/d of capacity) would deliver gas from the Marcellus to Canada.

Existing long-haul pipeline capacity into the Northeast is underutilized, and modifying facilities for bidirectional flow is less expensive and requires fewer regulatory permits than greenfield projects. But the industry also is planning to build 27 Bcf/d of new capacity to support Northeast production, according to EIA. As of Nov. 7, the industry added more than 2 Bcf/d of capacity in the Northeast, following 1.6 Bcf/d of additional capacity that came online a week earlier, the agency said.

Algonquin Gas Transmission and Tennessee Gas Pipeline, which supply most New England’s gas, plan to increase their capacities into the region by 3.6 Bcf/d by the end of 2018, according to EIA. This addition will “significantly increase” supply in New England and could reduce price volatility at the Algonquin Citygate.

(View the latest pipeline additions on NGI’s just-released 2015 edition of “The Shale/Resource Plays & North American Natural Gas Pipelines Wall Map.” It’s got it ALL in one 52 X 36-inch full-color durable glossy print. Go to naturalgasintel.com/shalemapto order.)

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |