Shale Daily | E&P | NGI All News Access

Argentina Natural Gas Production Down in February; Upstream Cuts Reported on Coronavirus Shutdown

Argentina’s production of natural gas in February fell 5.2% year/year to 127.7 million cubic meters/day (MMm3/d), or 4.51 Bcf/d, according to the latest report on the country’s energy sector produced by the IAE Argentine Energy Institute.

“Attention should be paid to the causes of the demand drop because if this trend persists it could halt the tendency of overall gas demand growth seen since 2014,” analysts said.

Activity in Argentina’s hydrocarbons sector has slowed since the election win of Peronist Alberto Fernández last year and amidst a growing economic crisis.

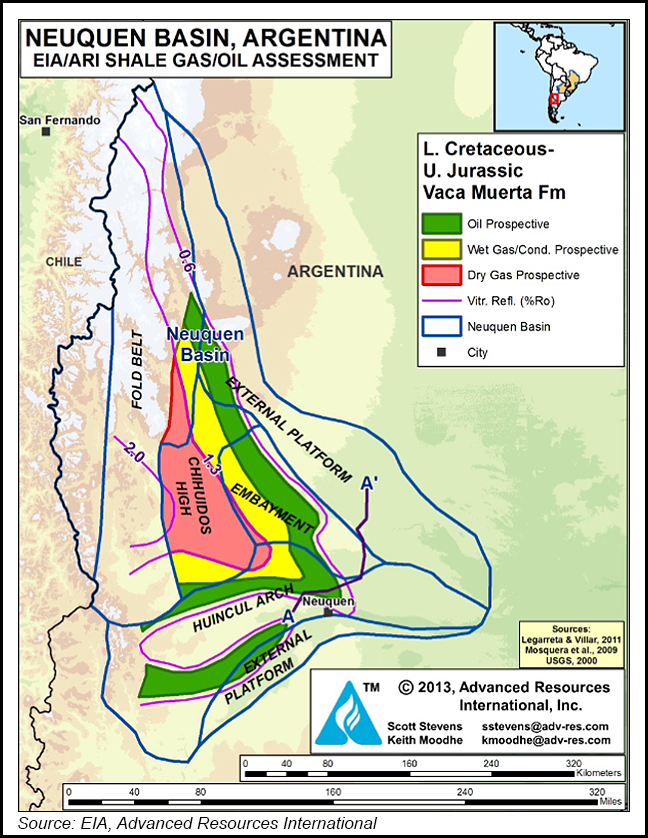

Still, Argentina’s Vaca Muerta formation, one of the most prospective shale plays outside the United States, continues to take on significance. It accounted for 32 MMm3/d (1.13 Bcf/d) of total February production, up 47.4% year/year.

Local firm Tecpetrol SA was the largest Vaca Muerta producer at 13 MMm3/d (459 MMcf/d) in February, followed by state oil company Yacimientos Petrolíferos Fiscales SA (YPF) which produced 9.7 MMm3/d (343 MMcf/d). Supermajor ExxonMobil was the fifth largest gas producer in Vaca Muerta in February, producing 1.2 MMm3/d (42 MMcf/d).

Argentina exported 327 MMm3 (11.5 Bcf) of natural gas in February, almost exactly double what it exported in the year-ago month.

These figures, however, do not yet take into account the impacts of the coronavirus decimating natural gas and oil demand across the globe. Argentina in particular has adopted strict measures to combat the pandemic, ordering a complete lockdown from mid-March through at least the end of April.

Last week, YPF reportedly was said to be shutting-in half of its estimated 40,000 b/d production at its flagship Loma Campana field in Vaca Muerta because of a lack of storage and plummeting demand.

YPF partners with U.S. supermajor Chevron Corp. at Loma Campana. In late March, San Ramon, CA-based Chevron cut capital expenditures by 20% across its portfolio, but said at the time that most of its upstream reductions would occur in the Permian Basin.

Vista Oil & Gas, Royal Dutch Shell plc and ExxonMobil have also all reportedly shut-in some of their Argentine wells.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |