NGI Archives | NGI All News Access

What Seasonal Advance? Physical NatGas Prices Grind Lower In Weekly Trading

It was a rough week for those thinking it was time for natural gas prices to begin their normal seasonal advance into late November. For the week ended Oct. 24 all market points west of the Ohio Valley followed by NGI fell into the loss column. NGI’s National Weekly Spot Gas Average fell by 13 cents to $3.29.

Of the actively traded points, the week’s greatest gainers were seen at market points in and around the New York metropolitan area. Gas on Transco Zone 6 New York added 55 cents to average $2.57 and gas on Transco Zone 6 non NY was up by 55 cents as well to $2.60. Greatest setbacks were seen on Iroquois Pipeline with Zone 2 dropping 76 cents to average $3.22 and Iroquois Waddington losing 63 cents to $3.29.

Of the handful of locations making gains on the week all were in the Northeast. Behind the gains on Transco Zone 6 were Texas Eastern M-2 30 with a 23 cent rise to $2.13 and Tetco M-3 posting a 20 cent gain to $2.22.

Points also showing hefty losses included Algonquin Citygates down 45 cents to $2.70 and deliveries to Tennessee Zone 6 200 L shedding 35 cents to $2.79.

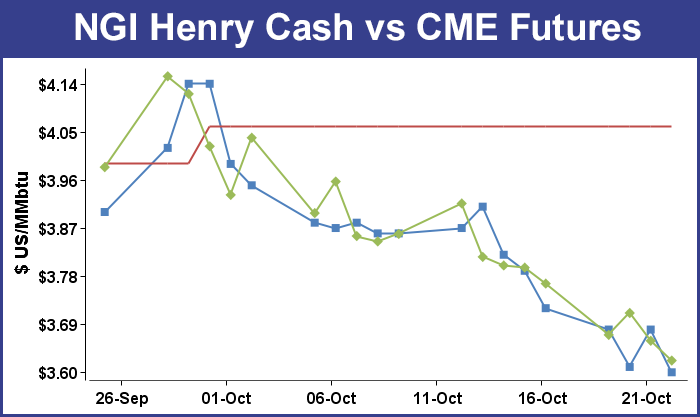

November futures continued their downward trek reaching an 11-month low Friday of $3.558. For the five trading days the November contract dropped 14.3 cents to a settlement of $3.623.

With only two weeks left on the traditional injection season analysts are now able to put the finishing touches on estimates of inventories available for the upcoming heating season. Thursday’s storage report shows that gas keeps rolling in, and at the end of the season supplies may only be a few hundred Bcf short of 2013’s record supply.

For the week ending Oct. 17 traders were looking for an increase of about 100 Bcf. A Reuters survey of 23 traders and analysts revealed an average increase of 97 Bcf with a range of 90 Bcf to 103 Bcf. United ICAP was looking for a build of 98 Bcf and industry consultant Bentek Energy utilizing its flow model anticipated an injection of 99 Bcf.

The actual EIA figure was an increase of 94 Bcf in the Energy Information Administration’s 10:30 a.m. report, somewhat short of expectations, and November futures had made it to a high of $3.681 by the time the number was released and by 10:45 EDT November was trading at $3.665, up a miserly 0.6 cent from Wednesday’s settlement.

“It doesn’t look like there is a strong push to do anything. There was a pretty lackluster response,” said a New York floor trader.

Others suggest a tighter supply demand balance. “The 94 Bcf build for last week was a match with the prior period, below the consensus expectation for 97-98 Bcf,” said Tim Evans of Citi Futures Perspective. This was also a clear step down from the 103 Bcf estimate our model had produced, and suggests some tightening of the recent supply/demand balance that would also translate into lower net injections for the weeks ahead.”

Inventories now stand at 3,393 Bcf and are 336 Bcf less than last year and 338 Bcf below the 5-year average. In the East Region 47 Bcf were injected and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 39 Bcf.

David Tameron, an analyst at Wells Fargo, sees a 3.5 Tcf ending inventory easily within reach. “At 3,393 Bcf, we are sitting about 0.4 Tcf below the five-year average winter starting-inventory level of about 3.8 Tcf, though consensus currently stands at around 3.5 Tcf as the end-of-refill season storage level. With two weeks left in the typical refill season, injections need to average about 54 Bcf/week to hit the 3.5 Tcf consensus target. With five straight weeks of 90-plus Bcf injections and a mild forecast for early winter season, the Lower 48 are on pace to hit/beat the consensus estimate of 3.5 Tcf barring any serious weather implications.”

With mild weather remaining on the horizon for the foreseeable future, storage injections may continue well into November, not only prolonging the build in inventories but shortening the available time for withdrawals. A stout build in inventories is likely next week as forecasts call for below-normal accumulations of degree days for the week ending Oct. 25.

The National Weather Service (NWS) predicts below-normal accumulations of combined heating and cooling degree days in major population centers. NWS says New England will see 95 degree days (DD), or 25 fewer than normal, and the Mid-Atlantic will have to endure 92 DD, or 12 fewer than its seasonal tally. The greater Midwest from Ohio to Wisconsin should experience 99 DD, or 14 fewer than normal.

Industry consultant Genscape utilized a combined sample of storage facilities as well as supply/demand-based analyses to formulate its 98 Bcf injection estimate. The company said its models “expect the EIA [Energy Information Administration] will announce 98 Bcf of gas was injected during the week ending Oct. 16. The forecast is a composite of Genscape’s supply and demand model — which is forecasting an 84 Bcf injection — and our adjusted flow sample of storage facilities, which is predicting a 101 Bcf injection.”

Natural gas prices are well known for their seasonal trends. Prices often advance from mid-September to late November, but traders suggest deferring any long market positions until well after the November contract expires [this] week. “Prices have continued to fall. There is a historical pattern of front-month price softening over this week, but it has been exacerbated by fundamental factors: mild weather forecasts, strengthening domestic production and relatively strong end-of-season storage trend,” said Breanne Doughtery, an analyst with Societe Generale in New York. “Our attention has shifted to the December and January contracts as we enter into a critical two months of pricing. We see further softening on these contracts as likely in the first 10 days of trading after next week’s expiration, so best to hold off on taking position until then if you are looking to make a bold bet on colder weather around the bend.”

Others noted that the market had something of a lukewarm response to Thursday’s reported 94 Bcf inventory build, and “the supply deficit against five-year averages contracted again by almost 25 Bcf,” said Jim Ritterbusch of Ritterbusch and Associates. “Now the market will begin to focus on what is likely to be another exceptionally strong build in next week’s report. Although the short-term temperature forecasts are beginning to take on a more neutral appearance when looking out beyond next week, this market will require some indication of a sustainable cold trend before posting any meaningful price advances.

“Fundamental dynamics continue to tilt bearish with the supply deficit against averages narrowing by about 1% per week as we anticipated,” Ritterbusch added. “Until this dynamic shifts, we see strong likelihood of this market drafting down to about $3.55 and ultimately to as low as $3.40 before major long term support is capable of building a base for a long-term up-move. In short, we see high probability of fresh lows but see as much upside as downside risk when extending a view out some one to two weeks.”

In Friday’s trading a few eastern points made it to the positive side of the trading ledger for weekend and Monday deliveries, but otherwise losses averaging a dime or more were common.

Particularly hard hit were West Coast prices as weather forecasts moderated, while the East, Northeast, and Marcellus endured their share of soft prices as well.

Overall, the market was 12 cents lower. November futures traded as low as $3.558, putting in a new low for the move and at the end of the day settled at $3.623, up 0.1 cent while December shed 0.8 cent to $3.698. December crude oil tumbled $1.08 to $81.01/bbl.

Southern California was forecast to enjoy a cooler weekend, and prices for weekend and Monday gas plummeted. The National Weather Service in Los Angeles said, “another warm and dry day is expected [Friday]. On Saturday…the remnants of a weak front will sweep across the area…bringing much cooler conditions and the chance of some light rain over the central coast. Cool conditions will continue on Sunday…then offshore flow will develop the first half of next week…bringing warmer temperatures to the area.”

Wunderground.com forecast that Friday’s high in Los Angeles of 84 would drop to 75 Saturday and hold to Monday. The seasonal high in Los Angeles is 74. Newport Beach’s Friday high of 86 was anticipated to fall to 73 Saturday before slipping to 72 Monday. The normal mid-October high in Newport Beach is 74. San Diego’s 80 high Friday was seen easing to 74 Saturday and holding to Monday. The normal high for San Diego this time of year is 72.

The West Coast isn’t the only place enjoying summer-like conditions. According to AccuWeather.com meteorologists, “After many locations over the Plains feel like late summer this weekend, the record-challenging warmth will expand to the Northeast next week, [and] millions of people will be reaching for shorts and short-sleeves for a few days as the warmth builds.

“High pressure over the South is forecast to continue to pump warm air in from Mexico and provide abundant sunshine to Texas and the Plains this weekend. Some major cities will challenge record highs as a result, including Dallas, Denver, Oklahoma City and Kansas City, MO. According to AccuWeather.com Senior Meteorologist Paul Walker, “Temperatures across the Plains will feel more typical of Labor Day than late October.”

AccuWeather.com also forecast that “temperatures will run between 10-15 degrees F above average as far north as North Dakota. On Sunday, high temperatures will reach the 80s as far north as northern Nebraska while highs will climb into the 90s over parts of Oklahoma and Texas. “The dome of high pressure will be pushed southward as a storm system moves over the West Coast. Cooler air will move in early next week but the heat will continue over southern Texas,” Walker said.

“As heat holds over southern Texas, warmth will surge northeastward early next week. Summer-like temperatures are in store across the Ohio Valley into the East Coast. More record-breaking high temperatures are possible. Many areas from New England to the mid-Atlantic and Southeastern states will record temperatures 10-20 degrees above average. Highs in Atlanta will be in the 80s Sunday through Tuesday. Temperatures are forecast to reach 70 or higher as far north as New York City on Tuesday and Wednesday, AccuWeather.com meteorologists said.

At Malin, gas for the weekend and Monday tumbled 14 cents to $3.35, and gas at the PG&E Citygates shed 7 cents to $4.07. SoCal Citygate deliveries came in at $3.48, down a stout 35 cents and at the SoCal Border gas changed hands at $3.41, down 21 cents. On El Paso S Mainline weekend and Monday parcels were quoted at $3.40, down 25 cents.

Northeast and Mid-Atlantic points were widely mixed. At the Algonquin Citygates, gas was seen at $2.28, up 9 cents, and on Iroquois Waddington, packages were seen at $2.47, down 57 cents. On Tennessee Zone 6 200 L, weekend and Monday gas came in at $2.41, up 6 cents.

Gas headed for New York City on Transco Zone 6 fell 43 cents to $2.38, and deliveries to Tetco M-3 gained 3 cents to $1.87.

Marcellus points also softened. Gas on Millennium fell 11 cents to $1.88, and deliveries to Dominion South came off a penny to $1.85. On Transco Leidy, gas changed hands at $1.84, down 6 cents, and on Tennessee Zone 4 Marcellus weekend and Monday packages shed 4 cents to $1.76.

Texas gas fell about a dime. On NGPL TX OK, gas was seen at $3.44, down 9 cents, and at Carthage gas fell 11 cents to $3.39. At Katy, weekend packages dropped 9 cents to $3.44, and at the Houston Ship Channel gas was quoted at $3.47, down 7 cents. Gas on Transco Zone 1 fell 8 cents to $3.41.

Power generators across the broad MISO footprint mulling gas purchases for weekend generation may have an easy go of it. Forecasters are calling for mild conditions with ample wind generation. “Generally fair and warm conditions are expected [Friday] into the weekend. A frontal system may move into the central U.S. during Sunday night into early next week with a chance of showers and/or storms,” said WSI Corp. in its Friday morning outlook.

“A southerly breeze ahead of this system will lead to unseasonably warm conditions during Monday. Highs into the 60s, 70s to near 80 will range 10-20 F above average. However, cooler, more seasonable temperatures may filter into the power pool by Tuesday. Period rainfall amounts may range 0.25 inch or less. Highly variable wind generation is expected during the next couple of days. A more substantial boost of wind generation is expected during late Saturday night into early next week associated with the expected frontal system. Output may occasional peak in excess of 7 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |