NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Continental Sees ‘Repeatability’ in Springer Wells

Continental Resources Inc.’s emerging Springer Shale in the South Central Oklahoma Oil Province (SCOOP) is indicating continuing success, if recovery rates from four new wells are any indication.

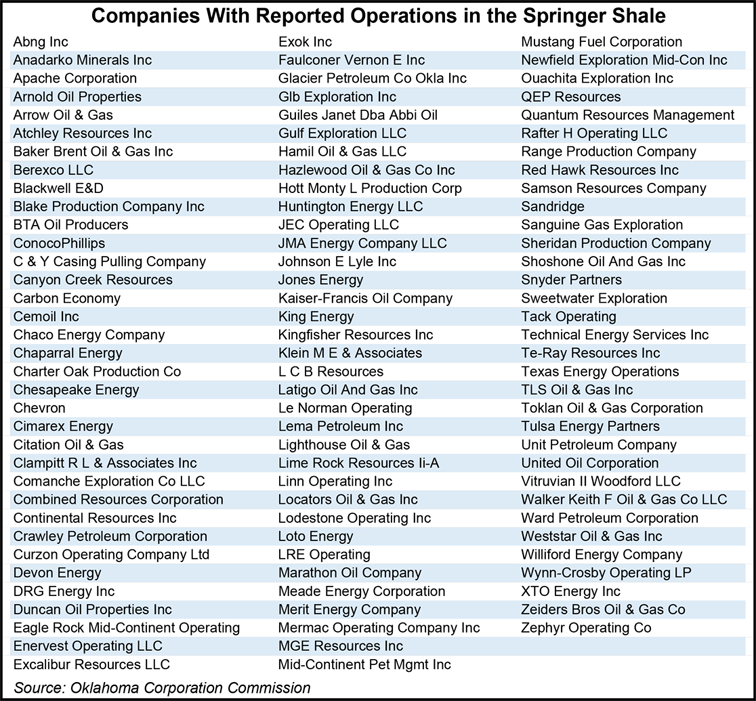

The Oklahoma City-based operator unveiled the play-within-a-play in September (see Shale Daily, Sept. 18). SCOOP, since its initial unveiling two years, ago has been drawing a lot of prospectors (see Shale Daily, Oct. 11, 2012). And Springer may do the same.

Based on company data, Springer may hold an estimated 447 million boe net unrisked resource potential to Continental, with 127 million boe net in the oil fairway and 320 million boe net, or 1.9 Tcfe, combined in the gas and condensate fairways. In September Continental had eight Springer wells on production with initial production rates as high as 2,133 boe/d.

“Four new wells further confirm the repeatability and growth potential of Continental’s new discovery, the Springer play in SCOOP,” said CEO Harold G. Hamm. “These individual delineation wells in the play are generating excellent returns, with shallow decline rates compared to other unconventional resource plays. We expect to realize even stronger well economics as development drilling gets under way utilizing extended laterals, pad drilling, and other drilling and completion efficiencies.”

The four new wells, unveiled last week, had an average horizontal lateral length of 4,475 feet. Estimated ultimate recoveries (EUR) for the four wells are 940,000 boe/well gross in the oil fairway, with a 4,500-foot lateral section. The four newest wells were drilled to an average vertical depth of 12,625 feet and average total measured depth of 17,650 feet.

Details of the initial production (IP) rates of the four new wells, all in Grady County, OK, over a 24-hour period were:

Continental’s current Springer production is 6,000 boe/d net (9,200 boe/d gross), 70% weighted to crude oil. Nine operated drilling rigs are active, “with a focus on rapidly expanding its understanding of the productive extent of the play.

Based on the four wells’ initial results, Continental in November plans to begin drilling its first extended lateral well in the Springer, with a planned length of 7,500 feet. The company expects an average EUR of 1.6 million boe gross for extended lateral wells of this length, reflecting the 67% longer lateral. The average completed well cost this year so far “has been in line with earlier projected cost of $9.7 million per well,” management noted.

“The Springer adds another significant oil resource driver to Continental’s strategic growth outlook,” Hamm said. “It’s distinguishing itself as the most productive play in Oklahoma, and it’s right in our backyard.”

Continental has a total 195,000 net acres in its SCOOP play, which is in the Anadarko Basin, with 118,000 net acres in the oil fairway and around 77,000 net in the combined gas/condensate area. The deepest layer is the Hunton Limestone, with Woodford Shale above it. Sycamore Limestone, Caney Shale and Springer Shale sit above the Woodford.

On Monday, Continental announced a joint development agreement with a subsidiary of South Korea’s SK Group — its first in the United States — to drill for natural gas in the legacy Cana-Woodford Shale holdings in Western Oklahoma. Continental is spending most of its capital to develop its oil resources in the Midcontinent, including in the Bakken Shale. SK E&S would receive almost half (49.9%) of Continental’s interests in 44,000 net acres, primarily in Blaine and Dewey counties, for $360 million. It includes stakes in 37 producing wells. No production figures were included for the wells being sold.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |