Infrastructure | NGI All News Access

NGV Industry Pushes Back on Proposed California Low-Carbon Standards

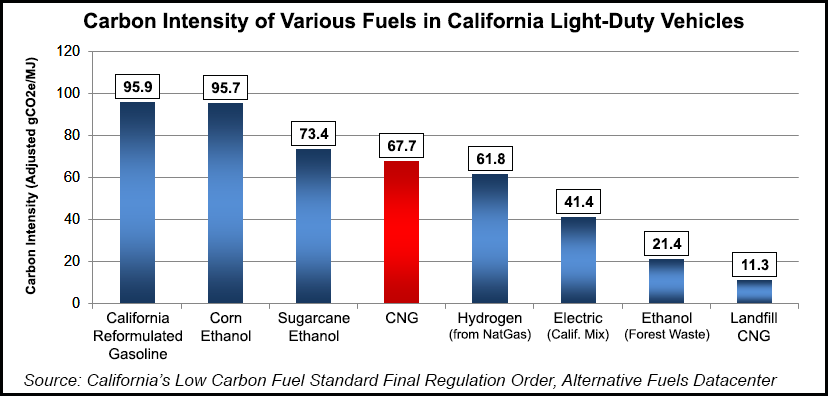

As part of the implementation of its 2006 Climate Change law (AB 32), California is considering major changes in the state’s low carbon fuel standards (LCFS) that could set back the growing natural gas vehicle (NGV) market. All the major NGV players have weighed in on the issue at the California Air Resources Board (CARB).

CARB, which has overall responsibility for implementing AB 32, has set another public workshop for Thursday in Sacramento to further review proposed changes to its CA-GREET 2.0 model (California-modified Greenhouse Gases, Regulated Emissions and Energy use in transportation) that would set the carbon intensity (CI) level lower for natural gas.

“We respectfully urge CARB to refrain from making changes in the California GREET model at this time,” NGVAmerica’s Jeffrey Clarke, director of regulatory affairs and general counsel, wrote in a letter to CARB. Clean Energy Fuels Corp., Southern California Gas Co., Pacific Gas and Electric Co., the California NGV Coalition, Westport Innovations and many others in the NGV sector wrote similar letters.

The pending changes, from the gas industry’s analysis, could mean lower clean fuel ratings for NGVs as the means to lower greenhouse gas (GHG) emissions. This could hurt the NGV sector’s ability to obtain grants and incentives or participate in the expanded statewide cap-and-trade program for GHG emissions (see Daily GPI, Oct. 20).

NGVs reportedly come out badly under the proposed GREET 2.0 model due to the emissions of unburned methane escaping from an NGV’s tailpipe. NGV sector advocates are challenging the validity of the models used by CARB, alleging they used obsolete data.

It was only in October that CARB released more information on the proposed changes, so the NGV sector is asking the state agency to slow the process and take more time for “a thorough review process and an anticipated influx of new data.”

“We believe there is more data currently being collected than all the data that has been collected [so far] on the issue of methane leakage,” wrote Tim Carmichael, president of the California NGV Coalition. “CARB seems to be rushing to make these changes, and we are unaware of any requirement or need to make these changes right now.”

Meanwhile, in other states the playing field is improving for NGVs as evidenced in Colorado where the state Energy Office is providing $3.9 million to help build eight compressed natural gas (CNG) fueling stations in the state. It has also sent out another request for proposals for a second round of project bids that are due early next year.

Salt Lake City-based Trillium CNG gained a $443,000 state energy grant to develop what is being described as a high-visibility CNG fueling facility in the Shell West Mart station in Glenwood Springs, CO, directly north of Interstate Highway 70.

Oklahoma-based Sparq Natural Gas is set to build two CNG stations in southern Colorado, creating the first public-access natural gas fueling in the area. Those two stations will get a total of $500,000 in support from the state energy office. The stations will be along Interstate Highway 25 connecting Denver and Albuquerque, NM.

In Pennsylvania, where the state has an ongoing incentive program for NGVs, Rev LNG plans to build two liquefied natural gas (LNG) production and truck fueling facilities that will also be available for the exploration/production sector and eventually for marine transportation fueling applications. The first station will be near Scranton in Bradford County in northeast Pennsylvania.

Rev LNG CEO David Kailbourne said the first station would be a 50,000-gallon-per-day production facility that can expand up to 200,000 gal/d. Initial onsite storage will be 150,000 gallons, or about 560 cubic meters of LNG, Kailbourne said.

The first facility is slated to be in operation next summer with the second one scheduled to start several months later in 2015, a Rev LNG spokesperson said. “We are looking to do an identical mirror-image plant south of Pittsburgh within a few months after the first facility,” Kailbourne said.

Rev LNG received an $800,000 technology innovation award under the Pennsylvania Department of Environmental Protection’s alternative fuels incentive grant program. The gas supply for the LNG production facilities will come from local wells in the state’s burgeoning natural gas production.

LNG and CNG both will be featured in the NGVAmerica North American NGV Conference and Expo, co-hosted with the Canadian NGV Alliance in Kansas City, MO (Nov. 11-14). It is being touted as the largest NGV trade event of the year.

Some of the companies and technologies that are likely to be on display in Kansas City were making headlines in other parts of the country in the first days of November: Amp/Trillium CNG’s joint venture (JV) in Texas; Ryder System Inc. in Maryland; CDP’s CNG kits for Chevrolet Cruze and Sonic passenger vehicles will soon be available; and Oshkosh Corp.’s McNeilus Truck & Manufacturing unit expanded its advanced CNG fuel systems to a wider variety of vehicles nationwide.

Amp/Trillium’s JV has opened the first public access CNG station in Sweetwater, TX, a 24/7 facility that can fuel up to three Class 8 trucks simultaneously at 10-12 gasoline-gallon-equivalents (GGE)/minute. The station is using Trillium’s fast-fill hydraulic intensifier technology. This is the fourth in a series of seven public CNG stations the JV is developing.

Ryder System, which has a commitment to expanding its alternative fuel vehicles in its fleet of rented and leased vehicles (see Daily NGI, April 4, 2011), has completed its first NGV lease deal in Maryland with Baltimore-based Northeast Foods, a baker and food distributor. Northeast will use CNG trucks for its exclusive servicing of McDonald’s. Ryder will maintain the 25 CNG vehicles.

Crazy Diamond Performance (CDP) said it has gained U.S. certification for its dedicated CNG systems for GM Chevrolet Cruze and Sonic compact sedans. The 1.8-liter and 1.4-liter Cruze and Sonic CNG retrofit systems will soon be available, according to CDP Executive Vice President Michelle Fern. The vehicles represent “a change in the status quo” for original equipment manufacturer (OEM)-level integration of the fuel system and its components, Fern said.

Calling itself a pioneer in CNG development, McNeilus now has more than 5,000 NGen CNG vehicles on the road, according to Brad Nelson, a senior vice president at Oshkosh. “We offer only fully tested and certified configurations that are backed by a national service network,” Nelson said. NGen CNG systems are available on new vehicles and retrofits.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |