E&P | Eagle Ford Shale | NGI All News Access

Mexico’s Alfa Eyeing Funds to Pursue Shale Gas, Other Energy Opportunities

Sparked by Mexico’s recent energy reform, Alfa, a Mexican diversified industrial company with dealings from energy to chemicals to branded foods, said Monday it is looking to raise significant capital to expand its energy production footprint in Mexico, with a focus on shale natural gas.

Alfa has called a general extraordinary shareholders’ meeting to approve a potential capital increase, reportedly in the neighborhood of $1 billion, by issuing new shares. The meeting is scheduled for Nov. 4.

“We intend to capitalize on opportunities created by Mexico’s energy reform and leverage our experience in shale gas, conventional E&P [exploration and production] and power generation and commercialization,” said Alfa Chairman Armando Garza Sada.

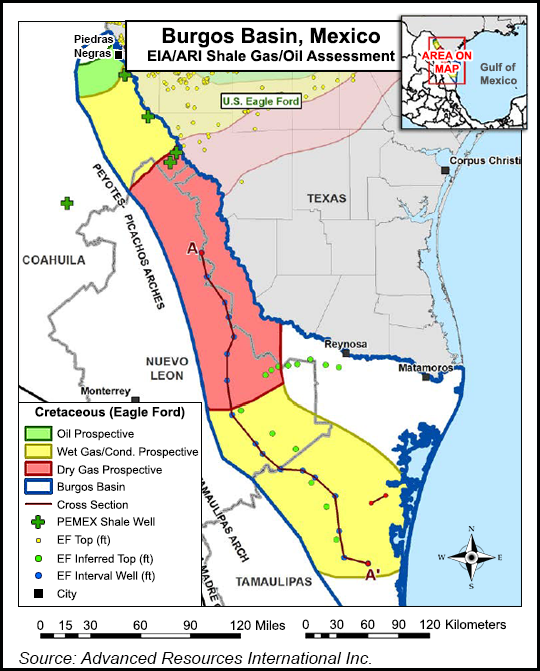

The most likely first target for shale development in Mexico has widely been reported to be the lowest reaches of the Eagle Ford Shale in the Burgos and Sabinas basins. According to a U.S. Energy Information Administration summer 2013 assessment, the best documented play is the Eagle Ford of the Burgos Basin, where oil- and gas-prone windows extending south from Texas into northern Mexico have an estimated 343 Tcf and 6.3 billion bbl of risked, technically recoverable shale gas and shale oil resource potential.

According to the company, Alfa, which operates natural gas and hydrocarbons businesses in Mexico and the United States, is the largest producer of aluminum engine components for the automotive industry in the world, and one of the world’s largest producers of polyester. In addition, the company produces petrochemicals such as polypropylene, expandable polystyrene and caprolactam for the Mexican market and produces, markets and distributes branded foods primarily in Mexico, the United States and Europe.

“The approval of this equity increase will provide us with significant financing flexibility to opportunistically raise capital when we deem it appropriate,” said President Alvaro Fernández Garza. “We also retain the ability to access other financing options, as we consider future investments.”

Petroleos Mexicanos (Pemex), Mexico’s state-owned oil company, has been positioning itself for change since the country’s energy sector was opened to private investment (see Daily GPI, Oct. 17; Oct. 8; Aug. 14; Aug. 7).

Earlier this month, Pemex signed an MOU with ExxonMobil Corp. “to establish the basis of dialogue and understanding” regarding upstream and downstream businesses (see Daily GPI, Oct. 2) and, in a separate move, announced that affiliate PMI and NuStar Energy LP of San Antonio plan to develop pipeline infrastructure to carry liquefied petroleum gases and refined products from the United States to Mexico (see Daily GPI, Oct. 15). Other recent moves by Pemex include the formation of an alliance with Mercuria and JP Morgan to import U.S. gas into Mexico (see Daily GPI, Aug. 1) and the awarding of a deepwater subsea project in the gas-rich Lakach field offshore Mexico to OneSubsea (see Daily GPI, Oct. 13).

Mexico’s legislative reforms were meant to stimulate oil and gas production in the energy-rich country. The Mexican government estimates private investments in the oil and gas sector could bring in $50 billion between 2015 and 2018. Eyeing increased federal revenues from the opening of the nation’s energy plays to foreign investment, the government recently established a special fund in the nation’s central bank (see Daily GPI, Oct. 3). Income from oil and natural gas activities will be distributed by the Mexican Oil Fund for Stabilization and Development to the federal government’s budget and to a long-term savings account.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |