Markets | NGI All News Access | NGI Data

Futures Falter Following Release of Storage Data

Natural gas futures took something of a hit off the release of government storage figures that were greater than what the market was anticipating.

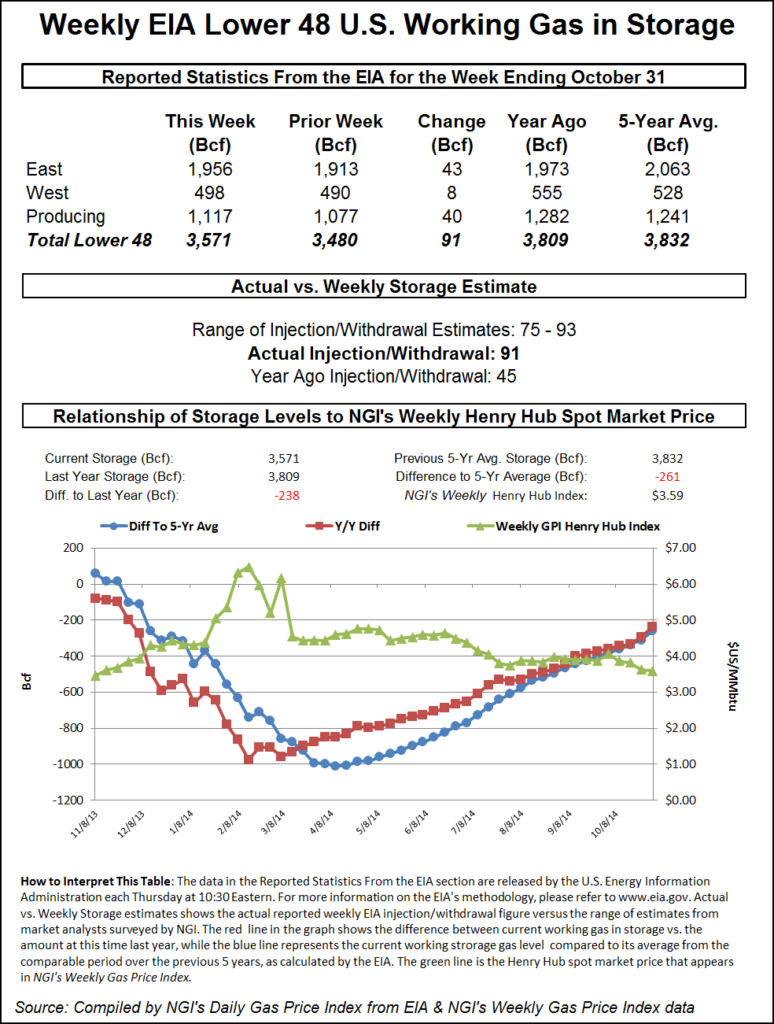

The injection of 91 Bcf for the week ended Oct. 31 reported by the Energy Information Administration (EIA) in its 10:30 a.m. EST release was about 6 Bcf more than market expectations. December futures had fallen to a low of $4.111 after the time the number was released and by 10:45 a.m. December was trading at $4.167, down 2.7 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase of about 85 Bcf. A Reuters survey of 27 traders and analysts revealed an average increase of 85 Bcf with a range of 75-90 Bcf. United ICAP came in with an 82 Bcf estimate, and Bentek Energy’s flow model anticipated an injection of 88 Bcf.

“We were hearing anywhere from 85 Bcf to 90 Bcf, but the market bounced back within minutes. Support is now $4 and resistance is at $4.25,” said a New York floor trader.

Tim Evans of Citi Futures Perspective said that “while it suggests that the seasonal market balance has been slower to tighten than expected, it doesn’t necessarily put the outlook onto a different path. The data is a test, but the market may still be able to pivot back to the cold temperatures in the forecast for the next two weeks and move higher.”

Inventories now stand at 3,571 Bcf and are 238 Bcf less than last year and 261 Bcf below the five-year average. In the East Region 43 Bcf was injected and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 40 Bcf.

The Producing region salt cavern storage figure added 16 Bcf from the previous week to 348 Bcf, while the non-salt cavern figure rose by 25 Bcf to 803 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |