Natural Gas Prices | Markets | NGI All News Access

April Natural Gas Futures Forge Ahead as LNG Volumes Reach Record Levels, Economy Musters Momentum

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Earnings

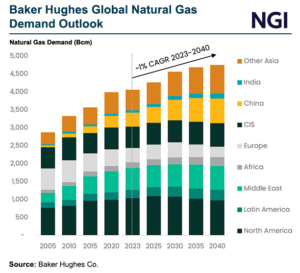

The world’s energy companies are becoming more pragmatic in their approach to reaching net-zero emissions and Baker Hughes Co.’s customers plan to boost their natural gas exposure in the coming years, CEO Lorenzo Simonelli said. It is “becoming clearer just how complex the undertaking is for the transition of the world’s energy ecosystem,” Simonelli said…

April 25, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.