Regulatory | NGI All News Access

Argentine Primary Election Results Resurface Interventionist Fears in Energy Sector

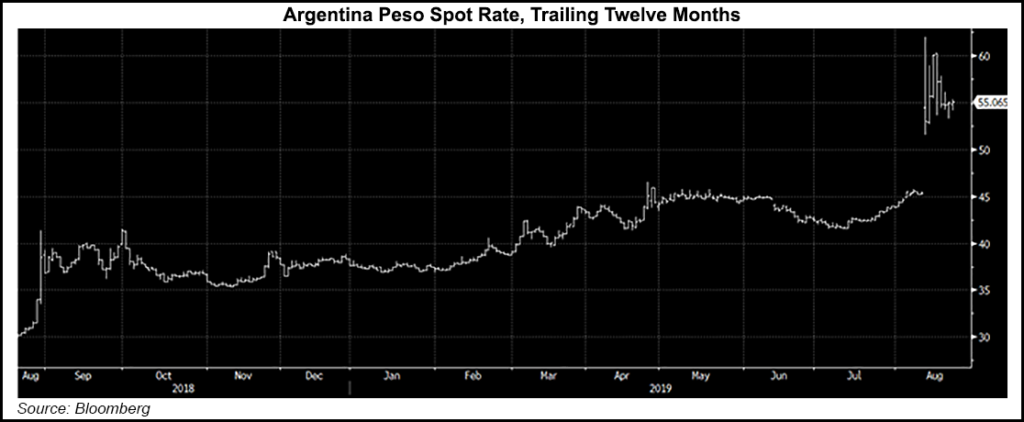

The resounding defeat for President Mauricio Macri in the Argentine primary elections earlier this month had an immediate financial impact: the peso lost 25% of its value against the dollar, and the stock market plunged. It also led many in the Argentine energy sector to fear the uncertainty of what is to come.

“An opposition victory in November would mean a return to interventionist policy,” Wood Mackenzie’s upstream Latin American analyst Fernanda Pedó told NGI’s Mexico GPI.

After the August 11 primaries, in which Macri lost by 16 percentage points to a left-wing coalition led by Alberto Fernández and former president Cristina Kirchner, an opposition victory in the general election slated for October 27 does look to be the likely result.

Business-friendly Macri has had a tumultuous time as president, with the economy in recession and inflation soaring, but he has also been credited with turning around the country’s energy fortunes, in particular in the prolific Vaca Muerta shale deposit where oil and gas production is booming.

In the wake of the shocking primary defeat and the ensuing financial turmoil, Macri went against his policy of market liberalization and imposed a 90-day freeze on oil prices. Crude is now capped at $59/bbl by government decree, with an exchange rate for crude sales fixed at 45.19 pesos per dollar, far below the current weakened rate of around 55 pesos per dollar.

The government decree also dictates that oil companies in Argentina must supply, at the established prices, “total domestic demand for liquid fuels, pursuant to the volumes required of them from the usual practices of the Argentine market, supplying on regular and continuous basis in each and all areas of the territory of the Republic.”

Vaca Muerta producers were quick to criticize the policy.

Vista Oil & Gas SAB de CV, the second largest shale oil producer in Vaca Muerta, said it is challenging the decision in Federal Administrative Contentious Court “requesting the nullity of the effects” of the decree, with the intention to “avoid those prejudices which may impact the current operations and financials of Vista.”

The governor of Neuquén province, where Vaca Muerta is located, has also said he will fight the decision in court and will request compensation for lost income.

State oil company YPF SA, responsible for around 40% of the country’s production, announced as a result of the freeze that it would cut spending by over $300 million, which represents more than 10% of the company’s total capex for 2019 in the upstream sector, according to Wood Mackenzie.

“Kirchner’s administration implemented numerous market controls affecting oil and gas and also nationalized YPF, formerly a joint venture with Repsol. If her left-wing party returns to power, further price controls on crude oil and natural gas are likely,” Pedó said.

Argentina’s General Mosconi Institute, an energy think tank, generally a proponent of the free market, has argued that the temporary price freeze is necessary to soften the blow of financial forces that have hammered the purchasing power of the average Argentine citizen. The institute has also argued that the freeze should be extended to natural gas.

The news comes at a time in which natural gas production shows no sign of slowing. Shale gas production has surged from the Vaca Muerta deposit, more than tripling between January and December 2018, from 0.3 Bcf/d to 1.0 Bcf/d. The country, which suspended natural gas exports to Chile in 2007, now sends seasonal shipments averaging 4.33 million cubic meters (MMm3) per day, or 153 MMcf/d, to its neighbor across the Andes.

Argentina also started shipping out small scale liquified natural gas (LNG) exports in June, the first of its kind, while McDermott International Inc. in July was awarded a “sizeable contract” by YPF to provide pre-FEED services for a 5-10 million metric ton/year (mmty) LNG liquefaction facility to serve producers developing the Vaca Muerta.

Wood Mackenzie, assuming no great changes are made, sees Argentina LNG ramping in 2024 with LNG production volumes reaching 6 million metric ton/year, which could then grow to 10 mmty by 2030.

Meanwhile, last month, Argentina launched an international tender for a multi-billion dollar pipeline to transport natural gas from the Vaca Muerta in the western part of the country to capital Buenos Aires. Bids were expected to be opened on September 12.

“While not ideal, political swings and economic instability are the norm in Argentina and operators will continue to develop the Vaca Muerta shale, though investments may slow if price controls become unworkable. International players will be cautious and tempered in Argentina and may prioritize North American shale,” Pedó said.

It is still too early to see the longer term impacts, and caution has been the byword this week.

Despite a “dramatic” market reaction to the primaries, “it’s not clear there will be a clear break from macroeconomic reform,” professor Steven Kaplan of George Washington University said in a podcast.

The presidential front-runner Alberto Fernández too has been careful to not sound any alarms. He said on Wednesday that there’s “no possibility” of the country defaulting on its debt if he’s elected. He also understands that Vaca Muerta is one of the bright spots of the current government, a secure source of investment in an otherwise rocky economic landscape.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |