Markets | NGI All News Access | NGI Data

Futures Inch Higher in Lackluster Response to Lean Storage Build

Natural gas futures got something of a lift off the Thursday morning release of government storage figures that were less than what traders were expecting.

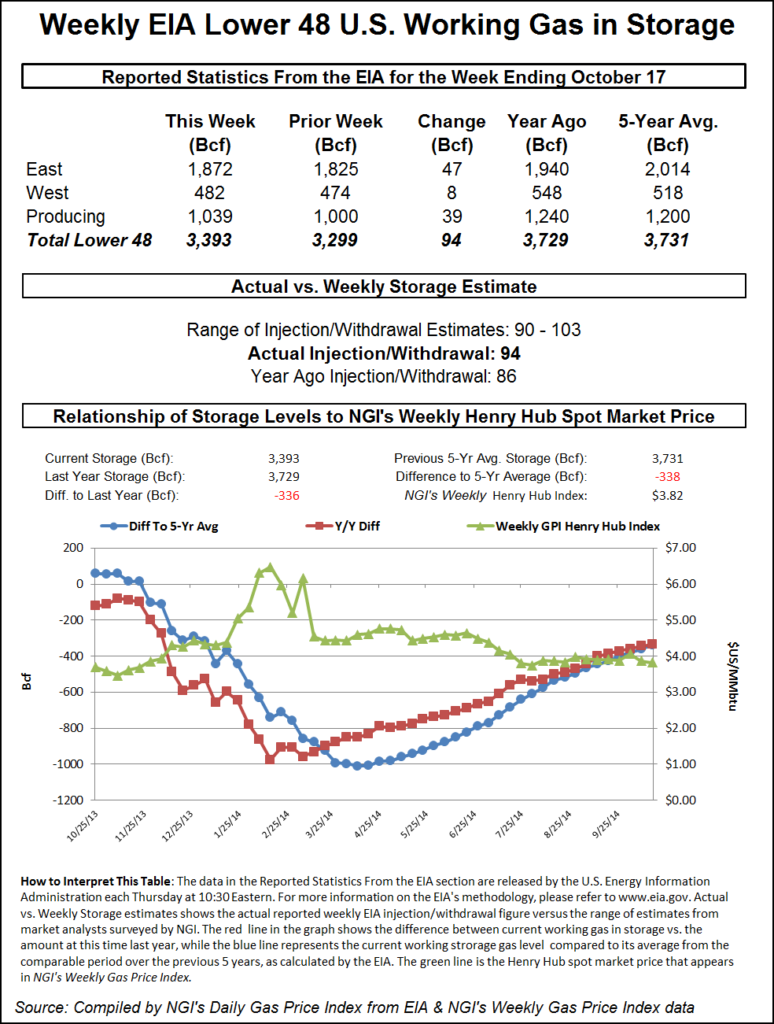

For the week ended Oct. 17, the Energy Information Administration reported an increase of 94 Bcf in its 10:30 a.m. EDT release. That was about 6 Bcf less than market expectations.

November futures had made it to a high of $3.681 by the time the number was released, and by 10:45 a.m. November was trading at $3.665, up 0.6 cent from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase of about 100 Bcf. A Reuters survey of 23 traders and analysts revealed an average increase of 97 Bcf with a range of 90-103 Bcf. United ICAP was looking for a build of 98 Bcf and Bentek Energy’s flow model anticipated an injection of 99 Bcf.

“It doesn’t look like there is a strong push to do anything. There was a pretty lackluster response,” said a New York floor trader.

Others suggest a tighter supply-demand balance. “The 94 Bcf build for last week was a match with the prior period, below the consensus expectation for 97-98 Bcf,” said Tim Evans of Citi Futures Perspective. “This was also a clear step down from the 103 Bcf estimate our model had produced, and suggests some tightening of the recent supply-demand balance that would also translate into lower net injections for the weeks ahead.”

Inventories now stand at 3,393 Bcf and are 336 Bcf less than last year and 338 Bcf below the five-year average. In the East Region, 47 Bcf was injected, and the West Region saw inventories increase by 8 Bcf. Stocks in the Producing Region rose by 39 Bcf.

The Producing region salt cavern storage figure added 13 Bcf from the previous week to 285 Bcf, while the non-salt cavern figure rose by 26 Bcf to 754 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |