Markets | NGI All News Access | NGI Data

Bulls Roaming After EIA Storage Stats

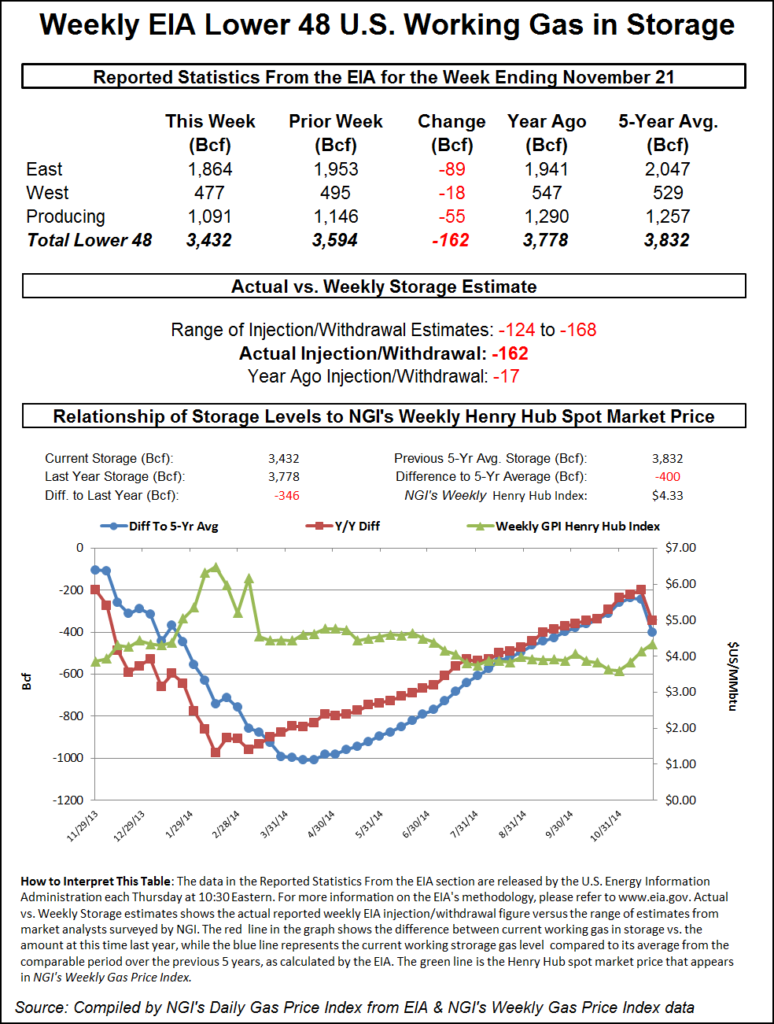

Natural gas futures rose following the release of government storage figures Wednesday morning that were greater than what the market was expecting. The withdrawal of 162 Bcf was about 12 Bcf above market surveys and independent analyst projections.

Shortly after the Energy Information Administration’s 12:00 p.m. EST release, January futures rose to a high of $4.529, and by 12:15 p.m. the contract had slipped slightly to $4.492, up 8.9 cents from Tuesday’s settlement.

Prior to the release of the data, analysts were looking for a build of approximately 150 Bcf. A Reuters survey of 21 traders and analysts revealed an average decrease of 150 Bcf with a range of 124 Bcf to 168 Bcf. United ICAP was looking for a draw of 160 Bcf, and Ritterbusch and Associates anticipated a pull of 145 Bcf. Last year, 17 Bcf was withdrawn and the five-year pace is for a 6 Bcf decrease.

Analysts saw the report as something of an outlier, with more seasonal numbers likely in upcoming reports.

“The 162 Bcf net withdrawal for last week was near the upper end of the range of expectations most likely due to heating demand spiking more than anticipating off the recent cold snap,” said Tim Evans of Citi Futures Perspective.

“The price reaction will still be limited by the swing to more moderate temperatures that will likely translate into bearish storage comparisons over the next three weeks. We continue to see some risk of a ‘sell the news’ reaction. A break below $4.35 in January futures would tend to confirm a short-term reversal to the downside.”

Inventories now stand at 3,432 Bcf and are 346 Bcf less than last year and 400 Bcf below the five-year average. In the East Region 89 Bcf was withdrawn, and the West Region saw inventories down by 18 Bcf. Inventories in the Producing Region fell by 55 Bcf.

The Producing region salt cavern storage figure decreased by 23 Bcf from the previous week to 306 Bcf, while the non-salt cavern figure fell by 32 Bcf to 785 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |