E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Apache’s Alpine High Named No. 1 Prospect; NatGas Trunkline Under Development

Lest there be any doubt that Apache Corp. is feeling its oats about the natural gas-rich Alpine High in West Texas, consider this: the 2016 planned capital allocation of $100 million has risen to $500 million, with a 60-mile 30-inch diameter gas pipeline now on the drawing board.

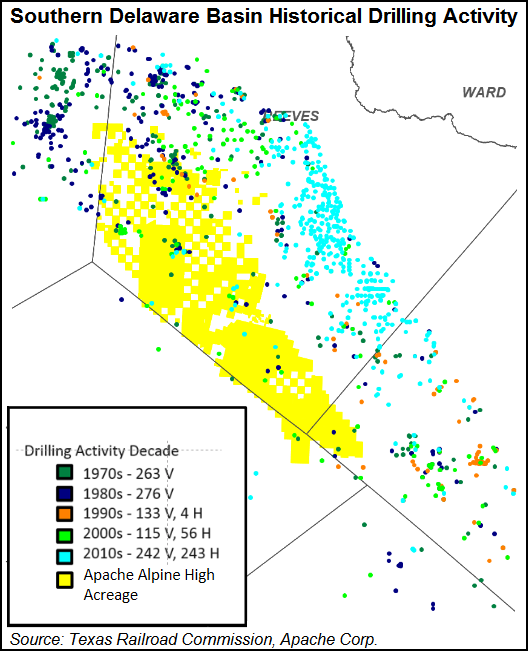

The super independent in early September unveiled its first production statistics for the stealth play, which is in the southern end of the Permian Basin’s Delaware formation (see Shale Daily, Sept. 7). The play spread within Reeves County may hold 8.1 billion boe of resources, with at least 75 Tcf of gas and 3 billion bbl of oil in two of the myriad formations alone, the Barnett and Woodford.

Permian prospectors have surveyed the massive basin for decades but infrastructure is lacking in Alpine Way, discouraging explorers (see Shale Daily, Oct. 31). Apache CEO John Christmann put some of those concerns to rest during the third quarter conference call on Thursday, announcing a 30-inch trunkline would be the main piece of near-term infrastructure buildout. More infrastructure is planned as the play progresses. Four rigs now are running in Alpine High.

“I’ll tell you it will move a tremendous amount of gas,” the CEO said of the initial pipeline. “Obviously, with compression and so forth, you can do a lot there…We’re not in a position to talk about scale; that’s just the main trunkline through the field and in terms of what we have run from north to south.” More details are expected during the year-end report in February, he said.

At the beginning of 2016, planned capital allocation for Alpine High “was less than $100 million,” Christmann said. “As the year progressed and cash flow came in above budgeted levels, we elected to invest incremental cash flow in Alpine High rather than chase near-term production growth elsewhere. As a result, we now expect to spend approximately $500 million in Alpine High this year, which effectively accounts for the incremental cash flow above our original budget.” Forty percent of Alpine High’s allocation is for midstream.

Gas trunkline construction has begun, allowing Apache to have “three directions in which we can connect to markets,” operations chief Timothy Sullivan said. “The amount of gas that the field can produce is not limited by a unilateral flow of gas through the trunkline, it can flow in different directions. And then there will be a third connection most likely to the east from the middle of the field over to Waha…So we’ll have trunk line connections, hopefully north, south into Waha, and an natural gas liquids line most likely into the Waha direction as well by the end of 2018…”

Refrigeration units would be installed in “50 MMcf/d to 100 MMcf/d increments,” Sullivan said. For processing and compression, “a kind of an industry cost estimate of somewhere in the 40-60 cent/Mcf per day in terms of capital spending is probably a reasonable estimate…We do anticipate that we will put in processing and compression capacity in advance of us needing it, so we won’t be takeaway constrained.”

CFO Stephen Riley said limited infrastructure now exists within the immediate vicinity. During delineation drilling, Apache installed skid mounted refrigeration units to process gas and recover liquids, but recovery volumes have been constrained by the units’ capabilities.

“Both the oil and the NGLs are being trucked to local sales points,” Riley said. “These temporary arrangements will over time be replaced by more permanent solutions. The initial objective of our infrastructure investment is to establish permanent gas processing capacity and transportation of residue gas to market sales points. First gas sales are expected in the middle of 2017…

“A high priority during the initial phases of field development is to ensure the production is not limited by processing or transportation capacity…Major third-party transport lines are currently situated or are under construction in locations approximately 10 miles to the north and south of the Apache leasehold. The Waha Hub is located less than 50 miles to the east of Apache’s acreage and provides access to most major U.S. markets…We will install the trunkline across the Alpine High and establish most market connections through 2017 and 2018.”

The Houston operator has gas and oil prospects worldwide, but “our top priority next year is funding the Alpine High,” Christmann told investors. “The budget will likely consist of a four to six rig program in a first wave of midstream buildout. The near-term pace of spending on Alpine High will be governed by the timing of infrastructure availability as well as a prudent appraisal and delineation program. Our goal in 2017 is to ensure that investment levels do not outpace our comprehensive understanding of the opportunity or our capacity to get product to market.”

Christmann said Apache had “invested a significant amount of human and financial capital through two years of extensive geologic and geophysical work and reservoir and fluid analysis” of the Delaware play, which included “concept testing an initial round of verification wells” first disclosed in September. At that time Apache provided production results from eight horizontals — six in the Woodford and one each in the Barnett and Bone Spring formations.

Since then two more wells have been flow tested. The Black Hawk 1H, a normally pressured Woodford well, flowed at a peak 24-hour initial production (IP) rate of 5.3 MMcf of gas, 224 bbl of oil, and 245 barrels of NGLs. The Redwood 1H, an overpressured Woodford well, flowed at a peak 24-hour IP rate of 18 MMcf. Redwood was drilled to a vertical depth of nearly 14,000 feet.

Apache management is convinced enough of its find that it has added more acreage in the past two months, bringing its Alpine High position to 320,000 net contiguous acres, Christmann said. Apache identified and captured the position for an average price of $1,300/acre over a two-year period.

“Our near-term drilling objectives at Alpine High include geographic testing to define geologic settings across our acreage position, stratigraphic testing to collect data from all five formations, defining the number of landing zones and the optimal well placement and orientation within each formation, and enhancing completions and testing longer laterals and well spacing to optimize full field development,” he said.

“At this point, we can say with confidence that the Alpine High contains thousands of predictable high-return horizontal drilling locations that will drive returns and production growth for many years to come. Importantly, Apache controls the vast majority of the play…”

Beyond Alpine High, the No. 2 priority for Apache is to increase activity in other Permian areas, specifically by adding three rigs in the Midland sub-basin through the end of the year, which would bring the total rig count in that play alone to five. The rig count could be expanded even more in 2017, Christmann said.

The Permian region produced 159,000 boe/d in the third quarter, nearly 60% of Apache’s total North American onshore production. Production in the Permian decreased by roughly 6,200 boe/d sequentially, as declines were buffered by 13 well tie-ins to its Northwest Shelf Yeso play.

“Outside of the Permian, Apache had no active drilling rigs operating in North America during the quarter,” Sullivan said. It did, however, test seven operating wells in Canada’s Montney formation.

Global production in the third quarter was 520,000 boe/d. In the North America onshore, production was 270,000 boe/d, while adjusted international and offshore production was 168,000 boe/d.

Apache reported a net loss in 3Q2016 of $607 million (minus $1.60/share), sharply down from a year ago, when losses totaled $4.13 billion (minus $10.91). The latest results included a $355 million impairment of proved properties in Canada following reserve revisions related to well performance and lower expected net gas realizations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |