Natural Gas Forward Basis Weakens on Easing Cold Temps

Moderating weather forecasts sent natural gas forwards markets lower for the start of the week, with stout double-digit declines seen in key consuming regions and a drop of nearly $2 in the constrained New England market.

“Weather isn’t locking in. We’re at very high levels already, and I think sentiment is that we can’t meet the weather expectations of last year,” a Northeast trader said.

Indeed, 14-day weather outlooks are showing milder conditions across much of the US by next week after back-to-back cold snaps put November on track to be the second coldest since 2000.

“The cold is forecast to stick around through next week, but then things get tricky for the final week of November as the modeling is starting to show more pattern variability,” according to Commodity Weather Group’s Matt Rogers. “We think this could lead to less cold air availability in the final week of November, but then we are watching some evolving factors that could lead to more cold air patterns by early December, including a strong stratospheric warming.”

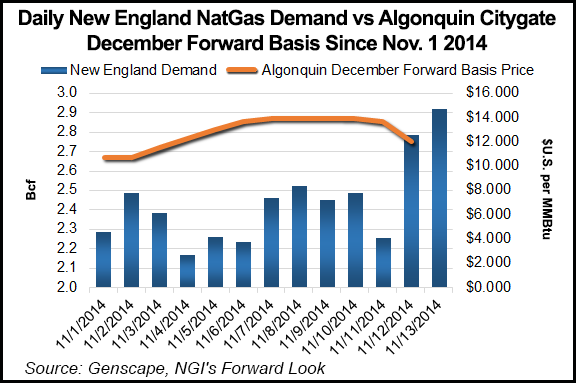

Indeed, projections from Genscape show demand in New England peaking above 3 Bcf/d by Friday before sliding back to around 2.8 Bcf/d by November 21. Appalachian demand is expected to top out at about 14 Bcf/d before falling to around 11.4 Bcf/d.

The absence of sustained cold and above-average demand took its toll on prompt-month packages in the natural gas market.

New England’s Algonquin Gas Transmission citygates December basis plunged about $1.94 between Monday and Wednesday to reach plus $12/MMBtu, according to NGI’s Forward Look. Wednesday’s basis represents a full value price of $16.19/MMBtu, which is more than double the Algonquin daily price for gas delivered Thursday.

Interestingly, Algonquin daily prices have been particularly strong this week as several constraints along the pipelines have limited flows during this high-demand period.

Meanwhile, the Algonquin January package tumbled more than 70 cents to plus $16.75/MMBtu, while the January-March strip slid more than 60 cents to plus $13.75/MMBtu.

Elsewhere in the Northeast, Transcontinental Gas Pipe Line zone 6-New York December was down 83.5 cents between Monday and Wednesday to reach plus $3.295/MMBtu. January plummeted about 64 cents to plus $9.15/MMBtu, and the balance of winter dropped 57 cents to plus $5.81/MMBtu.

In the Midwest, where Genscape forecasts demand to slide to around 8.4 Bcf/d November 21 after peaking above 10 Bcf/d earlier in the week, prompt-month basis prices also posted solid losses.

Chicago Citygates December basis fell 30.5 cents between Monday and Wednesday to land at plus 40.5 cents/MMBtu, while the balance of winter plummeted about 28 cents to reach plus 38.5 cents/MMBtu.

Points along the Northern Natural Gas Pipeline posted similar declines, while smaller decreases were seen in other areas of the US.

In the Rockies, Northwest Pipeline’s Wyoming Pool December basis was down more than 6 cents to minus 8.6 cents/MMBtu, and the balance of winter was down about 5 cents to minus 7 cents/MMBtu.

Meanwhile, the frigid conditions in the region resulted in the first freeze-offs for the winter season. According to Genscape’s Rick Margolin, senior natural gas analyst, about 30,000 Mcf/d of production has been cut as temperatures in areas like Denver plunged to the single digits at night.

“When the Rockies freezes off, it takes a while to recover,” Margolin said, noting that snow accumulation makes it difficult for maintenance crews to reach the affected pipelines. “This cold snap does not have a lot of snow, though,” so a sustained bump in basis prices is not likely.

No freeze-offs have been reported in the East or in the Bakken, Margolin added.

Other natural gas markets softened as well, following the lead of the Nymex December contract, which fell some 7 cents between Monday and Wednesday and appeared on track to weaken further ahead of Friday’s release of the US Energy Information Administration’s storage report.

“Looking ahead to this week’s storage release, the range of analyst estimates reflect a stock build between 38-42 Bcf for the week ending November 7,” Teri Viswanath, director of commodity strategy at BNP Paribas, said in a Wednesday note to clients. “More interesting is the possibility that the inventory restocking will come to an abrupt halt this week, with an early indication that the stock build will come in between 1-5 Bcf. Looking ahead to next week, the national gas-weighted heating degree days (nearly 70 degrees above normal for the reference week) suggest the possibility of the first triple-digit stock withdrawal of the season – a development that will likely encourage further buying.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |