NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Proppant Suppliers See No Slowdown for ’15, With Sand Eclipsing Ceramics

Onshore operators have been pumping millions of pounds of sand and ceramic proppants into their fractures (fracks) at a furious pace this year to improve estimated ultimate recoveries (EUR) from new wells and recompletions, a pace that suppliers don’t see slowing down going into 2015.

During recent quarterly conference calls to discuss third quarter earnings performance, one analyst questioned sand provider Hi-Crush Partners LP executives about how business will be once the “fire drill” has ended and oilfield service operators no longer were pounding on the door for more proppant.

“The fire drill in my mind is not going to end in 2015,” said Hi-Crush Co-CEO Bob Rasmus. Work is still to be done on “hordes on wells, tighter spacing, much more sand per well. This is really an early part of this powerful demand driver. And I think the service companies are not in panic mode, but it certainly has their attention.” Rasmus may know of what he speaks. Halliburton Co. in October extended an agreement with Hi-Crush to increase annual sand volumes through 2018 (see Shale Daily, Oct. 14).

For months now, Rasmus said, oilfield service companies “have been saying ‘wow, something new is happening here.’ Operators are finding much more sand produces outstanding returns…So we believe this is in the early stages of being a demand-driver for continuing market growth in sand. We’re all going to have to work together to avoid that Chinese fire drill. It’s all hands on deck and the sand providers are going to play a very large part of it, and so will our customers.”

Hi-Crush has 6.6 million tons of sand contracted in 2015, 88% of its production capacity. Commodity price volatility may play a role in business activity down the road, but so far, there’s no signs of a slowdown, said Rasmus.

“Demand for Hi-Crush sand continues to accelerate, as is clear from both the pace and commercial terms of contracts we’ve executed and from on-going discussions with our customers…We’re not seeing any data or having any discussions that indicate lower demand for our sand.” Up to now, the increased sand use for hydraulic fracturing operations has been by large-cap and medium-cap exploration and production (E&P) companies.

“The majority of E&Ps have not yet caught up to the industry leaders in terms of the very recent trend of a significantly increased sand usage per well,” Rasmus said. “As long as there is onshore drilling, there will be a need for our sand. As long as there is a focus on cost, the market will rely on the quality provider who can cost effectively and reliably deliver the large quantities of Northern white sand needed per well. And as long as there is an emphasis on quality, efficiency and performance that the well had, you will need the highest quality premium white sand.”

U.S. Silica Holdings Inc. CEO Bryan Shinn has seen a “step change in demand” this year, particularly from the blue chip customers, which helped drive record third quarter volumes to 3 million tons, 42% higher from a year earlier.

“Market trends of more horizontal wells, longer laterals, increased stage counts and more profit per well continued to drive sales higher,” Shinn said during a conference call in late October. “We’re seeing strong demand for our products across all of the major basins, and we expect to remain sold-out of all grades of frack sand for the foreseeable future.”

U.S. Silica also is reporting no slowdown in its sand or resin-coated business because of volatile oil prices.

“While much has already been said about the decline in oil prices and the potential impact to drilling activity, we see no signs of that to date and have experienced no reduction in demand or orders for our products,” Shinn said. “We’re actively engaged in conversations with our customers about their future growth and none has brought down their estimated requirements…

“That said, we’re closely monitoring the environment, but…activity continues to surge due to the unprecedented level of service intensity. Further, we believe that increasing usage of raw sand proppant to enhance well productivity and economics is a long-term direction of the industry.”

That’s not to say there aren’t challenges associated with all of the increased work, said Shinn.

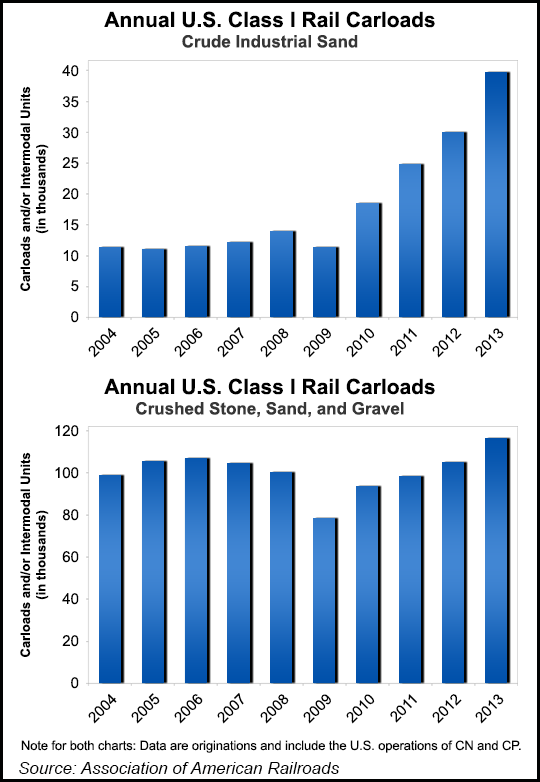

“Railcars continue to be in short supply, with lead times for ordering new railcars now as long as two years,” he said. “We’re currently managing over 6,500 railcars and will have over 7,000 railcars in our fleet by the end of this year, and we expect to have over 9,000 cars in service next year…We’ve shipped over 100 unit trains year-to-date, more than double the number we shipped last year, and we’re currently moving about 20% of our oil and gas volumes via unit trains. Unit trains give us faster railcar turns and thus, greater utilizations — utilization of those scarce rail assets.”

For U.S. Silica, “scale matters and speed matters even more,” said Shinn. “We believe the current transportation bottlenecks that some in our industry are encountering represent an opportunity to grow our customer base by taking share from less capable competitors who lack the infrastructure and the financial strength to be successful in today’s marketplace.”

The company’s Utica Shale plant currently is sold out as the location ramps to 24/7 operations, Shinn noted. A 3 million-ton sand mine and plant in Fairchild, WI, should begin construction this month, and initial work has begun to double capacity at the Pacific, MO, facility to 1.6 million tons. Around 8 million tons of incremental fracking sand capacity is set to come online in the next two years.

“We really haven’t seen anything in terms of price decreases,” he said when asked about requests for price breaks in light of oil prices. “Actually, we’re seeing some price increases, quite frankly…We’re pretty optimistic about pricing…”

Obtaining long-term contracts also isn’t an issue, nor are extensions, said Shinn. “Some have been volume expansions, and in other cases, we’ve had actually new customer contracts signed,” said Shinn. “Because of that, I expect that we’ll actually be higher than 70% contracted as we go into 2015. I think we could be 80% to 90% contracted in the first half of ’15.”

For Carbo Ceramics Inc., which offers premium-priced ceramic proppants and resin ceramic supplies, business has dropped off, despite the booming completions market. CEO Gary Kolstad has for several months complained about cheap Chinese ceramics flooding the North America market and about U.S. customers that have abandoned the premium service for cheaper priced sand (see Shale Daily, Sept. 22).

The third quarter “marked a period when a combination of events” impacted the company, Kolstad said. “A growing number of E&P operators are experimenting with the use of raw frack sand. In addition, some of our clients’ well pad completions were delayed. These events, along with an oversupplied ceramic proppant market, drove both domestic and international competitors to lower prices.”

Carbo isn’t losing sight of the opportunities ahead, despite the market conditions, said Kolstad.

“Today it is estimated that over 90% of the oil in a shale reservoir is left in the ground, providing significant potential to improve the estimated ultimate recovery, or EUR, of these wells…There are two key factors to optimize the production and EURs of the wells that are drilled in these low-permeability reservoirs and they are contact area and conductivity. It is important to have both, as the former focuses on the near-term production while the latter creates longer-term production results.”

As E&Ps experiment to hit the contact area, Carbo is getting the word out that ceramics may be better equipped to do that. It’s increased its customer service unit to ensure that customers “understand the economic benefits of developing solutions to optimize both contact area and conductivity,” said Kolstad. Sand may be cheaper, but it may not be optimum for EURs.

“We have conducted studies to show the production, EUR, and economic benefits of optimizing both the contact area and conductivity in the reservoirs,” said the CEO. “Results from these studies show that some of these wells, utilizing only low conductivity sand are underperforming offset wells within six months of completion. We believe the pendulum has swung too far in the direction of using large volume of sand in wells that need more conductivity and durability than sand can provide.

“While the use of more sand may initially lower well costs, we expected results in lost production, lower EURs and potential costly re-fracks in the future…The fundamental technical reasons wells need fracture conductivity have not changed. As such, we are committed to moving forward with the technologies we have and those in development, to increase the EUR of wells.”

Finding the best solution in the onshore involves a bit of experimentation. Carbo has had some customers that stopped using ceramics to experiment with proppant sand, but that returned after finding they didn’t get the results they wanted, said Kolstad.

Oftentimes, he said, customers that switched to sand have seen reduced EURs over a specific period, despite pumping millions of pounds of sand into fractures. And pumping all that sand may not be as cost efficient, said Carbo’s CEO. “Nobody’s asked the question about the cost-neutral designs that we’ve seen…15 million, 16 million pounds of sand versus 5 million pounds of ceramic in the well…and ceramic wells were out-producing,” he said of customer anecdotes…Sometimes it takes a long time when you switch over to something, you know, before people will move back. We’ve seen that before in this industry, and so on balance, we like to see what’s happening.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |