April Natural Gas Nosedives on Further Warmer Trends in Weather Outlooks, Bearish Storage Data

The April Nymex natural gas futures contract made a splash on its first day at the front of the curve. The prompt month cannon-balled on more major revisions to weather forecasts, shedding some 8.5 cents on Thursday to settle at $1.752/MMBtu. May dropped 8.0 cents to $1.800.

Spot gas, which traded Thursday for delivery through Saturday, also posted widespread losses as the cold weather system that arrived in the Northeast was set to move out quickly. NGI’s Spot Gas National Avg. tumbled 11.0 cents to $1.630.

Futures had little chance of finishing the day in the black as weather models slashed a significant amount of demand overnight. The European model lost 17 heating degree days (HDD) compared to Wednesday afternoon and a hefty 27 HDD versus the previous 24 hours, according to NatGasWeather. The model showed not nearly as much cold air arriving into the northern United States for March 5-8 by seeing a weather system over southern Canada only providing “a minor glancing blow,” the firm said.

The midday Global Forecast System model then caught up to the milder trend, shedding 10 HDD from its outlook.

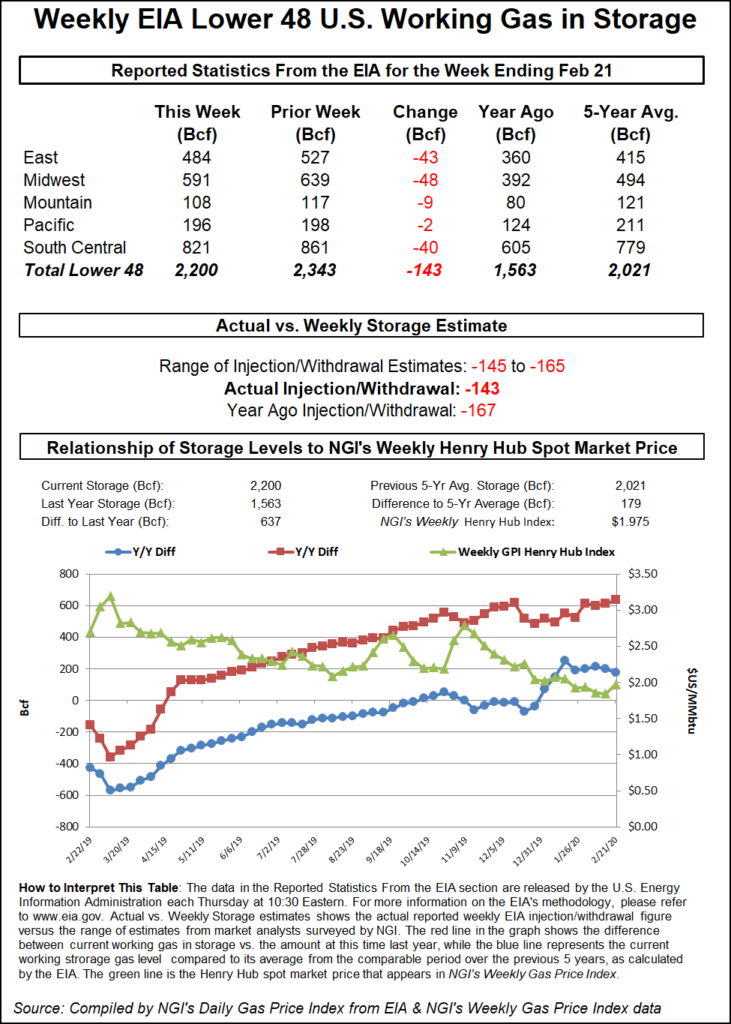

As if the weather data were not crushing enough, the Energy Information Administration’s (EIA) latest storage report sealed the gas market’s fate, at least for the day. The EIA reported a smaller-than-expected 143 Bcf natural gas storage withdrawal for the week ending Feb. 21.

The April gas futures contract was trading at $1.747, down 9.0 cents, in the minutes leading up to the 10:30 a.m. ET report. The prompt month then dropped as low as $1.719 before trimming its losses.

“That bump last week gave it just enough breathing room to roll down again,” said Huntsville Utilities’ Donnie Sharp. “Anyone who has sat on the sidelines should get on the field directly, with their A team, not the B team. Knock off some risk (end user). Leave an empty pocket for this fall.”

During a post-storage chat on Enelyst.com, an energy platform hosted by The Desk, managing director Het Shah said the short position “is building up,” which made him “a bit uneasy. Any bullish sign, and this market bounces quickly.”

Said Sharp, “a $1.60-ish pop could be it. Attention will be shifting to summer very soon.”

Ahead of the EIA report, surveys pointed to a withdrawal in the upper 150s Bcf, while NGI’s model projected a pull of 152 Bcf.

Genscape senior natural analyst Eric Fell, who also had projected a 152 Bcf draw, said the large miss could be attributed to “sloppy weekly storage data. The EIA can only work with the data they get from operators. It is what it is.”

The EIA recorded a 167 Bcf draw for the similar week last year, while the five-year average withdrawal stands at 122 Bcf.

Broken down by region, the Midwest withdrew 48 Bcf out of storage, while the East pulled 43 Bcf, according to EIA. Inventories in the South Central region declined by 40 Bcf, including a 27 Bcf draw from nonsalts and a 13 Bcf drop in salts. The Mountain region pulled 9 Bcf out of stocks, while the Pacific withdrew just 2 Bcf.

Total working gas in storage as of Feb. 21 stood at 2,200 Bcf, 637 Bcf above year-ago levels and 179 Bcf above the five-year average, EIA said.

Also potentially adding downward pressure to natural gas prices Thursday, fears over the coronavirus outbreak continued to assail financial and energy markets as the spread of the virus raises the prospect of slowing global economic activity.

Stocks continued to plunge, and crude followed suit. West Texas Intermediate front month futures settled at $47.09/bbl, down $1.64 day/day. Week to date, the April contract has shed more than $6, crashing through the $50 mark in the process.

After temperatures plummeted below freezing overnight, a warm-up on Thursday sent spot gas prices tumbling across Texas. Overnight lows in the upper 20s were expected to rise throughout the day to reach highs in the 60s. Even milder weather was in store over the next few days.

Katy dropped 16.0 cents to $1.710 for gas delivered through Saturday.

Waha was down 13.5 cents to average 22.0 cents.

Spot gas prices across the western United States fell similarly, with the Rockies’ Cheyenne Hub tumbling 17.5 cents day/day to $1.480 and the SoCal Border Avg. falling 14.5 cents to $1.665.

More significant decreases were seen in parts of the Midcontinent, where ANR SW fell 22.0 cents to $1.475.

Midwest prices also were down by the double-digits, as were prices throughout Louisiana and the Southeast.

Appalachia also ended the day in the red, but losses were not as pronounced. Transco-Leidy Line cash slipped 5.0 cents to $1.540.

A handful of Northeast markets posted the only gains on Thursday amid lingering chilly air in the region. Algonquin Citygate rose 13.5 cents to $2.240 for gas delivered through Saturday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |