Appalachian heavyweights Cabot Oil & Gas Corp. and Range Resources Corp. both plan to keep spending and production flat this year despite an improving outlook for natural gas.

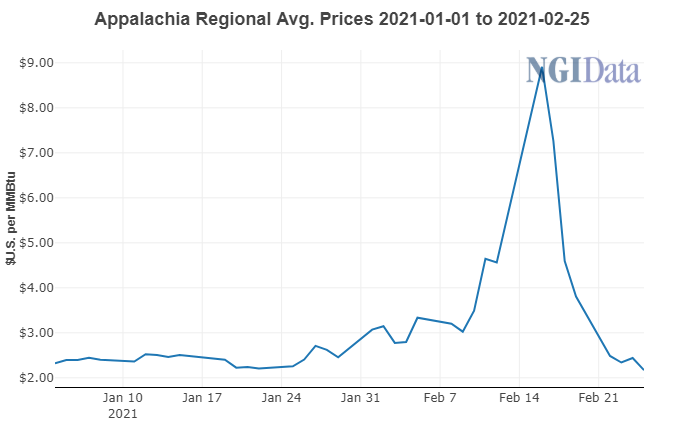

“While a warmer start to the winter heating season and higher storage levels resulted in wider than anticipated differentials across the Appalachian Basin during the fourth quarter, we remain optimistic that the improving outlook for lower end-of-season inventories will provide tailwinds for regional natural gas prices during 2021,” said Cabot CEO Dan Dinges on Thursday after the fourth quarter results were issued.

Full-year natural gas price realizations, including hedges, were $1.68/Mcf, down 31% from 2019. Cabot produces 100% natural gas.

The company, which operates only in Susquehanna County,...