Bakken Shale | E&P | NGI All News Access

Oxy Mum on Williston Sale Rumors, Cites Ongoing Strategic Review

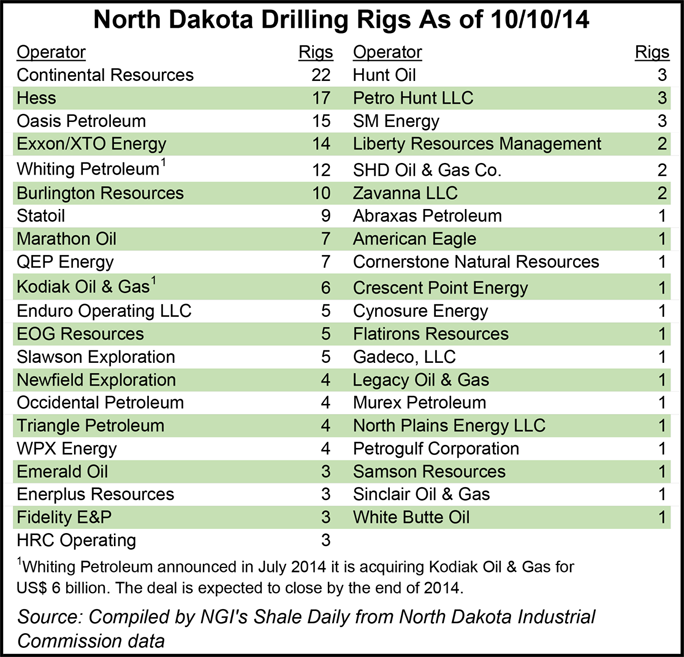

Exactly a year after it said parts of its 2.5 million acres in the Midcontinent could be up for sale, a Houston-based Occidental Petroleum Corp. (Oxy) spokesperson refused to comment Thursday on rumors in North Dakota that Oxy was selling all of its more than 330,000 acres in the Williston Basin for an asking price of $3 billion.

Melissa Schoeb, communications/public affairs vice president, referred an NGI inquiry back to Oxy’s announcement last year that it was “pursuing strategic alternatives” for select Midcontinent assets. These specifically include assets in the Williston Basin, Schoeb said.

On Oct. 18, 2013 the company said its board of directors as part of an ongoing strategic review authorized management to pursue alternatives pertaining to Midcontinent assets, along with pursuing sales of minority interest in the Middle East/North Africa and selling part of Oxy’s 35% interest in the general partnership of Plains All-American Pipeline LP (see Daily GPI, Oct. 21, 2013).

Oxy holds 2.5 million acres in the Williston, Hugoton and Rockies/Piceance basins in the Midcontinent region.

In the company’s announcement last year, CEO Stephen Chazen emphasized that the strategic sales were designed to make Oxy “somewhat smaller” over time. And he emphasized that the asset sales envisioned would generate “a significant amount of proceeds.”

Oxy’s Williston Basin assets, some of which could be sold, including 500,000 gross acres in the Bakken Shale play, along with what the company described as upside potential in the Pronghorn and Three Forks, along with potential oil-driven rate and reserve growth throughout the basin.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |