E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Oxy Puts More Emphasis on Permian as California Splits Off

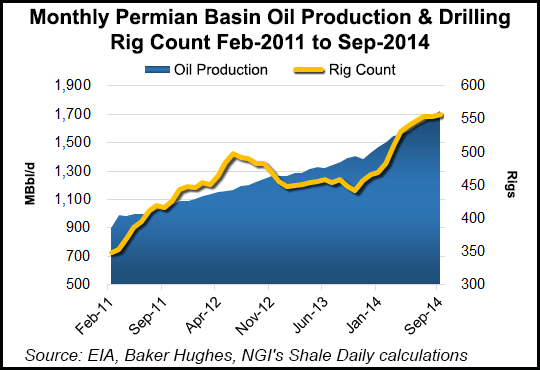

Reporting lower year-over-year 3Q2014 profits tied to lower oil prices and higher costs, Occidental Petroleum Corp. (Oxy) senior executives expressed bullishness Thursday about their slimmed down company’s future, emphasizing the huge growth potential they see in unconventional plays in the revitalized Permian Basin.

CEO Stephen Chazen reported 26% production growth in the Permian on a 3Q2014 conference call in which he also noted quarterly core income was $1.2 billion ($1.58/share) compared with $1.6 billion ($1.97/share) for the same period in 2013.

Separately, Oxy’s newly separated California operation, California Resources Corp. (CRC), reported 3Q2014 net income of $188 million, compared with $235 million in 3Q2013 for the same operations. The spin off will be completed the end of November, Chazen and CRC’s CEO Todd Stevens reported.

Chazen noted that California operations would be treated as “discontinued” after Nov. 30, and Oxy will reduce its capital spending on its assets in the Piceance and Williston basins to free up capital for its primary focus on the Permian. Over time it expects 60% of its oil/natural gas production will come from U.S. properties as its international holdings are monetized and reconfigured, he said.

The prospect of further oil price declines could be beneficial to Oxy, which is growing increasingly cash-rich with the California spin off and other moves, said Chazen. That would open up opportunities for Oxy to make small to medium-sized acquisition, although Chazen said he is not interested in acquiring any public companies. He sees oil prices rebounding over the longer term.

“We expect the bulk of our cash proceeds being used to repurchase our own shares, but we also hope to invest in the business to attract bolt-on acquisitions to our core assets [2 million acres] in the Permian Basin,” Chazen said. “Opportunities may exist for creating property acquisitions that have current production and growth prospects.

“We have no intention of acquiring public companies, since their current pricing reflects high oil prices and a near-perfect [unrealistic] outcome for production.”

Chazen said the vast majority of Oxy’s capital budget for next year will be devoted to U.S. oil/gas drilling operations, with an emphasis on the Permian Basin. “If lower crude oil prices persist or fall further, we will adjust our capital program to manage our cash flow,” Chazen said.

In the U.S. operations, Chazen said he expects the Permian to delivery production growth in 2015 of at least 20%, primarily from oil. Excluding California, U.S. production should grow 5%-8%, with a modest decline in natural gas and natural gas liquids volumes, in 2015.

Vicki Hollub, head of Oxy’s U.S. operations, said Permian production hit 77,000 boe/d in 3Q2014, and she expects it to reach 100,000 boe/d by the end of the year. The longer term goal is to hit 120,000 boe/d by 2016, Hollub said. Average rig counts in the Permian are at 30, and that will move up to 34 rigs by year-end, she said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |