Utica Shale | NGI All News Access | Permian Basin

McClendon’s Permian Business Talks Public Launch Within a Year

The Permian Basin unit of American Energy Partners LP (AELP) could go public within a year depending on market conditions, the Aubrey McClendon-led company said Tuesday.

American Energy-Permian Basin LLC (AEPB) said it was planning the initial public offering as it disclosed it was spending $726 million to acquire 1,400 boe/d and 27,000 net acres in the Wolfcamp Shale, a position within the Midland sub-basin that it is buying from multiple sellers. The producer said it’s been putting the deals together since the end of July.

In a first, the privately held producer also said it would provide the investment community with financial and operational results on Nov. 11. AEPB’s lead equity investor is The Energy & Minerals Group, with additional equity provided by First Reserve and AEPB’s management team. There were rumors early this year that McClendon would take one of his production partnerships public, which had been expected to be the Utica Shale unit (see Shale Daily, Feb. 20).

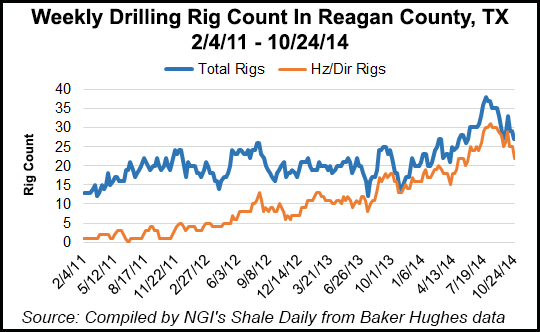

Most of the new Permian leases being acquired are in Reagan County, TX. For the Wolfcamp core A and B wells, estimated recoveries were put at 527,000 boe/well on a two-stream basis and 579,000 boe on a three-stream basis. Current costs per well would estimated at about $8.45 million, with an expected 2016 cost of $7.25 million and at $7 million in 2017 and thereafter. Estimated ultimate recoveries for a well with a two-stream 30-day average initial production (IP) rate would be 647 boe/d, the operator said.

Once the new Permian transactions are completed at the end of the year, AEPB expects to have about 158 million boe in proved reserves.

AEPB provided some recent Wolfcamp 24-hour IP well results in Reagan County:

? Halfmann 1214 01H, 1,796 boe/d and a 30-day average of 936 boe/d, 83% oil, lateral 8,500 feet.

? Loftin Hughes 13-1212 01H, 1,594 boe/d and a 30-day average of 980 boe/d, 78% oil, lateral 7,500 feet.

? Cope 107 3H, 1,363 boe/d, 30-day average 877 boe/d, 78% oil, lateral 10,000 feet.

? Cope 107 1H, 1,321 boe/d, 30-day average 755 boe/d, 78% oil, lateral 10,000 feet.

“These wells are all tracking at or above the 647 boe/d, first 30-day average production rate for AEPB’s 527,000 boe type curve, which is normalized to a 7,500-foot stimulated interval,” the producer noted.

For the coming year, 2015, the Permian operator is targeting average daily production of 33,000-38,000, 70-75% weighted to oil. Five horizontal drilling rigs now are working in the basin, with seven more expected to be in operation by the end of 2015.

The Permian unit now employs about 95 full time employees and also has Texas offices in Midland and Big Lake. AEPB said it has in place oil hedges covering 8,000 b/d for 4Q2014, 68-72% of projected output, at an average price of $94.51/bbl. It also has 11,000 b/d hedged for 2015, or around 40-45% of projected oil production, at an average price of $93.64/bbl.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |