Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Halcon Cuts Capex, Rig Count — But Sees 2015 Output Rising 15-20%

Onshore independent Halcon Resources Corp. is slashing its capital budget and will drop almost half of its rigs in 2015, but production year/year still will jump by 15-20%, CEO Floyd Wilson said Tuesday.

Even with rising output, falling crude prices and escalating service costs require some caution, Wilson told analysts during a conference call. As a result, capital expenditures have been reduced to $750 million from $950 million. A planned 11-rig program has been sliced to six.

“We will not employ five rigs that we had prior plans to employ next year,” said the CEO. “We’ll run six rigs to get started here and see how the year unfolds…We will remain flexible to increase or decrease that capital program for 2015.

“While we are substantially hedged for next year, we’re in that uncomfortable space where crude prices have declined dramatically while service costs remain at an all-time high. Of course, the flip side to that is, efficiencies are at an all-time high as well. So, it’s not a black hole by any means. But they are out of sync.”

Wilson said today’s events are similar to many he’s been through in his years in the business. “Our sales and our great partners on the service side of the industry will react accordingly to changing conditions and reach a comfortable space. As you all know, we need each other.”

Production next year will be “100% driven” by the Williston Basin and from East Texas assets, dubbed El Halcon. Each play now has three rigs running and in 2015, they still will have three each.

“Both our core plays are profitable if today’s prices were even lower,” Wilson said. “Our expectation is to run six rigs across our portfolio in 2015 and we’ll spend meaningfully less than what we had planned to spend next year.”

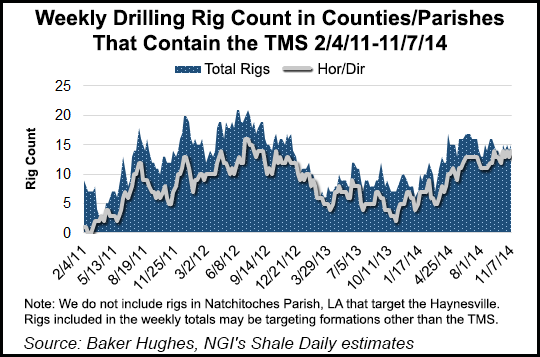

Push has come to shove in the Tuscaloosa Marine Shale (TMS), however, where two rigs now are in operation. Results are encouraging, but the costs to work there are too high in today’s oil world, said the CEO. Pulling back on activity in 2015 is no reflection on the play’s potential.

“I remain highly confident” in the TMS, “but it’s an early-stage development project.” There’s “plenty of commercial potential. However, it’s a high-cost play and with low crude prices, we won’t devote a lot of resources…in the near term…a temperate approach to drilling is warranted.”

There could come a time in 2015 when Halcon decides to ramp up activity in its two core plays or even in the TMS. How would the company determine the time is right, an analyst asked.

“Certainly we would have a better feeling about everything with a bit higher oil price,” said Wilson. “But we can’t plan for that and we wouldn’t change our program overnight. If we really made some changes in the future, it would be after a hard look at expected cash flows and benefits from spending more money.

“Actually, I believe that a company that can spend $750 million and grow 15-20% is in a class by itself.”

In the Williston Basin, one of the wells put online in the Fort Berthold area during the quarter had an initial production rate of 4,381 boe/d, a new record for Halcon. On average, wells put online during the quarter are outperforming Halcon’s type curves for each area, with 801,000 boe in Fort Berthold and 477,000 boe in Williams County, ND.

Halcon also said it reduced the amount of gas it flared in North Dakota by 50% in 3Q2014. The company currently is flaring around 25% of its gas production in the Williston Basin and expectations are for continued improvement over time.

Halcon now operates 169 producing Bakken wells and 51 Three Forks wells. Seven Bakken wells and three Three Forks wells are being completed or waiting on completion on the operated acreage. By the end of the year, the producer expects to spud up to 10 gross operated wells in the basin and participate in up to 70 other wells.

In the El Halcon field, considered an extension of the Upper Eagle Ford Shale, six wells were put online late in the quarter and were outperforming the 452,000 boe type curve, the company said. Halcon currently is targeting 7,000-8,000 foot laterals, where the unit configuration allows.

The drilling program in El Halcon is designed to hold acreage by production over the next year to 18 months, Wilson told analysts. Completed well costs are expected to decrease by up to $1 million per well once it transitions into development mode.

There currently are 78 Halcon-operated wells in East Texas producing and six wells being completed or waiting on completion. Up to 12 more wells are to be completed by the end of the year.

Total production averaged 43,554 boe/d in 3Q2014, 16% higher than in 3Q2013. Output was weighted 82% to oil, 10% to natural gas and 8% to natural gas liquids. Total operating costs fell 17% year/year to $23.50/boe.

Halcon received on average $87.20/bbl for its oil in 3Q2014, versus $100.14 in the year-ago period. Average realized gas prices were $3.44/Mcf, slightly up from 3Q2013’s $3.40. Liquids realizations were lower at $33.57/bbl from $36.21.

Net income was $186.9 million (36 cents/share) in 3Q2014, versus a year-ago loss of $860 million (minus $2.19). Revenues totaled $307 million, but missed Wall Street’s consensus of an estimated $318 million. In the year-ago quarter, revenues totaled $305 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |