Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

ARC Resources Cuts Capex, Defers BC Natural Gas Project on Low Commodity Prices

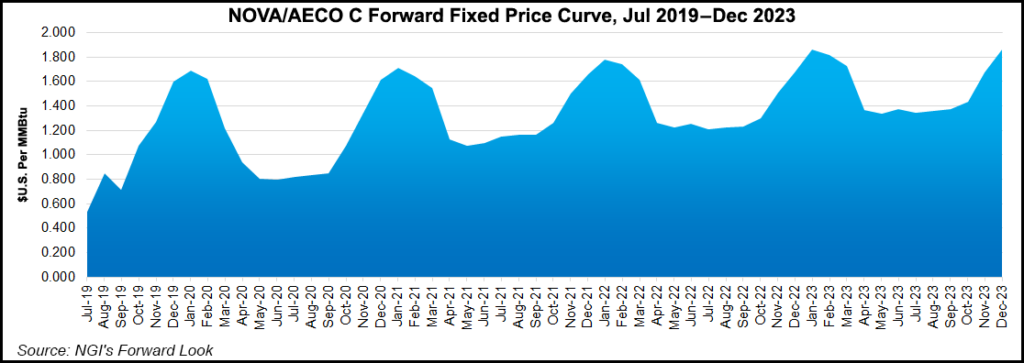

Low commodity prices have led Alberta-based Arc Resources Ltd. to slash capital spending and defer a British Columbia (BC) natural gas processing project for at least a year.

Capital expenditures (capex) for 2019 were reduced to C$700 million from $775 million, with 2020 expenditures forecast at C$550-625 million.

“ARC’s reduced capital investment levels are consistent with our long-held principles of stewarding low debt, sustainable dividends, and investing capital when it is profitable to do so,” CEO Myron Stadnyk said. “At this time, we feel it is appropriate to slow down the pace of development due to reduced commodity prices.”

The 2019 production guidance of 135,000-142,000 boe/d “remains unchanged” even with the reduction in capex.

Most of the spending cuts are tied to deferring for “at least” a year the proposed Attachie West Phase I gas processing and liquids-handling facility planned in northwestern BC. ARC earlier this year had received regulatory approval to proceed with the project.

Stadnyk in April said Attachie West was “an area that will provide our company with liquids-rich opportunities for many years to come.”

Production levels for 2020 remain unchanged because the Dawson Phase IV gas processing and liquids-handling facility, also sited in BC, is moving forward. Estimated capital requirements are about C$400 million.

“With the announced capital expenditure levels planned for 2019 and 2020, construction of the Dawson Phase IV facility is on schedule with the anticipated onstream date remaining in the second quarter of 2020,” management said.

ARC said it would “continue to pilot its Attachie operations” through existing infrastructure.

The producer also is maintaining a monthly dividend of C5 cents/share and expects to return more than C$200 million/year to shareholders.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |