Shale Daily | Coronavirus | E&P | NGI All News Access

Argentina Reports Zero Active Rigs in April as Coronavirus Lockdown Shutters Economy

Argentina’s rig count dropped to zero in April as activity ground to a halt from the country’s stringent lockdown that is keeping citizens, and oil and gas workers, at home.

The nationwide lockdown put in place in the middle of March to slow the spread of the coronavirus is ongoing; the government has said it will announce news of changes to the restrictions – if any — next week.

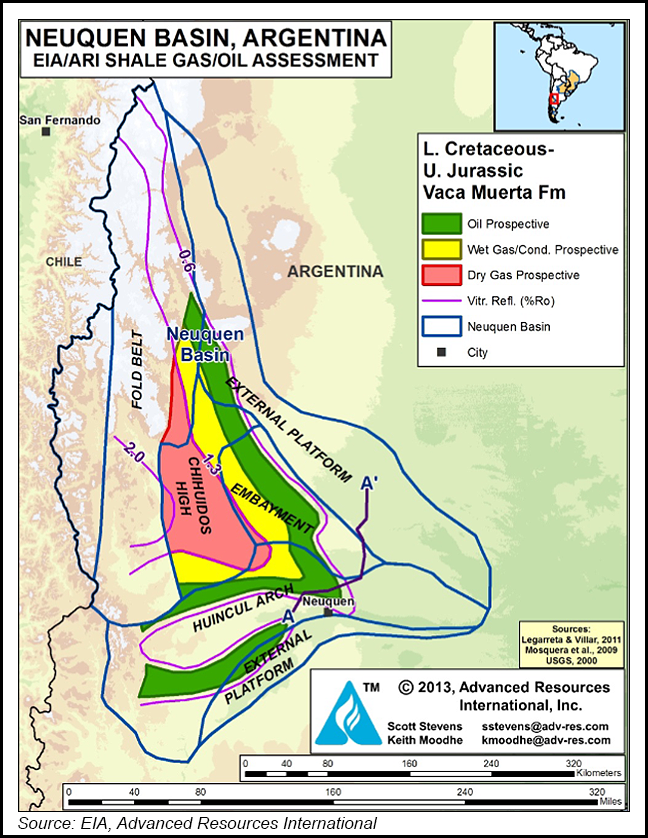

Western Argentina is home to the vast Vaca Muerta shale deposit, hailed by many as one of the best unconventional oil and gas prospects outside of the United States.

“In Vaca Muerta, there was no activity for drilling rigs and frac sets during April,” Wood Mackenzie Argentina analyst Igancio Rooney told NGI’s Shale Daily. “These operations have been affected by the quarantine measures at a national level. It’s not good news for the sector, as growth projections have been curtailed under a scenario of depressed demand.”

The oil and gas sector in Argentina already had seen slowing activity since the government changed hands last year. According to data from Baker Hughes Co. (BKR), Argentina had 38 oil and gas rigs running in March, compared to 65 in March of last year.

The collapse in the oil price has not helped.

Tulsa-based rig specialist Helmerich & Payne (H&P) CFO Mark Smith said in the company’s first quarter earnings call last week that Argentina was suffering from the “local macroeconomic situation and roll-off of legacy contracts,” but “the recent oil price declines have exacerbated and accelerated the pace of that decline.”

The lack of demand has led to operators shutting in wells and reducing production.

In April, state oil firm Yacimientos Petrolíferos Fiscales SA (YPF) reportedly was said to be shutting in half of its estimated 40,000 b/d production at its flagship Loma Campana field in Vaca Muerta because of a lack of storage and plummeting demand.

YPF partners with U.S. supermajor Chevron Corp. at Loma Campana. Vista Oil & Gas, Royal Dutch Shell plc and ExxonMobil also have all reportedly shut-in some of their Argentine wells.

In response, the government has said it is close to proposing a regulated price for oil in Argentina, known as the “criollo” barrel, but analysts have warned that it was in fact the lifting of market interventionist policies such as price fixing in 2016 that actually stimulated investment in Vaca Muerta in the first place.

“Going forward, both drilling and completions could ramp up again under a scenario of a more flexible quarantine,” Rooney said. “However, demand will also need to be there to ensure that the market is balanced. Operators may also be selective on how much they increase their upstream activity, and probably the contracting strategy adopted for drilling and completions services will play an important role in this decision too.”

Argentina’s production of natural gas in February fell 5.2% year/year to 127.7 million cubic meters/day (MMm3/d), or 4.51 Bcf/d, the last month for which official figures are available.

The lockdown so far has been effective in keeping the pandemic at bay. As of Tuesday, Argentina had 4,8887 cases of coronavirus, with 260 fatalities, according to Johns Hopkins University.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |