Former Rice Energy Inc. CEO Daniel Rice expects renewable natural gas (RNG) to play a bigger role in the energy transition as the push for decarbonization grows.

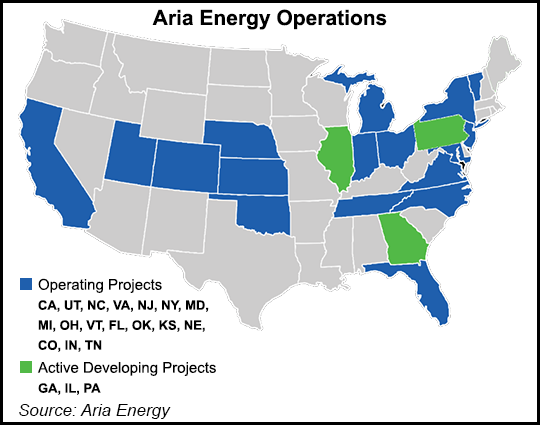

The special purpose acquisition company (SPAC) that he runs, Rice Acquisition Corp., on Wednesday announced plans to merge with landfill gas (LFG) specialists Aria Energy LLC and Archaea Energy LLC.

The $1.03 billion deal could create what Rice said would be the leading RNG platform in the United States.

“I think the missing piece to all of it historically has really been the commercial element,” Rice told NGI. “There hasn’t really been long-term demand for this type of product.”

However, RNG demand is growing, as businesses, organizations and governments announce ambitious goals to achieve carbon...