M&A | NGI All News Access | NGI The Weekly Gas Market Report

Targa, Atlas to Merge Midstream Operations in $7.7B Deal

Affiliates of U.S. midstream giants Targa Resources Corp. and Atlas Energy LP on Monday agreed to combine their natural gas and oil operations in a transaction worth $7.7 billion that would merge systems serving the Permian and Williston basins, Midcontinent, East/South Texas, the Gulf Coast and the Gulf of Mexico.

Houston-based Targa Resources Partners LP and Targa Resources Corp. plan to acquire Atlas Pipeline Partners LP (APL) and Atlas Energy LP (ATLS) once it spins off its nonmidstream assets — specifically, the exploration and production (E&P) arm. The acquisitions are contingent on one another and are to close concurrently in early 2015.

Targa and its affiliates provide midstream services for natural gas, natural gas liquids (NGL), terminaling and crude oil gathering services for the U.S. onshore and the shallow and deepwater Gulf of Mexico (GOM). Atlas would add Midcontinent depth in the Woodford Shale and emerging South Central Oklahoma Oil Province, or SCOOP, as well as in the Mississippian Lime. The merger would expand the combined company’s Eagle Ford and Barnett shale coverage in Texas and the Bakken Shale, the Permian Basin coverage in Texas and New Mexico, and on the Louisiana coast.

The merger provides a “great map, great math and a great opportunity for employees and investors,” said Targa CEO Joe Bob Perkins. He led a conference call to discuss the transaction. “This is a blockbuster deal based on a real structure that is highly appealing to Targa and Atlas constituents…It fits together nicely, and Targa’s simple structure remains intact.”

Pro forma for the merger, Targa would have:

There’s “no expectation” to reduce the headcount,” said Perkins. Atlas is headquartered in Philadelphia, with offices across the country. “Both companies need talented people…We’re very excited to add talent. It can create a powerful force for significant opportunities in the future.”

Perkins’ enthusiasm for the deal was evident during the hour-long call. “It boils down to results. The math is what to focus on right now…It doesn’t get much better from a win, win, win, win perspective…”

Even though the price deck outlook has been somewhat challenging for NGLs in the past few months, Targa’s executive team wasn’t put off by commodity prices. Spot prices for NGLs were considered “in and around the mid-$80s,” and it was determined it would be “good for Targa even at a sensitized price deck.” Added Perkins, “we certainly looked at it under the latest prices” and didn’t feel any pressure to end the discussions.

Last year, Targa produced 137,000 b/d of NGLs, while Atlas produced 115,000 b/d. This year Targa expects to produce 149,000 b/d of NGLs, while Atlas should produce 118,000 b/d, for a combined 268,000 b/d.

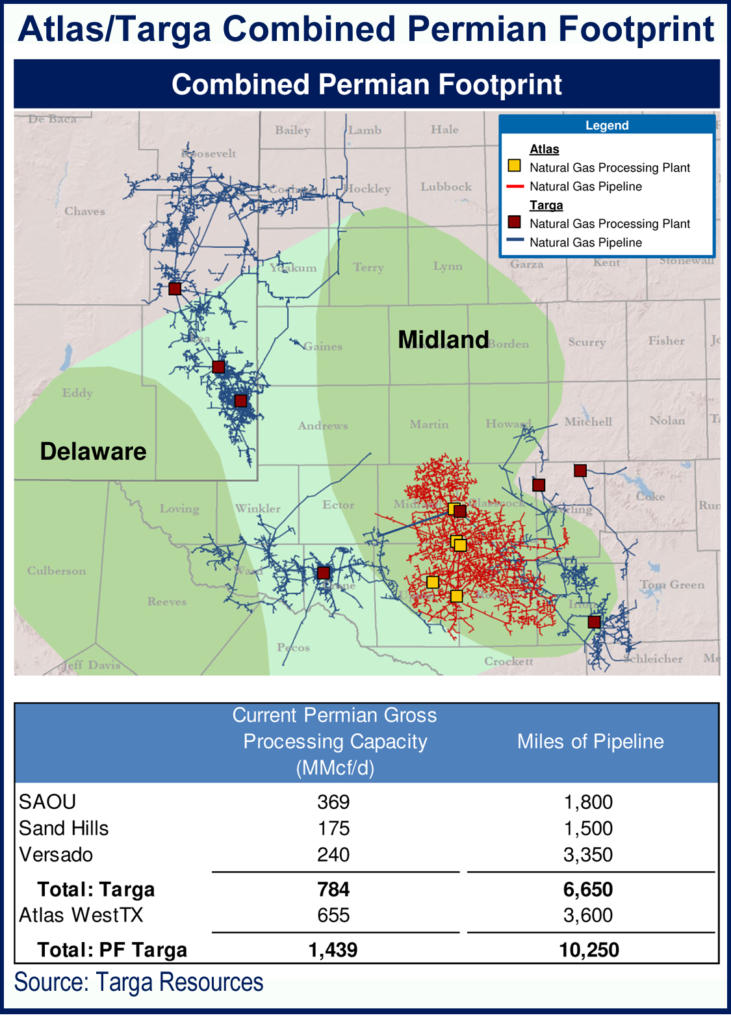

The Permian’s growth story underscores one of the merger’s primary draws, said Perkins. The Atlas WestTX system sits in the core of the Midland sub-basin, between Targa’s existing San Angelo Operating Unit and the Sand Hills systems, also in West Texas. More than 75% of the rigs now running in the Midland are in counties served by the combined systems. Pro forma, Targa would become the second largest Permian processor with 1.4 Bcf/d in gross processing capacity.

Targa and Atlas also have expansions recently placed into service in West Texas, with more expansions underway. Targa in June ramped up its 200 MMcf/d High Plains plant, while in September Atlas put its 200 MMcf/d Driver facility online (see Daily GPI, July 17, 2013). Within the Delaware sub-basin, Atlas has the 200 MMcf/d Buffalo plant expansion set to begin in mid-2015 (see Shale Daily, April 24). Targa’s 300 MMcf/d Delaware Basin plant is scheduled to ramp up in early 2016.

APL brings with it “an extensive backlog of organic growth projects, including the expansion of the 120 MMcf/d Stonewall processing plant in Southern Oklahoma and construction of a new 200 MMcf/d processing facility in the Permian Basin,” Perkins noted.

“However, execution risk is present. A key credit consideration, in our view, is Targa’s ability to maintain sound relationships with customers while effectively managing its robust capital spending program. Liquidity is ‘adequate,’ and we expect it to remain so pro forma for the merger.”

Perkins was questioned about how the merger came about. Rumors had circulated in June that Targa was working on a merger with Energy Transfer Equity LP (see Daily GPI, June 20).

“The industry knows each other pretty well,” Perkins said. He laughed about the rumors and noted that some of the details had been published. However, Targa started working with Atlas executives “last month,” and “we had a quick meeting of the minds…Conversations progressed between the parties and math progressed between the parties…

“We manage our businesses very similarly…We worked very hard over a short period of time to get it done. It’s a whole lot different than a rumored transaction.”

Last year, Targa’s field gathering and processing segment processed an average of 780.1 MMcf/d and produced an average of 91,900 b/d of NGLs. In addition to its gas gathering and processing, its Williston Basin Badlands operations include a crude oil gathering system and two terminals with operational storage capacity of 70,000 bbl.

Targa’s Coastal Gathering Segment produces from shallow-water Central and Western GOM gas wells and from the Shelf and deepwater, and last year processed an average of 1,330 MMcf/d and 45,000 b/d of NGLs. Targa also is majority owner (76.8%) owner of Venice Energy Services Co. LLC, which operates the Venice, LA gas plant with aggregate processing capacity of 750 MMcf/d, and the Venice Gathering System with nominal capacity of 320 MMcf/d.

Targa already has announced organic growth capital spending plans of $1.2 billion for 2014 and more than $1.2 billion for 2015. The partnership now is anticipating 11-13% distribution growth in 2015.

Atlas affiliates own and operate 17 processing plants, 18 treating facilities and around 11,300 miles of active intrastate gathering pipeline mostly in Oklahoma, Texas, Kansas and Tennessee. In 2004, APL began operating in the Midcontinent when it acquired the Velma Gas Processing Plant and its 2,000-mile gathering system from Spectrum Field Services.

Atlas currently operates four gas gathering and processing systems in the Midcontinent: the Velma system in Southern Oklahoma and North Texas, the Arkoma system in southeastern Oklahoma, the WestOK system in Northwest Oklahoma and Southern Kansas, and the WestTex system in West Texas.

In conjunction with terms of the merger, ATLS has to spin off nonmidstream assets, the biggest of which is Atlas Resource Partners LP (ARP), an E&P master limited partnership active in the Barnett, Marcellus, Chattanooga and New Albany shales, the Raton and Black Warrior basins, the Mississippian Lime and the Niobrara formation. All together, ARP owns an interest in more than 14,000 producing gas and oil wells, representing 1.5 Tcfe of net proved developed reserves.

Under financial terms of the transaction, Targa would acquire APL for $5.8 billion, including $1.8 billion of debt. Each APL common unitholder would be entitled to receive 0.5846 units of Targa Resources Partners and a one-time cash payment of $1.26/unit of APL for total consideration of $38.66/unit. Prior to the ALP acquisition, ATLS is to spin off its nonmidstream properties. Once the spin off is completed, Targa would acquire ATLS for $1.869 billion. The boards have approved the merger agreements.

Atlas executives held a separate conference call also on Monday to discuss the transaction.

“When you look at the combined entity of the Atlas-Targa midstream franchises, you see not only a complementary footprint across the Midcontinent with a tremendous position in the Permian Basin, but strategic access and exposure to many of the top plays in the country with high levels of activity from the Bakken to the Gulf,” APL CEO Eugene Dubay said.

“Additionally, you have the ability to send products to Targa’s world-class logistics and marketing facilities for further cash flow generation. With improved size and scale, the pro forma business will be able to fund a combined multi-year, multi-billion dollar backlog of high returning organic projects utilizing a significantly lower cost of capital.”

Standard & Poor’s Ratings Services (S&P) said the merger would be a positive for the master limited partnerships.

“In our view, the transaction complements Targa’s core competencies in the gathering and processing business, enhances its asset position in the Permian Basin, and expands its operating footprint to attractive regions such as the Anadarko Basin and Eagle Ford Shale,” said S&P credit analyst Nora Pickens. “Pro forma for the transaction, we expect fee-based arrangements to represent about 60% of the partnership’s operating margins and that Targa will continue to manage its commodity risk in a disciplined manner.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |