NGI Data | NGI All News Access

Weekly Natgas Trading Sees Weak Futures Eclipsed By A Weaker Cash Market

Low power loads, weak power pricing, and moderate seasonal shoulder season weather all were on duty to send weekly natural gas prices scurrying lower. TheNGI Weekly National Spot Gas Price Average tumbled 30 cents to $3.41, and of all market points followed by NGI, only 3 made it to the plus column.

Most individual price locations were down by 10 to 20 cents or more. The week’s biggest gainer was Transco Zone 6 non-NY South with a rise of 42 cents to average $2.60, and the greatest setback was seen by Algonquin Citygate gas posting a 71 cent loss to $2.67.

Only two other points registered gains. Iroquois Zone 2 was seen 9 cents higher at $3.33 and Iroquois Waddington also added 9 cents to $3.37.

Greatest losses were seen at Northeast points, and in addition to Algonquin Citygates, Tennessee Zone 6 200 L lost 51 cents to average $2.96, but Texas Eastern M2 30 Delivery dropped 33 cents to $1.80 and Tennessee Zone 5 200 L shed 37 cents to $2.57.

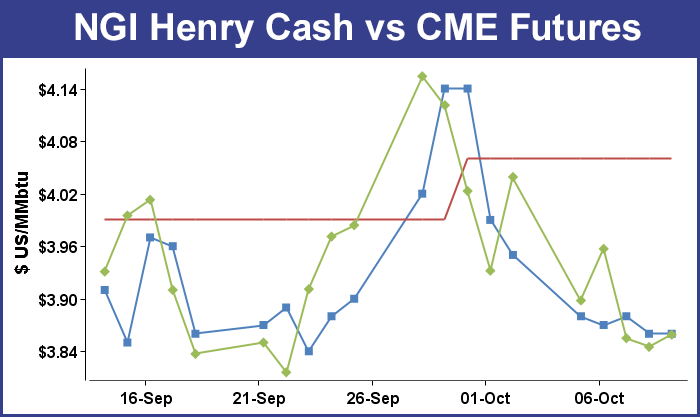

For the week November futures fell 18.0 cents to $3.859.

Analysts and traders were expecting a build in Thursday’s inventory report for the week endin Oct. 3 along the lines of the 112 Bcf reported the week before. Last year, 91 Bcf was injected, and the five-year pace stands at 84 Bcf. Another sizeable reduction in the storage deficit seemed to be in the cards. Houston-based IAF Advisors forecast an increase of 109 Bcf, and a Reuters poll of 23 traders revealed an average 108 Bcf with a range of 99-118 Bcf. Denver-based First Enercast was looking for 104 Bcf.

Industry consultant Genscape was anticipating a 103 Bcf build and said in a morning report that “if realized it would mark the second consecutive +100 Bcf injection and maintain Genscape’s forecast for inventories to reach 3,556 Bcf by Nov.1. This week’s number is robust due to sustained production growth outpacing demand gains. Production during the week was fairly constant to slightly increasing, averaging 69.6 Bcf/d and reaching a high of 69.9 Bcf/d. Demand gradually increased during the week, growing from 56.3 Bcf/d on Sept. 27 to a peak of 64.0 Bcf/d on Oct. 2. A portion of the Lower 48 demand growth was met by increased imports from Canada as spreads from AECO to U.S. markets widened.”

The actual figure of a 105 Bcf build raised a few eyebrows. November futures rose to a high of $3.900 soon after the number was released Thursday and by 10:45 EDT November was still trading at $3.900, up 4.5 cents from Wednesday’s settlement. The market was unable to hold the gains and at settlement November had lost 1.0 cent to $3.845 and December was off by 1.4 cents to $3.937.

“The idea that traders were looking for was 109 to 110 Bcf and it came out 105 Bcf, not really all that much of a bullish indication,” said a New York floor trader.

“We’re still at $3.75 to $4.00, and I don’t think this number will break us out of that range,” he said.

Analysts at Citi Futures Perspective pegged the report as “slightly bullish.”

Inventories now stand at 3,205 Bcf and are 359 Bcf less than last year and 378 Bcf below the 5-year average. In the East Region 62 Bcf were injected and the West Region saw inventories increase by 11 Bcf. Stocks in the Producing Region rose by 32 Bcf.

If degree-day forecasts are any guide, next week’s build report is likely to be plump as well. The National Weather Service (NWS) forecasts below-normal accumulations of combined heating and cooling degree day requirements for major population centers for the week ended Oct. 11. NWS expects New England to see 65 degree days, or 23 fewer than normal, and the Mid-Atlantic should experience 53 heating and cooling degree days, or 21 fewer than its normal tally. The greater Midwest from Ohio to Wisconsin is expected to see 81 combined days, or three more than normal.

In perusing the storage data Phillip Golden, director of risk and product management at Energy Market Exchange in Houston noted that “We will need injection numbers of 55 Bcf/week to refill storage to the levels expected by the Energy Information Administration and to get to the high of 2012, we would need to average 176 Bcf/week. We are not going to reach either the high levels of 2012 levels nor are we going to be at the same level as last year.”

“EMEX [Energy Management Exchange] projects that natural gas at the end of the injection season will be right around 3,525 BCF, which will be the lowest level since 2008, where we entered the winter with storage at just over 3,400 BCF. If we were to revert back to historical averages, we would end this injection season at just over 3,450 Bcf, which would be a very nice recovery from this past winter.”

Top traders for the longer term favor higher prices, but in the near term they advise caution as weather forecasts continue to be moderate.

“Although this market saw an initial upward response of about 5-6 cents to a slightly supportive EIA storage report [Thursday], the inability to hold gains suggests some further downside price risk to the $3.79 summer lows,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday. “The 105 Bcf injection was only 2-3 Bcf less than average Street expectations but furthered our projected trend for about a 1% per week reduction in the deficit against five-year average levels. The current shortfall is about 10.5%, and we expect more contraction to about 6% in about a month.

“Meanwhile, short-term temperature trends remain skewed bearish with above-normal temps expected across the entire country during the next couple of weeks. Until these trends inevitably shift back toward the cool side, downside price risk will remain and we will advise caution in approaching the long side. Nonetheless, we still feel that the next major move of some 30-35 cents, or 8-9%, is much more apt to develop on the upside rather than the downside. Looking ahead to [Friday’s] trade, we will expect some price consolidation that could set the stage for a price rally by Monday if weekend updates to the temperature views shift colder. We favor probing the long side at current levels for a trading turn but would maintain close stop protection below the 3.77 level on a close-only basis.”

Market technicians are not convinced that lower prices are imminent.

“[We are] still stuck in neutral territory. But as we are closer to support, that is our focus,” said Brian LaRose, a technical analyst at United ICAP after the market closed Thursday. “Ideally if this retreat is corrective, natgas should be able to carve out a bottom from the $3.793-3.787-3.771 vicinity. However, [we] still peg 3.712, the 200-week moving average, as critical support. [We] see no reason to entertain a resumption of the down trend unless this level can be broken.”

In Friday’s trading physical natural gas for weekend and Monday delivery fell hard as increased supplies, mild temperatures and load-killing rain over the weekend in eastern markets were expected to give way to seasonal readings by Monday.

Prices up and down the East Coast took hefty double-digit hits, but market losses of a nickel to a dime were common. Only a handful of points managed gains, and they were only for a penny or two. Overall, the market shed 17 cents. Futures posted an uninspired pre-weekend gain with the November contract gaining 1.4 cents to $3.859 and December adding 1.2 cents to $3.949.

Northeast points suffered the heaviest, bruising with losses of a half-dollar or more. Even though cool temperatures and rain were forecast over the weekend along the Atlantic Seaboard, temperatures were expected to return to seasonal conditions by Monday.

According to AccuWeather.com meteorologists, “after a cool weekend around Philadelphia, much of next week will be warm for mid-October, but a potentially very disruptive storm will come calling at midweek. Temperatures during the middle of October average from a low in the upper 40s F to a high in the middle 60s around Philadelphia, [but] during much of next week, highs will be at or above these levels and will be well into the 70s for a couple of days.

“However, a storm forecast to gather strength over the central states will swing eastward during the middle of the week, while a southerly flow associated with the storm will help push warmth into the region; winds could begin to affect the region on Tuesday.”

AccuWeather.com reported that Friday’s high in Boston of 63 would give way to rain and only 54 on Saturday before reaching 61 on Monday. The normal high in Boston this time of year is 63. New York City’s Friday high of 64 was seen turning into a wet and soggy Saturday with a high of 59 before making it to 66 Monday. The normal high in New York is 65. In Philadelphia the high on Friday of 63 was forecast to dip to 60 Saturday and then rise to 70 Monday. The normal mid-October high in Philadelphia is 68.

Additional supplies are on their way to New England. According to industry consultant Genscape, Tennessee Gas Pipeline reported “that maintenance on Station 261 in western Massachusetts has completed, [and] flows into New England have reached 0.85 Bcf/d, up from an average 0.7 Bcf/d for the week previous. Also [Thursday] Algonquin completed a one-day maintenance at the Chaplin compressor station. This followed a 20-day maintenance event between the Cromwell and Burrillville stations, which ended on Wednesday.

“Imports into New England on Algonquin at the Southeast compressor station have jumped to 1.26 Bcf/d, up from an average of 1.04 Bcf/d from the week before. This increase in imports is meeting rising demand in New England, projected at 2 Bcf/d for today, up from an average 1.75 Bcf/d for the previous week. With the maintenance season coming to an end, imports to the region should just be limited by their typical constraints,” the firm said.

Power loads over the weekend were expected to be nominal from New England into the Midwest. ISO New England forecast that peak power Friday of 14,700 MW would ease to 14,400 MW Saturday before inching up to 14,440 MW Sunday. The New York ISO predicted peak loads Friday of 18,271 MW would drop to 17,132 MW Saturday and then ease further to 16,914 MW Sunday.

Across the broad PJM footprint, Friday peak load of 30,197 MW was seen dropping to 27,788 MW Saturday before reaching 28,227 MW Sunday.

Weekend and Monday deliveries to the Algonquin Citygates shed 66 cents to $1.69, and deliveries to Iroquois Waddington fell 61 cents to $2.47, and gas on Tennessee Zone 6 200 L changed hands 59 cents lower to $2.14.

A number of points in the Mid-Atlantic and Marcellus came close to scrubbing new lows. Deliveries to Transco Leidy traded as low as $1.15 before finishing at $1.43, down 38 cents, and packages on Tennessee Zone 4 Marcellus skidded to $1.30 before ending the day at $1.40, down 34 cents.

Dominion South and Millennium were in a similar pickle with Millennium down to $1.35 before finishing at an average of $1.48, down 33 cents, and Dominion South probing $1.34 and closing at $1.41, down 38 cents.

In the Mid-Atlantic, packages into New York City on Transco Zone 6 were down to $1.30 before ending the day to average $1.37, 46 cents lower. Gas on Tetco M-3 changed hands as low as $1.30, also before reaching an average $1.42, 37 cents lower.

WSI Corp. in its Friday morning six- to 10-day outlook shows above-normal temperatures across the western half of the U.S. with much above normal temperatures in New York and New England, but it said, “[Friday’s] six-10 day period forecast is a bit cooler along the East Coast but warmer over the interior West and central U.S. due to the day shift. However, temps did run a bit cooler across the north-central U.S. and warmer across the southern and eastern U.S. late in the period.

“Confidence in the forecast is average at best today due to technical and timing model differences with the progression of the pattern. The risk is to the cooler side across the East and warmer over the interior West into the Plains based on the ensembles, which depict a positive PNA- [Pacific North America] like pattern.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |